Remitly vs bKash: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-22 14:48:31.0 19

Introduction

Sending money across borders has become a daily necessity for millions of people. However, many still face challenges such as high transaction fees, slow delivery times, and unfavorable exchange rates. Both Remitly and bKash have positioned themselves as digital payment leaders catering to international users. Yet, with the growing demand for faster and cheaper remittance options, alternatives like Panda Remit are also gaining attention. To understand which platform delivers better overall value, this article dives deep into Remitly vs bKash comparison.

For a broader overview of remittance services, see Investopedia’s guide to international money transfers: https://www.investopedia.com/articles/personal-finance/111815/best-ways-send-money-internationally.asp

Remitly vs bKash – Overview

Remitly, founded in 2011 in the United States, is a global online remittance service that helps users send money to over 170 countries. The platform is known for its easy-to-use app, competitive exchange rates, and transparent pricing model.

bKash, launched in 2011 in Bangladesh, is one of South Asia’s largest mobile financial services platforms. Originally focused on domestic transactions, bKash has expanded into international remittances through partnerships with global networks. It caters especially to Bangladeshi workers abroad who send money home.

Similarities:

-

Both offer mobile apps for iOS and Android.

-

Support bank deposits, mobile wallets, and cash pickup.

-

Provide real-time notifications and tracking.

Differences:

-

Remitly focuses on global remittances with multi-country coverage.

-

bKash mainly serves users sending money to and within Bangladesh.

-

Remitly offers express and economy delivery options, while bKash emphasizes wallet-based transfers.

If you’re looking for another flexible option, Panda Remit also provides convenient and affordable transfers to Asia and other regions.

Remitly vs bKash: Fees and Costs

Both platforms charge transaction fees based on destination, payment method, and currency. Remitly typically offers two types of transfers:

-

Express: Faster delivery, slightly higher fee.

-

Economy: Lower cost, longer processing time.

bKash fees vary depending on the sending partner and payout method. For instance, international transfers sent from global remittance partners to bKash wallets may include small transaction fees handled by the originating provider.

Users can compare updated remittance fees via NerdWallet’s money transfer comparison tool: https://www.nerdwallet.com/best/international-money-transfer-services

For lower-cost transfers, Panda Remit often stands out for offering competitive exchange rates with minimal fees, particularly for transfers across Asia-Pacific.

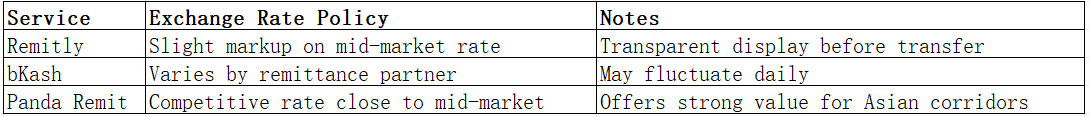

Remitly vs bKash: Exchange Rates

Exchange rates can greatly affect the total amount received by recipients. Remitly applies a small markup over mid-market rates, which is displayed transparently before confirming a transfer. bKash, on the other hand, relies on its partner networks, which may result in fluctuating rates depending on the remittance corridor.

Remitly vs bKash: Speed and Convenience

Remitly provides express transfers that can arrive within minutes, depending on the receiving country and payment method. Its mobile app and 24/7 customer support enhance user convenience.

bKash transfers to Bangladesh are usually instant when sent from authorized global partners. However, outbound international transfers are limited.

For users seeking both speed and low fees, Panda Remit is known for fast delivery times through an all-online process.

Learn more about transfer speeds from MoneyTransfers.com’s remittance guide: https://www.moneytransfers.com/guides/how-long-does-an-international-money-transfer-take

Remitly vs bKash: Safety and Security

Both Remitly and bKash prioritize user security. Remitly is regulated by financial authorities in multiple jurisdictions and uses encryption and identity verification to protect users. bKash operates under the oversight of the Bangladesh Bank, ensuring compliance with national financial standards.

Similarly, Panda Remit is a licensed and secure platform, committed to protecting user data and complying with financial regulations in the regions it serves.

Remitly vs bKash: Global Coverage

Remitly supports sending money from over 20 source countries to 170+ destinations. bKash, while primarily serving Bangladesh, continues to expand its international inflow capabilities through remittance partnerships.

For a global view of remittance networks, see the World Bank’s remittance data report: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data

Remitly vs bKash: Which One is Better?

When comparing Remitly vs bKash, both platforms cater to distinct user groups. Remitly is ideal for users seeking multi-destination transfers with flexible delivery speeds, while bKash is best for those focused on remittances to Bangladesh.

However, users prioritizing lower costs and faster processing may find Panda Remit to be a more efficient choice. Its user-friendly interface and competitive rates make it a valuable alternative in 2025.

Conclusion

In summary, Remitly vs bKash highlights two strong digital money transfer solutions, each with unique strengths. Remitly excels in global reach and flexibility, while bKash remains a reliable wallet-based system for Bangladesh users.

That said, Panda Remit provides a compelling balance with low fees, strong exchange rates, and rapid delivery. It supports over 40 currencies and multiple payment methods such as POLi, PayID, bank cards, and e-transfers — all through a seamless online platform.

For those exploring alternatives, visit Panda Remit’s official site: https://www.pandaremit.com/

You can also check international remittance comparisons via Forbes Advisor: https://www.forbes.com/advisor/money-transfer/best-international-money-transfer-apps/

Ultimately, the best service depends on your needs — but this Remitly vs bKash comparison makes it clear that users in 2025 have more affordable, faster, and safer remittance choices than ever before.