Remitly vs OFX: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-21 11:35:07.0 12

Introduction

International money transfers are essential for individuals and businesses managing funds across borders. Common challenges include high fees, slow processing, hidden charges, and complex user interfaces. In this guide, we compare Remitly vs OFX, highlighting their features, costs, and user experience. For those looking for a simple and reliable alternative, PandaRemit offers fast and secure online transfers. Learn more about international transfers on Investopedia.

Remitly vs OFX – Overview

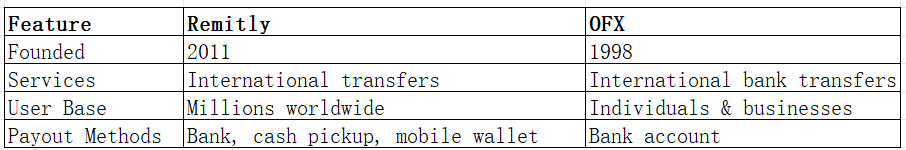

Remitly, founded in 2011, focuses on international remittances, offering bank deposits, cash pickup, and mobile wallet transfers through intuitive mobile and web platforms.

OFX, established in 1998, specializes in larger international money transfers for individuals and businesses. It offers bank-to-bank transfers with competitive exchange rates.

Similarities:

-

Digital platforms for transfers

-

Support for multiple countries

-

Secure transaction processing

Differences:

-

Fees: Remitly charges per transaction with different speed options; OFX offers no transfer fees for most transactions but requires higher minimum amounts.

-

Target Audience: Remitly is remittance-focused; OFX serves individuals and businesses sending larger amounts.

-

Payout Methods: Remitly supports cash pickup and mobile wallets; OFX primarily uses bank accounts.

PandaRemit is another option for users seeking convenient online transfers.

Remitly vs OFX: Fees and Costs

Remitly uses tiered fees based on transfer speed and amount. Express transfers cost more but deliver faster.

OFX generally does not charge fees but requires minimum transfer amounts, making it suitable for larger transactions.

For fee details, visit NerdWallet’s transfer guide.

PandaRemit offers a cost-effective alternative with low fees and no hidden charges.

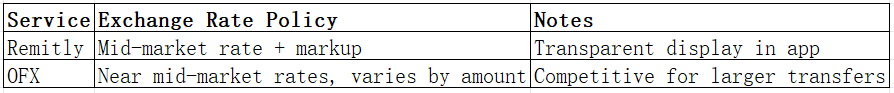

Remitly vs OFX: Exchange Rates

Exchange rates can significantly impact total transfer costs.

PandaRemit provides competitive rates with minimal markup, suitable for standard international transfers.

Remitly vs OFX: Speed and Convenience

Remitly offers rapid delivery, especially with Express transfers, and supports various payout methods.

OFX transfers typically take 1–2 business days depending on the currency and bank network.

See WorldRemit speed guide for reference on typical transfer times.

PandaRemit is a fast, all-online alternative for convenient international transfers.

Remitly vs OFX: Safety and Security

Both platforms prioritize security:

-

Remitly is regulated and encrypted for safe transfers.

-

OFX is regulated globally and insured for secure transactions.

PandaRemit is a licensed and secure option for users prioritizing safety.

Remitly vs OFX: Global Coverage

Remitly supports transfers to 50+ countries via multiple payout methods.

OFX covers over 190 countries but is limited to bank account transfers.

For detailed coverage, see the World Bank remittance report.

Remitly vs OFX: Which One is Better?

Remitly excels in speed, payout flexibility, and small-to-medium transfers. OFX is ideal for larger transfers with competitive exchange rates but limited payout options.

For users seeking convenience, lower fees, and fast delivery, PandaRemit is a compelling alternative.

Conclusion

When choosing between Remitly vs OFX, consider transfer size, speed, and payout preferences. Remitly is better for quick remittances and diverse payout methods, while OFX is suitable for larger international transfers with minimal fees.

PandaRemit offers:

-

Competitive exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Support for multiple currencies

-

Fast, all-online transfers

Learn more at pandaremit.com, or explore guides on Investopedia and NerdWallet. Choosing the right service ensures your money reaches its destination safely and efficiently, making Remitly vs OFX a key decision for international transfers.