Remitly vs GrabPay Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-22 14:32:56.0 17

Cross-border money transfers have become essential for global workers and families. However, users often face high fees, poor exchange rates, and long processing times. Both Remitly and GrabPay Remit aim to simplify this process with digital solutions. Yet, understanding their costs and features is vital before choosing one.

For those seeking a reliable alternative, Panda Remit also provides competitive rates and convenient online transfers. Learn more about how remittance services work on Investopedia.

Remitly vs GrabPay Remit – Overview

Remitly was founded in 2011 in the U.S. and focuses on affordable international transfers for individuals sending money to Asia, Europe, and Latin America. It’s known for its mobile-first approach and fast delivery options.

GrabPay Remit, launched under Grab’s financial services arm, is part of the Grab ecosystem popular in Southeast Asia. It allows users to send money abroad through the Grab app with a focus on convenience and integration.

Similarities: Both offer mobile apps, transparent fees, and global coverage for personal remittances.

Differences: Remitly is widely used among overseas workers, while GrabPay Remit is tailored for Southeast Asian residents using Grab’s digital wallet.

Panda Remit also serves a growing base of users across Asia, offering a digital-first solution with low transfer costs.

Remitly vs GrabPay Remit: Fees and Costs

Fees vary depending on transfer amount, currency, and destination.

-

Remitly: Charges vary by payment speed. Express transfers are faster but more expensive, while Economy transfers are cheaper but slower.

-

GrabPay Remit: Offers competitive transfer fees within its supported markets, often with promotional discounts for first-time users.

For more detailed comparisons, you can check independent reviews on NerdWallet.

Panda Remit, on the other hand, is known for its transparent fee structure and no hidden costs, making it a cost-effective alternative.

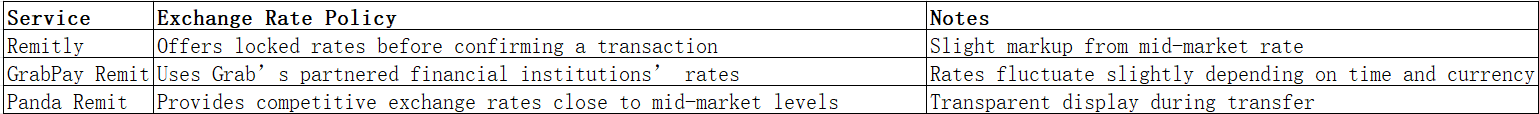

Remitly vs GrabPay Remit: Exchange Rates

Exchange rate margins are crucial for determining actual transfer value.

Remitly vs GrabPay Remit: Speed and Convenience

Remitly typically delivers funds within minutes for express transfers, or 1–3 business days for economy options. GrabPay Remit is integrated into the Grab ecosystem, allowing quick remittances from users’ digital wallets.

Both apps are designed for ease of use, with multilingual support and mobile tracking. Panda Remit also offers fast, all-online transactions with 24/7 access.

For more on transfer speed expectations, visit Forbes Advisor.

Remitly vs GrabPay Remit: Safety and Security

Both platforms are licensed and regulated in their operating regions.

Remitly uses encryption, identity verification, and anti-fraud systems.

GrabPay Remit operates under Grab’s licensed financial entity and applies strict compliance and KYC protocols.

Panda Remit is also a licensed remittance provider, ensuring safety through encryption and compliance with local regulations.

Remitly vs GrabPay Remit: Global Coverage

Remitly supports transfers to over 100 countries. GrabPay Remit, meanwhile, focuses mainly on Southeast Asia, including Malaysia, the Philippines, and Indonesia.

According to the World Bank, Asia remains the top remittance-receiving region globally.

Panda Remit offers coverage in more than 40 currencies, primarily in Asia and major international corridors.

Remitly vs GrabPay Remit: Which One is Better?

Both platforms are strong contenders in the digital remittance industry.

Remitly is ideal for users seeking global reach and flexible delivery options, while GrabPay Remit is better for users in Southeast Asia who already use Grab’s ecosystem.

However, for users looking for a balance between low cost, speed, and coverage, Panda Remit could be a better alternative.

Conclusion

In the Remitly vs GrabPay Remit comparison, both provide reliable and secure ways to send money abroad. Remitly stands out for its international network and flexible delivery options, while GrabPay Remit integrates convenience within the Grab app.

If you prioritize competitive rates, quick delivery, and transparent fees, Panda Remit is worth exploring. It offers high exchange rates, low transfer costs, and supports 40+ currencies across Asia and beyond.

For further insights, explore remittance trends on NerdWallet and World Bank.