Remitly vs GCash Remit: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-22 14:22:20.0 16

Cross-border money transfers have become an essential part of global financial life, especially for overseas workers supporting families. However, users still face issues like high fees, hidden charges, and slow delivery times. Two major players—Remitly and GCash Remit—stand out for their digital-first remittance solutions. At the same time, some users turn to Panda Remit for competitive rates and smoother online experiences.

For more about how international remittances work, visit Investopedia’s remittance guide.

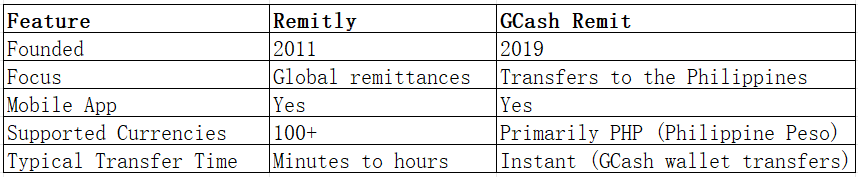

Remitly vs GCash Remit – Overview

Remitly, founded in 2011 in Seattle, offers cross-border transfer services to over 170 countries, targeting migrant workers who send money home. It supports bank deposits, cash pickups, and mobile wallet transfers.

GCash Remit, the international arm of the Philippines-based GCash platform, enables overseas Filipinos to send funds directly into GCash wallets back home. Launched as part of the GCash ecosystem, it simplifies the remittance process through mobile integration.

Similarities: Both offer mobile-friendly apps, real-time transaction tracking, and multi-currency support.

Differences: Remitly supports a wider range of countries and currencies, while GCash Remit specializes in transfers to the Philippines. GCash’s local ecosystem integration makes it particularly strong for wallet-to-wallet transfers.

For users looking for a globally accessible, low-cost option, Panda Remit provides another solid choice for personal transfers worldwide.

Remitly vs GCash Remit: Fees and Costs

Remitly offers two main fee tiers—Economy (lower fees, slower delivery) and Express (faster, higher cost). Fees vary by destination, usually between USD 1.99–3.99. Transparent pricing is displayed before each transfer.

GCash Remit often charges low fees for transfers to the Philippines, depending on the sending partner or payment channel. However, since GCash Remit’s network relies on partnerships, intermediary costs can affect total fees.

To compare remittance fees globally, check World Bank’s Remittance Prices Worldwide.

Panda Remit is often recognized for offering low or zero transfer fees during promotions, making it a competitive option for personal remittances.

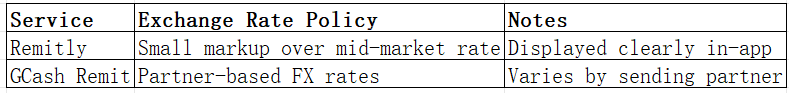

Remitly vs GCash Remit: Exchange Rates

Exchange rate transparency matters when sending money across borders. Remitly applies a small markup on the mid-market rate, clearly shown before users confirm the transaction. GCash Remit’s rates depend on its partner networks, which may include slight variations.

Panda Remit frequently offers exchange rates close to the mid-market rate, ensuring users receive more value in the recipient’s currency.

Remitly vs GCash Remit: Speed and Convenience

Speed and reliability are key when sending money abroad. Remitly’s Express transfers arrive in minutes when using debit cards, while Economy transfers can take 1–3 days.

GCash Remit enables instant transfers to GCash wallets in the Philippines, making it one of the fastest wallet-to-wallet remittance options for Filipino users.

For insights into average remittance speeds, visit NerdWallet’s remittance speed guide.

When it comes to convenience, Panda Remit also offers near-instant delivery for many destinations through its online platform and easy verification process.

Remitly vs GCash Remit: Safety and Security

Security is a top priority for both services. Remitly is licensed in multiple jurisdictions, including the U.S. and the U.K., and uses bank-grade encryption and fraud monitoring systems. GCash Remit is regulated under Bangko Sentral ng Pilipinas (BSP) and adheres to strict anti-money laundering standards.

Panda Remit, similarly, is a licensed provider that uses encryption and compliance controls to ensure safe, secure international transfers.

Remitly vs GCash Remit: Global Coverage

Remitly supports transfers to 170+ countries across Asia, Europe, and Latin America. GCash Remit’s reach is more limited but highly effective for transfers to the Philippines through its integration with GCash wallets.

For an overview of remittance flows and coverage, refer to the World Bank’s remittance report.

Panda Remit currently supports over 40 currencies and provides multiple payment methods such as PayID, POLi, bank transfer, and e-wallet payments (excluding credit cards).

Remitly vs GCash Remit: Which One is Better?

Both Remitly and GCash Remit have unique advantages. Remitly’s strength lies in its wide international coverage and transparent structure. GCash Remit excels in speed and convenience for transfers to the Philippines, especially for users already in the GCash ecosystem.

However, if you want a flexible, low-cost alternative that combines global access with speed and transparency, Panda Remit offers a great balance for personal remittance users.

Conclusion

In the Remitly vs GCash Remit comparison, both services cater to distinct user needs. Remitly is best for those sending money to a variety of countries, while GCash Remit shines for quick transfers to GCash wallets in the Philippines.

For users who prioritize affordability, strong exchange rates, and secure online service, Panda Remit stands out with:

-

High exchange rates and low fees

-

Multiple payment methods (PayID, POLi, bank card, e-transfer, etc.)

-

Support for 40+ currencies

-

Fast, online-based transfer process

To explore more about remittance platforms, visit https://www.pandaremit.com or read NerdWallet’s best money transfer services.

Ultimately, the choice between Remitly vs GCash Remit depends on your transfer needs—but Panda Remit remains a reliable, secure, and user-friendly alternative for 2025.