Paysend vs Zelle: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-10 15:46:04.0 16

Cross-border money transfers remain vital for workers, families, and businesses worldwide. With high fees and slow delivery still common pain points, users increasingly look for platforms that balance cost, convenience, and security. In this article, we compare Paysend vs Zelle — two well-known names in the remittance space — to see which suits international transfer needs better in 2025. We’ll also touch on Panda Remit, a reliable alternative for fast, low-cost global transfers.

For a detailed overview of remittance systems, visit Investopedia’s money transfer guide.

Paysend vs Zelle – Overview

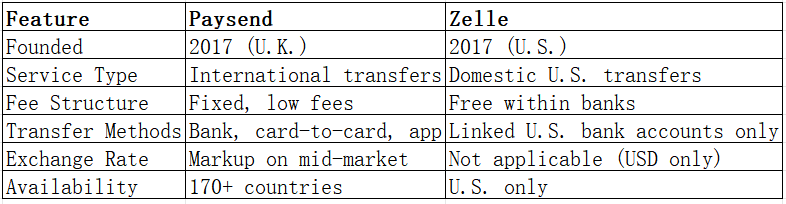

Paysend was founded in 2017 in the U.K. and has since grown to serve users in over 170 countries. It focuses on global transfers, offering fixed transfer fees and direct-to-card delivery options. Paysend’s mobile app and web platform make it a convenient choice for individuals and small businesses.

Zelle, on the other hand, is a U.S.-based digital payments network launched in 2017. It allows instant domestic bank transfers directly between U.S. accounts, integrated within many major banks’ mobile apps. However, it is not designed for cross-border payments.

Both services emphasize simplicity and digital convenience, but their target markets differ significantly — Paysend for global users, and Zelle for U.S. domestic transfers.

For those who require flexible, multi-currency international transfers, Panda Remit is another trusted option in the market.

Paysend vs Zelle: Fees and Costs

When it comes to cost, Paysend generally charges a small flat fee for international transfers (e.g., $2 or less per transaction), while Zelle transactions are free for domestic users. However, Zelle does not support international transfers, making Paysend the only viable option for global users.

Those seeking lower overall transfer costs for overseas remittances can consider Panda Remit, which offers competitive fees and favorable exchange rates without hidden markups.

For a deeper understanding of fee structures, check NerdWallet’s comparison guide.

Paysend vs Zelle: Exchange Rates

Zelle operates exclusively in USD and does not apply exchange rate policies, as it’s not built for foreign currency transfers. Paysend applies a small markup above the mid-market rate, but displays the total cost upfront.

Users sending money abroad may find Panda Remit more cost-effective due to its near mid-market exchange rates and transparent pricing.

Paysend vs Zelle: Speed and Convenience

Zelle’s domestic transfers are near-instant within supported U.S. banks. Paysend’s international transfers typically arrive within minutes to a few hours, depending on the destination country and receiving bank.

Both services feature user-friendly mobile apps, though Zelle’s is limited to U.S. bank integrations. For users seeking global reach with similar speed, Panda Remit provides a fully digital experience for international transfers.

Read more about transfer speed factors on Remitly’s delivery time guide.

Paysend vs Zelle: Safety and Security

Paysend is regulated by the Financial Conduct Authority (FCA) in the U.K., while Zelle operates under strict U.S. banking security standards. Both use encryption and anti-fraud technology to protect transactions.

Similarly, Panda Remit is a licensed remittance provider that adheres to international compliance standards for user security and fund protection.

Paysend vs Zelle: Global Coverage

Paysend supports over 170 countries and multiple currencies, whereas Zelle operates exclusively within the U.S. banking network. Zelle’s lack of cross-border reach limits its usability for global money transfers.

For broader coverage and international payment flexibility, Panda Remit serves users across Asia, Europe, and Oceania, supporting 40+ currencies.

Learn more about remittance trends from the World Bank’s remittance report.

Paysend vs Zelle: Which One is Better?

Paysend is the better choice for users seeking affordable and simple international transfers. It offers transparent pricing and global reach. Zelle, however, remains an excellent tool for instant U.S.-only transactions, especially among bank account holders.

For users needing a wider international network, fast processing, and strong exchange rates, Panda Remit stands out as a practical alternative.

Conclusion

In this Paysend vs Zelle comparison, the choice depends on your needs: Zelle excels in instant domestic transfers within the U.S., while Paysend leads in global accessibility with low, fixed fees.

If you’re seeking an international money transfer solution that combines affordability, speed, and transparent rates, Panda Remit is worth considering. It offers high exchange rates, low fees, flexible payment options like PayID and bank cards, and service across 40+ currencies — all through an easy, online experience.

For more insights, explore NerdWallet’s guide on money transfer apps and Investopedia’s remittance overview.