Remitly vs Azimo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-21 09:37:03.0 15

Introduction

Sending money across borders can be challenging due to high fees, complex exchange rates, and long delivery times. As users search for faster, safer, and cheaper options, digital transfer platforms like Remitly and Azimo have gained popularity. Both aim to simplify global remittances, but each platform caters to slightly different audiences and needs. For those looking for a balance between affordability and reliability, Panda Remit also stands out as a trusted option.

For a deeper understanding of how digital remittance services work, check Investopedia’s remittance guide.

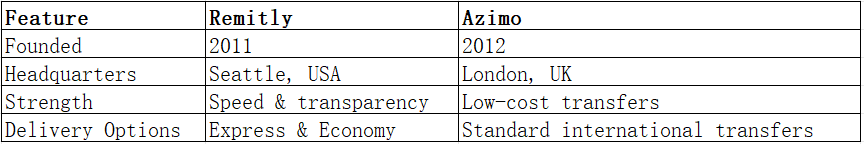

Remitly vs Azimo – Overview

Remitly was founded in 2011 in Seattle and has become a major name in digital remittances. It offers services to send money from over 20 countries to 170+ destinations, focusing on speed and transparency. Users can choose between “Express” and “Economy” delivery options, depending on how fast they need the funds delivered.

Azimo, established in 2012 in London, gained popularity for its low-cost transfer model and strong European presence. Acquired by Papaya Global in 2022, Azimo focuses on affordable international transfers for individuals and small businesses.

Similarities

-

Both offer mobile apps and web platforms.

-

Support multiple payout methods such as bank deposit and cash pickup.

-

Provide user-friendly interfaces and transparent pricing.

Differences

In the growing digital remittance market, Panda Remit also offers competitive fees and broad coverage, appealing to users seeking both value and reliability.

Remitly vs Azimo: Fees and Costs

Both Remitly and Azimo promote low-cost transfers, but pricing structures vary depending on the sending country, transfer method, and destination currency.

-

Remitly: Charges can range from £1.99–£3.99 depending on payment type. Express transfers funded by debit cards may have higher fees but offer instant delivery.

-

Azimo: Typically offers lower fees, starting from £0.99 for some routes, making it attractive for smaller transfers.

For an updated fee comparison, refer to NerdWallet’s money transfer comparison.

While both aim for affordability, Panda Remit often provides lower total costs by offering competitive exchange rates with minimal markup.

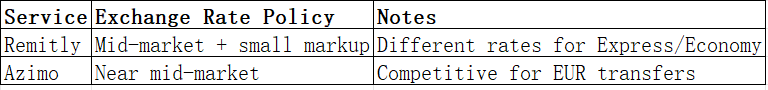

Remitly vs Azimo: Exchange Rates

Exchange rates play a critical role in determining the actual cost of transfers. Both platforms add a small markup to the mid-market rate.

While Remitly’s rates can fluctuate based on speed, Azimo tends to maintain consistency, especially for Euro transactions. Panda Remit also provides highly competitive rates close to the mid-market average, enhancing transfer value without hidden costs.

Remitly vs Azimo: Speed and Convenience

Remitly excels in speed through its Express service, enabling instant delivery to many destinations. Azimo’s transfers usually take from a few minutes to one business day, depending on the payout method. Both have intuitive apps that make sending money straightforward.

For reference, see Monito’s remittance speed comparison.

Panda Remit is also recognized for its efficient processing and fast payouts, often completing transfers within hours — a valuable benefit for urgent remittances.

Remitly vs Azimo: Safety and Security

Both services operate under strict financial regulations:

-

Remitly is licensed as a money transmitter in the U.S. and regulated by the Financial Conduct Authority (FCA) in the U.K.

-

Azimo is also FCA-regulated and follows EU payment standards.

Both employ encryption, secure data protection, and verification processes to prevent fraud. Similarly, Panda Remit is a fully licensed service provider that ensures secure transfers and data protection across all transactions.

Remitly vs Azimo: Global Coverage

Remitly serves over 170 countries, offering wide global reach. Azimo focuses mainly on European senders, supporting over 80 receiving countries.

For more information, see the World Bank’s remittance data overview.

While both platforms cover key markets in Asia, Europe, and the Americas, Panda Remit continues expanding in Asia-Pacific regions and offers extensive currency options — excluding Africa and credit card funding.

Remitly vs Azimo: Which One is Better?

Choosing between Remitly and Azimo depends on user priorities:

-

Choose Remitly for faster transfers and broader destination coverage.

-

Choose Azimo for lower transfer fees and simple European remittances.

For users seeking a blend of affordability, reliable service, and strong exchange rates, Panda Remit may serve as a well-balanced alternative.

Conclusion

In the Remitly vs Azimo comparison, both platforms perform strongly in digital remittances. Remitly’s express speed and global network make it ideal for those needing quick international payouts, while Azimo’s affordable structure appeals to frequent European users.

However, users looking for the best mix of low fees, competitive rates, and fast delivery should explore Panda Remit. Panda Remit offers:

-

Competitive exchange rates with transparent pricing.

-

Flexible payment methods including POLi, PayID, bank card, and e-transfer.

-

Transfers in 40+ currencies worldwide.

-

Fast, fully digital transactions with strong compliance and security.

For more on global remittance trends, see Forbes Finance Council and Panda Remit’s official site.

Overall, whether you prefer Remitly’s speed or Azimo’s affordability, understanding your transfer needs helps you choose the service that saves you the most time and money in 2025.