PaySend vs Venmo: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-10 15:55:38.0 14

Introduction

Cross-border money transfers have become increasingly essential for sending funds to family, friends, or business partners. Users often face high fees, slow delivery times, hidden charges, and complex interfaces that complicate the process. PaySend and Venmo are two popular options in the digital payment space, each offering unique advantages. For those seeking an alternative, PandaRemit provides a secure and flexible solution. According to Investopedia, understanding fees and transfer methods is crucial for choosing the right service.

PaySend vs Venmo – Overview

PaySend, founded in 2012, offers international money transfers with a focus on low fees and quick delivery. Its platform supports debit cards and bank accounts, catering to a global audience.

Venmo, launched in 2009, primarily serves the U.S. market for peer-to-peer transfers. It emphasizes social features and convenience through mobile apps.

Similarities: Both services provide mobile apps, digital wallet functionality, and convenient fund transfers.

Differences: PaySend focuses on international transfers with flat fees, while Venmo emphasizes domestic, social payments with variable charges.

Another alternative in the market is PandaRemit, offering competitive rates and online convenience.

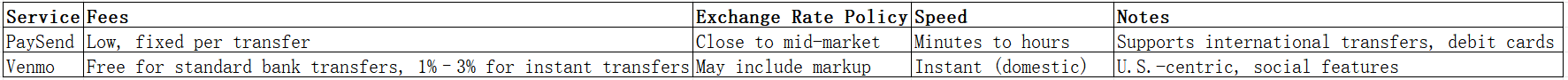

PaySend vs Venmo: Key Comparison

Fees and Costs

PaySend charges low, flat fees for international transfers, making it predictable for users. Venmo offers free standard U.S. transfers but charges for instant transfers and certain card payments. For a low-cost alternative with flexible international coverage, PandaRemit is worth considering. NerdWallet provides an in-depth fee comparison guide.

Exchange Rates

PaySend offers rates close to the mid-market value, minimizing hidden costs. Venmo does not specialize in currency exchange since it is primarily domestic. PandaRemit provides competitive exchange rates for global transfers.

Speed and Convenience

PaySend transfers are typically processed within minutes to a few hours. Venmo excels in domestic instant transfers but cannot handle international transfers directly. PandaRemit offers fast, online international transfers as a reliable alternative. See Remittance Speed Guide for more insights.

Safety and Security

PaySend and Venmo both use encryption and comply with financial regulations to ensure secure transfers. Fraud detection and buyer protection are standard. PandaRemit is also licensed and secure, providing peace of mind for users.

Global Coverage

PaySend supports numerous countries and currencies, while Venmo focuses on the U.S. market. PandaRemit covers multiple regions outside Africa and supports flexible online transfers. Refer to World Bank Remittance Coverage Report for coverage details.

Which One is Better?

PaySend is ideal for users needing international transfers with low fees and quick processing. Venmo suits U.S.-based users who prefer social and domestic payments. For global needs and flexible payment options, PandaRemit can provide better value and speed.

Conclusion

In summary, PaySend vs Venmo highlights the differences between international and domestic money transfer services. PaySend excels in international low-cost transfers, while Venmo is optimal for U.S. domestic payments. PandaRemit emerges as a strong alternative, offering high exchange rates, low fees, multiple payment methods (POLi, PayID, bank card, e-transfer), and fast online transfers across 40+ currencies. For comprehensive guidance, visit PandaRemit Official Site and check Investopedia for detailed money transfer insights.