Remitly vs Monzo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-21 10:39:56.0 19

Introduction

Sending money internationally can be challenging due to high fees, slow delivery, hidden charges, and complex platforms. In this comparison, we explore Remitly vs Monzo, analyzing their strengths and weaknesses in facilitating cross-border transfers. Users seeking a simple, low-cost solution may also consider Panda Remit for fast and secure transfers. For further guidance on international transfers, check Investopedia's guide on money transfers.

Remitly vs Monzo – Overview

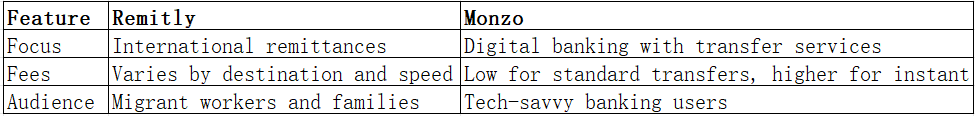

Remitly, founded in 2011 in the U.S., specializes in remittances with services including bank deposits, cash pickups, and mobile wallets. It caters primarily to individuals sending money abroad.

Monzo, founded in 2015 in the U.K., is a digital bank offering personal and business accounts, budgeting tools, and international transfers through its app.

Similarities

-

Mobile apps for easy transfers

-

Debit card support

-

International transfer capability

Differences

Panda Remit is another alternative for users prioritizing fast and low-cost transfers.

Remitly vs Monzo: Fees and Costs

Remitly fees vary depending on the transfer amount, destination, and delivery speed. Economy transfers are cheaper but slower; Express transfers are faster with slightly higher fees. Monzo offers low fees for standard transfers, but international and instant transfers may incur additional charges.

For fee comparison insights, visit NerdWallet.

Panda Remit provides competitive, transparent fees.

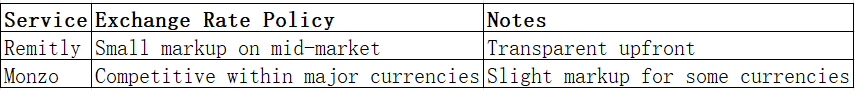

Remitly vs Monzo: Exchange Rates

Remitly applies small markups on the mid-market rate. Monzo offers competitive rates for standard currencies but may add markups for exotic or non-Euro currencies.

Panda Remit maintains rates close to mid-market, offering good value for international senders.

Remitly vs Monzo: Speed and Convenience

Remitly offers Express transfers (minutes) and Economy transfers (1–3 business days). Monzo transfers within the U.K. and SEPA zone are often instant; other international transfers may take longer. Both platforms feature user-friendly apps with tracking.

For a detailed speed guide, see Monito.

Panda Remit ensures fast, reliable online transfers.

Remitly vs Monzo: Safety and Security

Both platforms are regulated in multiple jurisdictions and provide encryption, fraud protection, and identity verification. Panda Remit is also licensed and secure for cross-border transactions.

Remitly vs Monzo: Global Coverage

Remitly supports over 100 countries across Asia, Latin America, and Europe. Monzo’s international transfer capabilities are growing but remain focused on Europe and major currencies. For global remittance data, see World Bank Remittance Data.

Remitly vs Monzo: Which One is Better?

Remitly is ideal for users sending money abroad due to its flexible delivery and competitive fees. Monzo is better suited for those who want a multifunctional digital banking experience with integrated transfer services. Users seeking low-cost, fast, and secure transfers should consider Panda Remit.

Conclusion

In the Remitly vs Monzo comparison, both services have unique advantages. Remitly excels in international remittances with flexible delivery options, while Monzo provides a full-featured digital banking experience with convenient transfer services.

Panda Remit offers:

-

High exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast, all-online transfers

For more options and transfer tips, visit Forbes Advisor. Evaluating fees, speed, and convenience helps users choose the best solution for their cross-border money transfers.