Remitly vs Panda Remit: The Best Way to Send Money from the UK to Kenya

Benjamin Clark - 2025-10-14 14:52:37.0 12

Introduction

Whether it's for family support, tuition fees, or emergencies, many people in the UK need to send money to Kenya. Increasingly, users search for “Remitly send money Kenya” to find a secure, fast, and cost-effective way to transfer funds.

Remitly is a globally trusted remittance platform known for transparent fees, fast delivery, and easy-to-use services. At the same time, Panda Remit has gained popularity, especially with its zero-fee first transfers and loyalty rewards for new users.

Can You Send Money to Kenya with Remitly?

Remitly fully supports sending money from the UK to Kenya, offering multiple delivery options:

-

Bank Transfer: Funds are sent directly to the recipient's local bank account in Kenya.

-

Cash Pickup: Recipients can collect cash at Remitly partner locations in Kenya.

-

Mobile Wallet: Platforms like M-Pesa allow recipients to receive funds on their mobile phones quickly.

Common banks in Kenya include:

-

Equity Bank

-

KCB Bank

-

Co-operative Bank

-

NCBA Bank

-

Stanbic Bank

Popular mobile wallets are:

-

M-Pesa

-

Airtel Money

-

T-Kash

Panda Remit also offers instant bank deposits, which is very convenient for users who need fast transfers.

Step-by-Step Guide — How to Use Remitly for Kenya

-

Create a Remitly Account

Visit the Remitly website (https://www.remitly.com) or download the app and register. -

Verify Your Identity

Upload identification documents and proof of address as required by UK and Kenyan regulations. -

Select Kenya as the Recipient Country

Choose Kenya in the transfer settings. -

Choose Delivery Method

Options include bank transfer, cash pickup, or mobile wallet. -

Enter Recipient Information

Include recipient's full name, bank account details, or mobile wallet number. -

Pay & Track Transfer

Fund the transfer using a debit card or bank account (credit cards are not supported). You can track your transfer in real-time.

💡 Panda Remit supports fully online transfers with zero-fee for the first transaction.

Fees, Exchange Rates & Limits

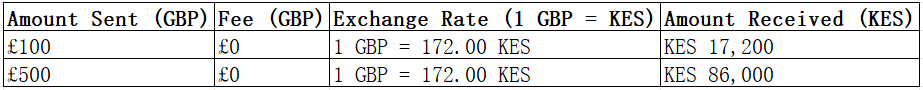

Remitly charges no fee for sending money to Kenya, with an approximate exchange rate of 1 GBP = 172.00 KES.

Note: Actual exchange rates may vary, and the received amount could differ slightly.

Panda Remit provides zero-fee first transfers and seasonal promotions for new users.

Transfer Speed & Delivery Options

Remitly offers two main speed options:

-

Express: Funds are usually delivered within minutes to a few hours, ideal for urgent transfers.

-

Economy: Transfers typically take 1–3 business days and have lower costs.

Delivery channels include:

-

Bank transfer: Direct to major Kenyan banks.

-

Cash pickup: Available at partner locations.

-

Mobile wallet: Such as M-Pesa.

Panda Remit provides instant bank deposits, suitable for users needing immediate funds.

Useful Tips Before Sending Money

-

Monitor Exchange Rates

Rates fluctuate and can impact the received amount; consider sending larger amounts when rates are favorable. -

Avoid Using Credit Cards

Remitly does not support credit card payments, and credit cards may incur extra charges. -

Verify Recipient Information

Ensure the recipient’s name, bank account, or mobile wallet details are correct. -

Compare Providers

Fees and exchange rates differ between platforms. Check each time before sending money. -

Check Promotions

Panda Remit offers referral bonuses and coupon rewards to reduce costs.

Conclusion & Recommendation

Overall, Remitly is a widely used platform for sending money from the UK to Kenya, offering ease of use, fast transfers, and transparent fees. Panda Remit, with its zero-fee first transfers and reward programs, provides great value for new users.

👉 For secure, fast, and economical transfers, both Remitly and Panda Remit are worth considering.

Official websites:

-

Remitly: https://www.remitly.com

-

Panda Remit: https://www.pandaremit.com