Remitly vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-21 12:51:05.0 15

Introduction

Cross-border money transfers have become increasingly important for individuals and businesses, but users often face high fees, slow delivery, hidden charges, and complex processes. This article provides a comprehensive comparison of Remitly vs Payoneer in terms of fees, exchange rates, transfer speed, security, and global coverage. For those seeking a fast, secure, and convenient solution, PandaRemit offers a reliable online alternative. For more information on international money transfer, see Investopedia.

Remitly vs Payoneer – Overview

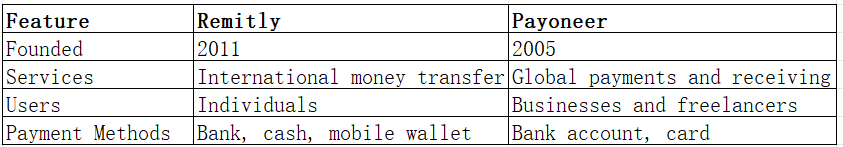

Remitly, founded in 2011, focuses on personal international money transfers, offering bank deposits, cash pickups, and mobile wallet transfers, accessible via mobile app and website.

Payoneer, founded in 2005, provides global payment and cross-border receiving services, catering to freelancers and businesses, with multi-currency accounts and card-based payments.

Similarities:

-

Digital money transfer platforms

-

Multi-country and multi-currency support

-

Security and regulatory compliance

Differences:

-

Fees: Remitly charges based on speed and amount, while Payoneer has account-related and cross-border withdrawal fees.

-

Target Users: Remitly focuses on individual remitters; Payoneer targets businesses and freelancers.

-

Payment Methods: Remitly supports bank, cash, and mobile wallet; Payoneer mainly uses bank accounts and global cards.

PandaRemit provides a convenient online alternative.

Remitly vs Payoneer: Fees and Costs

Remitly fees vary by transfer speed and amount, with faster delivery costing more but offering quicker processing.

Payoneer fees include account maintenance, cross-border withdrawals, and currency conversion, suitable for regular payments and business transactions.

Refer to NerdWallet money transfer guide for detailed fee comparisons.

PandaRemit provides a low-cost, transparent alternative.

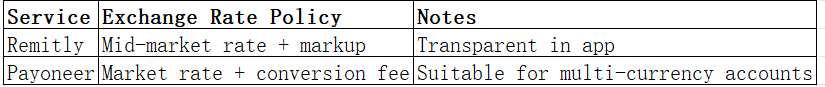

Remitly vs Payoneer: Exchange Rates

Exchange rates significantly impact transfer costs.

PandaRemit offers competitive rates for personal cross-border transfers.

Remitly vs Payoneer: Speed and Convenience

Remitly offers fast delivery options, flexible payment methods, and easy-to-use mobile and web apps.

Payoneer transfer speed depends on bank processing and account setup, generally 1-3 business days.

See WorldRemit transfer speed guide for more information.

PandaRemit is a fast and convenient online alternative.

Remitly vs Payoneer: Safety and Security

Both platforms prioritize security:

-

Remitly is regulated and uses encryption to protect funds.

-

Payoneer adheres to global financial regulations and enterprise-grade security standards.

PandaRemit is also a licensed and secure option.

Remitly vs Payoneer: Global Coverage

Remitly supports over 50 countries with multiple payout options.

Payoneer covers many countries and currencies, ideal for freelancers and businesses receiving international payments.

Detailed coverage information is available in the World Bank remittance report.

Remitly vs Payoneer: Which One is Better?

Remitly is ideal for small personal transfers with fast delivery and flexible payment options.

Payoneer is suitable for businesses and freelancers managing multi-currency accounts, with transparent fees but longer processing times.

For users seeking low-cost, fast, and convenient transfers, PandaRemit is a viable alternative.

Conclusion

Choosing between Remitly vs Payoneer depends on transfer amount, speed, and preferred payment methods. Remitly excels in quick personal transfers, while Payoneer is better for business and multi-currency account management.

PandaRemit advantages:

-

Low fees with competitive exchange rates

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online process

For more information, visit PandaRemit official site, or check Investopedia and NerdWallet guides. Choosing the right service ensures secure and efficient transfers, making Remitly vs Payoneer a critical decision in cross-border payments.