PaySend vs XE Money Transfer: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-10 11:14:28.0 21

Cross-border money transfers have become essential in a globalized economy, yet users often face high fees, slow delivery, and hidden exchange rate margins. In 2025, PaySend and XE Money Transfer are two notable solutions addressing these issues.

PaySend specializes in instant low-cost transfers, ideal for personal remittances, while XE Money Transfer caters to users seeking competitive exchange rates for larger transfers. Panda Remit is another fast, secure alternative for everyday transfers. (Source: Investopedia: International Money Transfer Guide)

PaySend vs XE Money Transfer – Overview

PaySend, established in 2017 in the UK, offers fast transfers to over 170 countries, prioritizing speed and transparency with an intuitive mobile app.

XE Money Transfer, founded in 1993 in Canada, is known for competitive exchange rates, supporting high-value transfers for personal and business clients worldwide.

Similarities:

-

International money transfers

-

Mobile apps for easy tracking

-

Debit card support

Differences:

-

PaySend: Best for small, rapid transfers

-

XE Money Transfer: Better for larger transfers with favorable exchange rates

Panda Remit is another alternative combining speed and affordability.

PaySend vs XE Money Transfer: Fees and Costs

PaySend charges a fixed low fee (approximately $1.50) visible before transfer.

XE Money Transfer applies exchange rate margins, generally decreasing with higher transfer amounts. It does not charge flat fees but the margin affects total cost.

Panda Remit can be a cost-effective alternative for smaller, fast transfers. (Reference: NerdWallet: Money Transfer Fees Comparison)

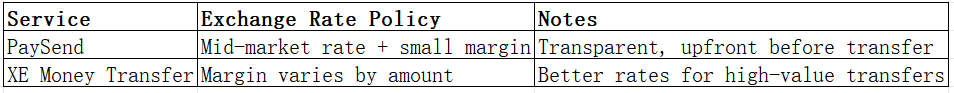

PaySend vs XE Money Transfer: Exchange Rates

Both ensure no hidden fees. PaySend suits smaller, rapid transfers, while XE favors bulk remittances. Panda Remit provides consistently competitive rates for everyday use.

PaySend vs XE Money Transfer: Speed and Convenience

PaySend offers instant or same-day transfers with real-time tracking via the app.

XE Money Transfer typically completes transfers in 1–2 business days, optimal for planned payments. App usability is solid, but not optimized for instant personal transfers.

Panda Remit is a fast alternative for users needing quick, fully online transfers. (Reference: Monito: Transfer Speed Guide)

PaySend vs XE Money Transfer: Safety and Security

Both platforms are licensed and regulated, using encryption, fraud monitoring, and multi-factor authentication.

Panda Remit also offers secure, licensed transfers, ensuring safety for international transactions.

PaySend vs XE Money Transfer: Global Coverage

PaySend: Transfers to over 170 countries via bank cards and bank accounts.

XE Money Transfer: Transfers to 100+ countries, supporting major currencies.

Neither supports credit card transfers or African remittance corridors.

Panda Remit supports 40+ currencies with fast online transfers. (Source: World Bank: Remittance Data)

PaySend vs XE Money Transfer: Which One is Better?

-

PaySend: Ideal for small, fast personal transfers

-

XE Money Transfer: Suited for larger, value-sensitive transfers

For users seeking speed, affordability, and convenience, Panda Remit offers a compelling alternative.

Conclusion

In the PaySend vs XE Money Transfer comparison, PaySend shines in fast, low-cost transfers, while XE is better for high-value remittances. The right choice depends on transfer size and urgency.

Panda Remit provides high exchange rates, low fees, flexible payment methods (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fast online transfers, making it an excellent alternative for 2025 international remittances.

(References: NerdWallet Money Transfer Review, Investopedia International Transfer Guide, Panda Remit Official Site)