Remitly vs Chime: Which is Better for International Money Transfers?

Benjamin Clark - 29

Introduction

Cross-border money transfers are increasingly essential for businesses, expatriates, and families supporting loved ones abroad. However, users often face high fees, slow delivery, hidden charges, and poor digital experience. Choosing the right service is crucial to save money and ensure reliable transfers. In this comparison, we look at Remitly vs Chime to understand their offerings, costs, and convenience. For users seeking a flexible alternative, PandaRemit provides a fast and user-friendly option for sending money internationally. Learn more about international transfers on Investopedia.

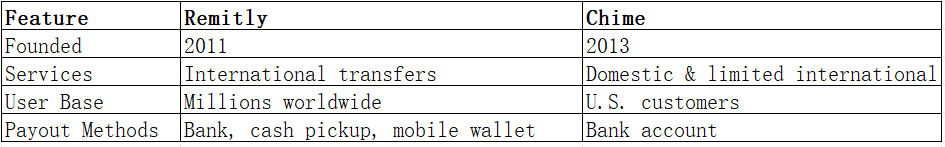

Remitly vs Chime – Overview

Remitly, founded in 2011, specializes in international money transfers. It serves millions of users worldwide, offering mobile and web platforms for remittances, with options for bank deposits, cash pickup, and mobile wallets.

Chime, launched in 2013, is primarily a U.S.-based digital banking platform offering spending accounts and debit cards. While not a traditional remittance service, Chime allows domestic and select international transfers through its app.

Similarities:

-

Both offer digital platforms (mobile apps and web).

-

Both support transfers to multiple destinations.

-

Both provide debit card integrations.

Differences:

-

Fees: Remitly charges based on speed and transfer amount; Chime offers limited fee-free transfers.

-

Target Audience: Remitly focuses on international remittance; Chime caters mainly to U.S. banking customers.

-

Payout Options: Remitly supports cash pickup and mobile wallets; Chime is bank-centric.

PandaRemit is another alternative for users looking for convenient, all-online transfers.

Remitly vs Chime: Fees and Costs

Remitly uses a tiered fee system. Standard transfers may have lower fees but longer delivery times, while Express transfers are faster but cost more. Subscription plans or loyalty programs can influence fees.

Chime allows transfers within the U.S. mostly fee-free. International transfers are limited and may involve intermediary fees from banks.

For a detailed fee comparison, see NerdWallet’s transfer guide.

PandaRemit is often a lower-cost alternative for users seeking high-value international transfers without hidden fees.

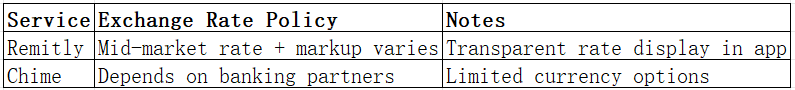

Remitly vs Chime: Exchange Rates

Exchange rates are crucial in determining the total cost of a transfer.

PandaRemit often provides competitive exchange rates with minimal markup, making it attractive for frequent international transfers.

Remitly vs Chime: Speed and Convenience

Remitly offers fast delivery, with Express transfers reaching recipients within minutes. The mobile app is intuitive, supporting multiple payout methods.

Chime transfers are generally faster for domestic payments but slower or less flexible internationally.

For more on transfer speeds, visit WorldRemit speed guide.

PandaRemit also provides fast, online-only transfers with coverage across multiple countries.

Remitly vs Chime: Safety and Security

Both services use encryption and comply with regulations in their respective regions.

-

Remitly is licensed and regulated for international transfers.

-

Chime is FDIC-insured and has built-in fraud protection.

PandaRemit is also licensed and secure, ensuring safe transfers without sharing sensitive data unnecessarily.

Remitly vs Chime: Global Coverage

Remitly supports transfers to over 50 countries with various payout methods.

Chime has limited international coverage, mainly tied to U.S. banking networks.

For a detailed global coverage report, see the World Bank remittance report.

Remitly vs Chime: Which One is Better?

Remitly excels in international coverage, speed, and payout flexibility. Chime is ideal for U.S. domestic transfers with easy app integration but limited international functionality.

For users prioritizing cost-efficiency, speed, and broad currency coverage, PandaRemit may be the better choice, offering a seamless online experience.

Conclusion

When comparing Remitly vs Chime, the choice depends on your transfer needs. Remitly provides reliable international transfers with flexible payout methods and clear exchange rates. Chime is a strong option for domestic or limited international banking but lacks full remittance features.

For a balanced alternative, PandaRemit offers:

-

Competitive exchange rates and low fees

-

Multiple payment methods (POLi, PayID, bank card, e-transfer)

-

Support for over 40 currencies

-

Fast, all-online transfers without leaving your home

Learn more about PandaRemit at pandaremit.com or explore its benefits through guides like Investopedia and NerdWallet.

Choosing the right service ensures your money reaches its destination safely, quickly, and cost-effectively, making Remitly vs Chime a critical consideration for global money transfers.