Remitly vs Panda Remit: The Best Way to Send Money from the UK to Colombia

Benjamin Clark - 2025-10-15 10:51:35.0 8

Introduction

If you need to support family, pay tuition, or handle emergencies, finding a fast and affordable way to send money from the UK to Colombia matters. Many people search for “Remitly send money Colombia” because Remitly is a trusted digital remittance service that makes international transfers straightforward. In addition, Panda Remit has become a popular alternative thanks to its zero-fee first transfers and loyalty rewards, giving UK senders more choices than ever before.

Whether you’re helping relatives in Bogotá, covering bills in Medellín, or supporting business operations, understanding the options, fees, and delivery times can help you get the best value for your money.

Can You Send Money to Colombia with Remitly?

Yes — Remitly supports transfers from the UK to Colombia. You can choose from several delivery options depending on your recipient’s preferences:

-

Bank deposit – Send funds directly to Colombian bank accounts.

-

Cash pickup – Recipients can collect cash in-person at designated partner locations.

-

Mobile wallet – Send money to supported digital wallets for easy access.

Remitly works with well-established local financial institutions to make the process reliable.

Common banks in Colombia include:

-

Bancolombia

-

Banco de Bogotá

-

Banco Davivienda

-

BBVA Colombia

-

Banco Popular

Popular mobile wallets in Colombia include:

-

Nequi

-

Daviplata

There are typically no unusual location restrictions within Colombia, but the recipient must have valid ID and meet any compliance requirements of the chosen payout method.

Panda Remit also supports instant bank deposits to Colombia, offering a fully online experience and a zero-fee first transfer for new users.

Step-by-Step Guide — How to Use Remitly for Colombia

Sending money with Remitly is simple and can be completed online in minutes:

-

Create an account – Visit https://www.remitly.com and sign up using your email address.

-

Verify your ID – Complete identity verification for security and compliance.

-

Choose Colombia – Select Colombia as your destination country.

-

Select a delivery method – Pick between bank deposit, cash pickup, or mobile wallet.

-

Enter recipient info – Provide accurate bank details or personal information for cash pickup.

-

Pay & track your transfer – Pay via bank transfer or debit card, and follow your transfer status in real time.

Panda Remit also offers a streamlined, fully online process, with zero-fee first transfers, making it attractive for first-time users.

Fees, Exchange Rates & Limits

When sending money from the UK to Colombia, it’s important to understand how Remitly’s fees and exchange rates work:

-

Fixed fees: Remitly charges a fee depending on the amount and delivery speed.

-

Exchange rate markup: The GBP→COP exchange rate includes a small margin compared to the mid-market rate.

-

Transfer limits: Daily or monthly sending limits may apply based on your account verification level.

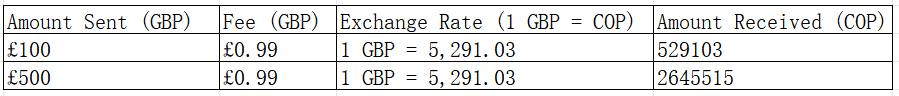

Here’s an example of Remitly’s fees and exchange rates for GBP→COP:

Panda Remit, on the other hand, provides zero-fee first transfers and occasionally offers seasonal coupon codes for ongoing users, which can help reduce costs over time.

Transfer Speed & Delivery Options

Remitly offers two main delivery options for transfers to Colombia:

-

Express – Transfers typically arrive within minutes, ideal for urgent payments. Fees may be slightly higher.

-

Economy – Lower fees, but transfers usually take 1–3 business days, depending on bank processing times.

Delivery channels include:

-

Bank deposit – Common for most users; direct to Colombian accounts.

-

Cash pickup – Recipients can collect funds at partner locations like Bancolombia or Davivienda branches.

-

Mobile wallets – Fast transfers to wallets like Nequi or Daviplata.

Panda Remit supports instant bank deposits and often achieves same-day arrivals, providing a competitive alternative for UK senders looking for speed.

Useful Tips Before Sending Money

To ensure your transfer goes smoothly and cost-effectively, keep these tips in mind:

-

Monitor exchange rates: Even small differences in GBP→COP rates can affect the total amount received.

-

Avoid credit card fees: Transfers from credit cards are not supported for this corridor.

-

Verify recipient info: Double-check account numbers, ID, and names to prevent delays.

-

Compare providers: Always check transfer options before sending — rates and fees can change.

-

Watch promo offers: Referral bonuses and seasonal coupons (especially from Panda Remit) can save you money.

Conclusion & Recommendation

Remitly is a widely used, trusted platform for sending money from the UK to Colombia. It offers competitive rates, flexible delivery options, and reliable service.

However, if you want to save on fees — especially for your first transfer — Panda Remit is a strong alternative. With zero-fee first transfers, loyalty rewards, and a fully online experience, it’s worth comparing both services each time you send money.

👉 Try Panda Remit here: https://www.pandaremit.com