Remitly vs iPayLinks: Which is Better for International Money Transfers?

Benjamin Clark - 19

The global remittance industry continues to grow as millions send funds abroad for family, work, or business. Remitly and iPayLinks are two well-known digital platforms offering international transfer services, each catering to unique customer needs. However, some users also consider Panda Remit for its simple and cost-effective online remittance options.

For more insights into international transfers, visit Investopedia’s remittance guide.

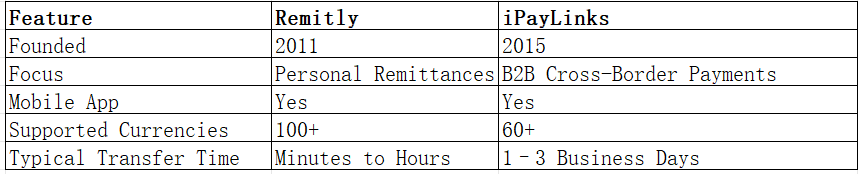

Remitly vs iPayLinks – Overview

Remitly, founded in 2011 in the U.S., provides fast, user-friendly international transfers to over 170 countries. It focuses primarily on personal remittances for migrant workers and families.

iPayLinks, established in 2015 in China, focuses on cross-border payment infrastructure for digital businesses and e-commerce platforms. It enables seamless B2B payments and merchant settlements globally.

Similarities: Both offer multi-currency support, online transfer platforms, and mobile-friendly interfaces.

Differences: Remitly is geared toward personal money transfers, while iPayLinks targets businesses with cross-border payment solutions. Remitly charges transaction-based fees, whereas iPayLinks offers enterprise-based pricing and API integrations.

If you prefer a simpler, individual-oriented transfer option, Panda Remit offers an affordable, online-based alternative with transparent pricing.

Remitly vs iPayLinks: Fees and Costs

Remitly’s pricing depends on destination and delivery method, with fees typically between USD 1.99–3.99. It also provides two transfer types: Economy (cheaper, slower) and Express (instant but with slightly higher costs).

iPayLinks offers customized pricing based on business transaction volume and regions. Its fees often include processing charges, foreign exchange costs, and integration-related fees.

To explore average remittance charges, visit World Bank’s Remittance Prices Worldwide.

Panda Remit remains a strong competitor for low-cost personal transfers, providing transparent fees and promotional free transfers for new users.

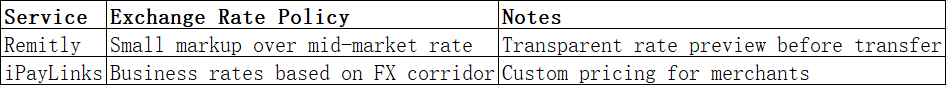

Remitly vs iPayLinks: Exchange Rates

Remitly adds a small margin to the mid-market rate, clearly shown before users confirm a transfer. iPayLinks offers competitive business exchange rates depending on payment corridors and currency pairs.

Panda Remit is also known for providing exchange rates close to mid-market levels, giving users more value for each transfer.

Remitly vs iPayLinks: Speed and Convenience

Remitly offers fast transfers, with Express options enabling funds to reach recipients within minutes using debit cards. Economy transfers may take 1–3 days, depending on the receiving country.

iPayLinks handles transactions typically within 1–3 business days, emphasizing reliability for corporate payments. Both provide tracking tools and notifications for status updates.

For general guidance, see NerdWallet’s guide to remittance speed.

Users looking for faster, simpler transactions can consider Panda Remit, which delivers near-instant transfers through its online platform.

Remitly vs iPayLinks: Safety and Security

Both providers prioritize user protection. Remitly is licensed by the U.S. Department of Treasury and employs encryption and two-factor authentication. iPayLinks complies with global standards like PCI DSS and local regulatory frameworks, ensuring secure fund movement for businesses.

Similarly, Panda Remit is a fully licensed service that uses encryption and verification systems to ensure secure money transfers.

Remitly vs iPayLinks: Global Coverage

Remitly operates in over 170 countries and supports more than 100 currencies, with strong networks in Asia, Europe, and Latin America. iPayLinks, while smaller in reach, focuses on Asia-Pacific and the Middle East, powering global business payments.

For more information on international remittance coverage, visit the World Bank remittance report.

Panda Remit currently supports 40+ currencies and offers flexible payment options such as PayID, bank cards, and e-transfer (excluding credit cards), making it an attractive choice for individuals.

Remitly vs iPayLinks: Which One is Better?

Choosing between Remitly vs iPayLinks depends on your goals. For personal remittances, Remitly offers an intuitive app, transparent pricing, and fast delivery. For business operations, iPayLinks provides advanced cross-border solutions and integration flexibility.

However, if you want an affordable and straightforward platform for individual transfers, Panda Remit offers a balanced mix of low fees, quick delivery, and secure transactions.

Conclusion

In the Remitly vs iPayLinks comparison, both platforms serve specific audiences effectively. Remitly stands out for personal use, offering reliable service to families and individuals abroad. iPayLinks is a robust choice for businesses managing multi-currency transactions and payment infrastructure.

For users seeking an alternative that combines ease of use, affordability, and transparency, Panda Remit provides:

-

High exchange rates and low fees

-

Convenient payment methods (bank card, PayID, POLi, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast transfers with an all-online experience

You can learn more at https://www.pandaremit.com or read NerdWallet’s comparison of transfer services for a broader overview.

Ultimately, whether you choose Remitly or iPayLinks, compare fees, rates, and coverage carefully—and keep Panda Remit in mind as a trusted and efficient alternative for your 2025 remittance needs.