Payssion vs PandaRemit: Fees, Exchange Rates, and Global Coverage

Benjamin Clark - 2025-09-29 15:27:40.0 24

Introduction

In today’s global economy, seamless cross-border payments are essential for both businesses and individuals. Payssion offers a robust platform for online payments and business-focused international transactions, enabling merchants to receive payments across multiple countries efficiently. PandaRemit, on the other hand, is designed for personal users, providing fast, low-cost, and secure money transfers worldwide. Comparing Payssion vs PandaRemit helps determine which service meets your specific needs. For further context on international remittances, see Wikipedia.

Fees and Costs

-

Payssion: Transaction fees vary depending on the payment method and volume, often tailored for businesses. Some fees may be hidden within currency conversion rates.

-

PandaRemit: Offers transparent, low fees for personal transfers. Fees are displayed upfront, with occasional promotions reducing costs further.

Exchange Rates

-

Payssion: Exchange rates are integrated into the payment settlement and may include margins for business transfers.

-

PandaRemit: Uses near mid-market rates, clearly shown before transaction confirmation, ensuring recipients receive maximum value.

Speed and Convenience

-

Payssion: Business payments generally take 1–3 business days depending on the destination and method.

-

PandaRemit: Transfers usually complete in minutes to a few hours. Available on mobile and web platforms for convenient access anytime, anywhere.

Safety and Security

-

Payssion: Implements strong anti-fraud systems and complies with PCI DSS standards to secure online payments for businesses.

-

PandaRemit: Ensures bank-level encryption, KYC verification, and AML compliance for safe personal transfers.

For more information on consumer financial safety, visit ConsumerFinance.gov.

Global Coverage

-

Payssion: Operates in over 100 countries, primarily supporting businesses and digital merchants, with multiple payment options.

-

PandaRemit: Available in 40+ countries and regions, supporting bank accounts, e-wallets, and cash pickup for personal users.

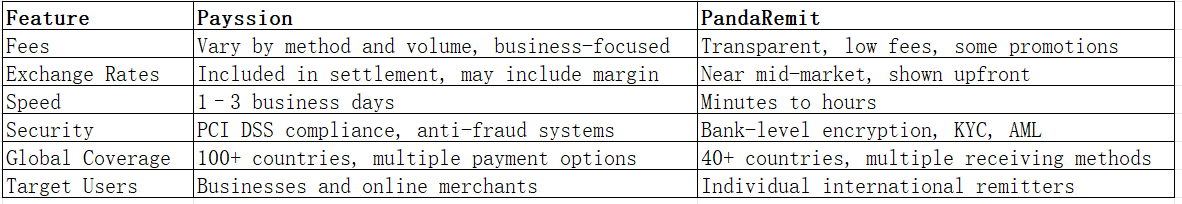

Comparison Table

-

Payssion official site: https://www.payssion.com

-

PandaRemit official site: https://www.pandaremit.com

Which One Is Better?

Choosing between Payssion vs PandaRemit depends on your use case:

-

Businesses requiring multi-currency online payments and merchant solutions may prefer Payssion.

-

Individuals sending money internationally will benefit more from PandaRemit, thanks to its simplicity, transparency, and speed.

Conclusion

In the Payssion vs PandaRemit comparison, each platform serves distinct audiences. Payssion excels in business-focused online payments, while PandaRemit offers fast, secure, and affordable solutions for personal remittance. For personal money transfers, choosing PandaRemit ensures convenience, clear fees, and reliable service across multiple countries.