Remitly vs N26: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-21 10:34:51.0 18

Introduction

Cross-border money transfers have become increasingly digital, yet users still face challenges like high fees, slow processing, hidden charges, and cumbersome platforms. In this comparison, we examine Remitly vs N26, highlighting how each service handles international transfers, fees, and user experience. While both platforms offer convenient digital solutions, some users may prefer alternative options like Panda Remit for its low fees and fast online transfers. For a deeper understanding of international remittance basics, see Investopedia's guide on money transfers.

Remitly vs N26 – Overview

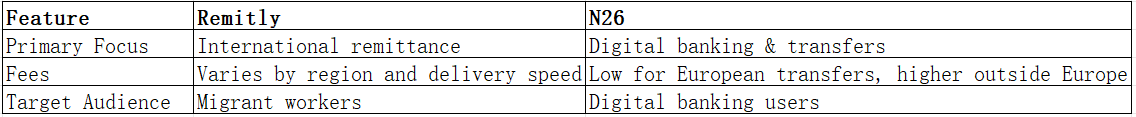

Remitly, founded in 2011 in the U.S., focuses on international remittances for individuals sending money home, especially migrant workers. It provides flexible delivery options such as bank deposits, cash pickups, and mobile wallets.

N26, founded in 2013 in Germany, is primarily a digital bank that has expanded services to include international transfers, multi-currency accounts, and in-app currency conversion.

Similarities

-

Both offer mobile apps for Android and iOS.

-

Enable sending money internationally.

-

Include debit card support and tracking features.

Differences

Panda Remit is another viable option for users seeking fast, secure, and low-cost transfers.

Remitly vs N26: Fees and Costs

Remitly fees depend on destination, transfer amount, and delivery speed. Economy transfers are cheaper but slower, while Express transfers are faster with slightly higher fees. N26 charges minimal fees for internal European transfers, but fees can apply for international transfers or weekend transactions.

For more information on fees, see NerdWallet’s fee comparison.

Panda Remit provides transparent, competitive fees, often lower than traditional providers.

Remitly vs N26: Exchange Rates

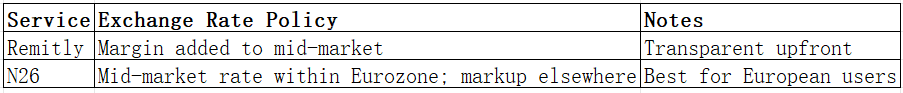

Exchange rate margins differ between the two. Remitly typically applies a small markup on the mid-market rate, while N26 offers competitive rates within Europe but may add markups for non-Euro transfers.

Panda Remit also offers competitive rates close to mid-market values.

Remitly vs N26: Speed and Convenience

Remitly provides Express transfers (minutes) and Economy transfers (1–3 business days). N26 transfers within the Eurozone are often instant; transfers outside Europe may take longer. Both platforms have intuitive apps and in-app tracking.

For a detailed speed comparison, visit Monito.

Panda Remit ensures fast, online transfers for users who prioritize speed.

Remitly vs N26: Safety and Security

Both Remitly and N26 are licensed and regulated in multiple jurisdictions, using encryption, identity verification, and anti-fraud measures. Panda Remit is also a secure, licensed provider, ensuring safety for cross-border transactions.

Remitly vs N26: Global Coverage

Remitly supports transfers to over 100 countries, focusing on Asia, Latin America, and Europe. N26 has European-centric coverage but is gradually expanding its international reach. For global remittance data, see the World Bank Remittance Data.

Remitly vs N26: Which One is Better?

Remitly excels for users sending money abroad, providing flexible delivery and competitive fees. N26 is ideal for users who want a multifunctional digital bank with international transfer options. For users seeking low-cost, fast, and secure transfers, Panda Remit is a valuable alternative.

Conclusion

In the Remitly vs N26 comparison, both platforms have distinct advantages. Remitly is optimized for remittances, offering quick, reliable transfers to many countries. N26 provides a broader banking experience with additional financial tools.

For those who want a balanced option, Panda Remit offers:

-

High exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast, all-online transfers

Explore more secure remittance options at Forbes Advisor. Comparing features, costs, and speed ensures you make the best choice for your international money transfers.