Remitly vs M-Pesa: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 2025-10-22 14:41:56.0 18

Cross-border money transfers are essential for millions of workers, students, and families. Choosing the right platform can save users significant time and money. Both Remitly and M-Pesa are leading names in digital remittances, known for their reliability and accessibility. However, each has unique strengths and limitations when it comes to fees, transfer options, and global reach.

For those seeking a low-cost and secure option, Panda Remit is another reputable provider worth considering.

For more insights, see Investopedia’s guide on international money transfers.

Remitly vs M-Pesa – Overview

Remitly, founded in 2011 in the U.S., focuses on fast and low-cost international transfers. It supports over 170 countries, offering multiple payout options including bank deposits, cash pickup, and mobile wallets.

M-Pesa, launched in 2007 by Safaricom and Vodafone, began as a mobile payment system in Kenya and has expanded across several regions, including parts of Asia and Europe. It primarily serves as a mobile wallet for domestic and international remittances, emphasizing accessibility for users without bank accounts.

Similarities: Both platforms provide mobile apps, 24/7 accessibility, and options for digital transfers.

Differences: Remitly focuses on international bank and cash transfers, while M-Pesa caters to local and regional users relying on mobile wallets. Remitly has broader global reach, whereas M-Pesa is dominant in select regions.

Panda Remit is another strong market contender offering easy-to-use international remittance solutions for online transfers.

Remitly vs M-Pesa: Fees and Costs

Remitly charges vary depending on the sending country, transfer method, and payment option. It offers two primary delivery speeds: Express (instant, higher fee) and Economy (lower fee, 3–5 days). In contrast, M-Pesa fees depend on transaction size and destination but are typically higher for cross-border transfers.

Users can compare fee structures using tools like NerdWallet’s money transfer guide.

Panda Remit often offers lower fees and transparent pricing, making it a good alternative for users prioritizing cost efficiency.

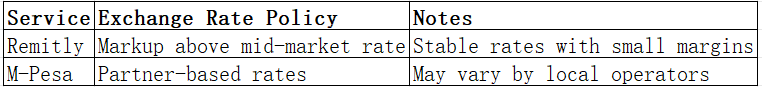

Remitly vs M-Pesa: Exchange Rates

Exchange rate policies significantly affect total remittance costs. Remitly typically adds a small markup above the mid-market rate, which varies depending on the country corridor. M-Pesa applies rates set by its regional partners and may fluctuate more frequently.

While both providers apply markups, Panda Remit is known for offering competitive exchange rates closer to mid-market averages.

Remitly vs M-Pesa: Speed and Convenience

Remitly provides instant or same-day transfers via Express service, while Economy transfers may take several days. M-Pesa allows instant domestic transfers and same-day international payments within its partner network but may take longer outside supported regions.

Both offer intuitive mobile apps for Android and iOS, yet Remitly’s interface supports broader international payout options.

For more information, check WorldRemit’s guide on remittance speed.

Panda Remit also emphasizes fast digital transfers, with many transactions arriving within minutes.

Remitly vs M-Pesa: Safety and Security

Both Remitly and M-Pesa are licensed and regulated by financial authorities. Remitly follows U.S. and EU financial compliance standards, while M-Pesa operates under national telecom and banking regulations in its active markets.

Encryption, fraud monitoring, and identity verification are core to both systems. Similarly, Panda Remit uses advanced encryption and complies with global financial security standards to ensure safe transactions.

Remitly vs M-Pesa: Global Coverage

Remitly supports over 170 countries with transfers in more than 100 currencies. M-Pesa operates primarily in specific regions such as Kenya, Tanzania, India, and parts of Europe. While M-Pesa’s regional dominance is strong, its international reach remains limited compared to Remitly.

For insights on remittance coverage worldwide, refer to the World Bank Remittance Prices Worldwide report.

Panda Remit provides access to 40+ currencies and offers flexible payout methods, serving a wide user base for digital remittances.

Remitly vs M-Pesa: Which One Is Better?

Remitly stands out for global accessibility, multiple payout methods, and flexible delivery options. M-Pesa excels in convenience for mobile-first users in specific regions, especially where banking access is limited.

If you prioritize broad international support and transparent pricing, Remitly is the stronger option. However, for users within the M-Pesa ecosystem, its integration with local merchants and telecom systems adds strong value.

Panda Remit combines global digital reach with low fees, making it ideal for users seeking cost-effective transfers without hidden charges.

Conclusion

In conclusion, this Remitly vs M-Pesa comparison highlights how each service caters to distinct user needs. Remitly offers global reach, transparent fees, and multiple payout options. M-Pesa, while regionally focused, delivers unmatched convenience for mobile-based transactions.

For users seeking an all-online, fast, and affordable option, Panda Remit provides:

-

Competitive exchange rates & low fees

-

Fast transfer speed

-

Multiple payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Secure transactions across 40+ currencies

Learn more about how Panda Remit simplifies international transfers at

https://www.pandaremit.com.

For more global remittance insights, see NerdWallet’s remittance comparison.