PingPong Payments vs PandaRemit: Fees, Speed, and Security Compared

Benjamin Clark - 2025-09-28 17:57:25.0 16

Introduction

International money transfers are a cornerstone of today’s global economy. According to Wikipedia, billions of dollars are sent worldwide every year via remittance and payment platforms.

PingPong Payments primarily serves e-commerce sellers, freelancers, and businesses, offering multi-currency accounts, global payment solutions, and integration with marketplaces. PandaRemit, in contrast, focuses on low-cost, fast, and flexible transfers suitable for personal users and smaller transactions.

This article provides a detailed analysis of PingPong Payments vs PandaRemit, comparing fees, exchange rates, speed, safety, and global coverage to help you choose the best option for your needs.

Fees and Costs

-

PingPong Payments: Charges transaction fees, currency conversion fees, and withdrawal fees. Designed for business payments, the fees may be higher for personal users.

-

PandaRemit: Offers low or zero fees, transparent pricing, and no hidden charges, making it ideal for small or personal transfers.

Conclusion: For small personal transfers, PandaRemit is more cost-effective. Businesses handling larger amounts may benefit from PingPong’s business-oriented features.

Exchange Rates

-

PingPong Payments: Provides competitive rates for business transactions, supports multiple currencies, but may have slightly higher spreads.

-

PandaRemit: Offers rates close to mid-market values and allows locking exchange rates, reducing risk for personal transfers.

Conclusion: PandaRemit is more advantageous for personal and small transfers, while PingPong Payments suits business transactions requiring multi-currency handling.

Speed and Convenience

-

PingPong Payments: Transfers typically take 1–3 business days, with platform access via web and mobile for payment management.

-

PandaRemit: Transfers often complete within minutes to 24 hours. Users can track transfers in real-time via mobile apps.

Conclusion: PandaRemit offers faster and more flexible transfers for personal needs, whereas PingPong Payments is designed for structured business operations.

Safety and Security

-

PingPong Payments: Licensed and regulated in multiple jurisdictions. Uses encryption and multi-factor authentication for account protection.

-

PandaRemit: Fully licensed, compliant with global AML/KYC regulations, and uses advanced encryption to safeguard transactions.

For further consumer protection guidance, visit ConsumerFinance.gov.

Conclusion: Both platforms are secure, but PandaRemit emphasizes fast, digitally monitored transfers, especially for individual users.

Global Coverage (Countries and Payment Methods)

-

PingPong Payments: Available in over 100 countries, with multi-currency accounts, local bank transfers, and integration with e-commerce marketplaces.

-

PandaRemit: Serves 50+ countries, strong presence in Asia and Africa, and provides flexible payout options including bank transfers, e-wallets, and cash pickup.

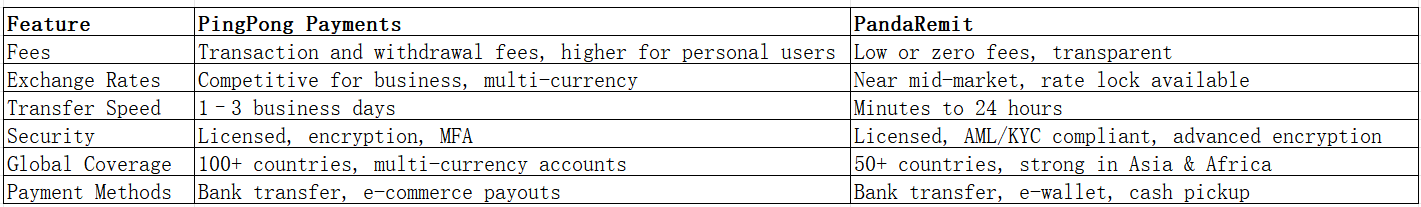

PingPong Payments vs PandaRemit Comparison Table

Official Websites:

-

PingPong Payments: https://www.pingpongx.com

-

PandaRemit: https://www.pandaremit.com

Which One is Better?

-

For businesses and e-commerce sellers, PingPong Payments provides robust multi-currency solutions and marketplace integrations.

-

For personal, low-cost, fast international transfers, PandaRemit is more suitable.

Conclusion

The PingPong Payments vs PandaRemit comparison highlights that both platforms are secure and reliable. PingPong Payments excels in business-focused features, multi-currency accounts, and e-commerce integrations. PandaRemit stands out for low fees, speed, and flexible payout options.

For fast, convenient, and cost-effective transfers, visit PandaRemit Official Site.