Remitly vs Panda Remit: The Best Way to Send Money from the UK to Canada

Benjamin Clark - 2025-10-14 09:25:27.0 7

Introduction

Sending money to loved ones, paying tuition fees, or covering urgent expenses abroad has become a regular part of life for many people in the UK. Whether you’re supporting family in Toronto, helping a student in Vancouver, or managing property in Montreal, Remitly send money Canada services offer a reliable way to get funds where they need to go.

Remitly is one of the most trusted digital money transfer platforms for UK residents. It provides transparent fees, clear exchange rates, and convenient delivery options. Another fast-growing alternative is Panda Remit, which offers zero-fee first transfers and loyalty rewards to help you save more on international remittances.

Can You Send Money to Canada with Remitly?

Yes, you can. Remitly fully supports transfers from the UK to Canada. You can send money in British pounds (GBP), and your recipient will receive Canadian dollars (CAD). The platform provides several delivery methods to suit different needs:

-

Bank deposit – Funds can be deposited directly into Canadian bank accounts.

-

Cash pickup – Recipients can collect funds from partnered locations.

-

Mobile wallet – While less common in Canada, some wallet options may be available depending on the recipient’s bank.

There are no major recipient location limitations within Canada. Whether your recipient is in a major city or a smaller town, as long as they have access to supported banks or pickup points, receiving funds is simple.

Panda Remit offers instant transfer options for many destinations, including Canada. Their system is fully online, allowing for fast and secure processing.

Common Banks in Canada

Some of the most frequently used Canadian banks for international transfers include:

-

Royal Bank of Canada (RBC)

-

Toronto-Dominion Bank (TD Canada Trust)

-

Scotiabank

-

Bank of Montreal (BMO)

-

Canadian Imperial Bank of Commerce (CIBC)

Popular Mobile Wallets

Although mobile wallet usage is less widespread than in some countries, these are notable options:

-

Interac e-Transfer – Widely used for sending funds domestically, and can receive funds via bank-linked transfers.

-

PayPal Canada – Useful for some recipients, though fees may apply.

Step-by-Step Guide — How to Use Remitly for Canada

Sending money to Canada with Remitly is straightforward. Here’s a quick guide:

-

Create a Remitly Account

Sign up on www.remitly.com or through the mobile app using your email address. -

Verify Your Identity

To comply with regulations, you’ll need to provide personal information and upload a valid ID. -

Choose Canada as Your Destination

Select Canada from the list of available countries. -

Select a Delivery Method

Choose between bank deposit, cash pickup, or mobile wallet depending on the recipient’s preference. -

Enter Recipient Information

Include accurate bank details or pickup information to avoid delays. -

Pay & Track Your Transfer

Pay using your bank account or debit card. You can track the transfer’s progress in real time.

💡 Tip: Panda Remit also provides a fully online process with zero-fee first transfers, making it easy to try as an alternative.

Fees, Exchange Rates & Limits

One of the most important factors to consider when sending money internationally is the cost of the transfer. Remitly’s pricing typically includes:

-

Fixed fees depending on the transfer amount and delivery method

-

Exchange rate markup – the rate you receive is slightly lower than the mid-market rate

-

Transfer limits that vary depending on your verification level

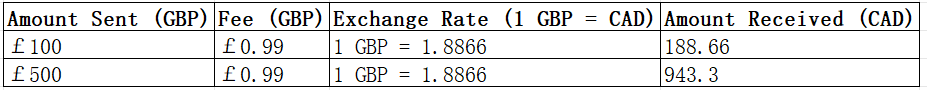

Below is an example Remitly transfer table from the UK to Canada (as of 2025):

⚠️ These are example rates for illustration. Actual rates may vary depending on market conditions and delivery method.

Panda Remit offers zero-fee first transfers and often runs seasonal coupon codes for additional savings, making it a strong alternative for cost-conscious senders.

Transfer Speed & Delivery Options

Remitly typically offers two speed options:

-

Express – Usually delivered within minutes, ideal for urgent transfers.

-

Economy – Takes longer (usually 3–5 business days) but may offer better exchange rates and lower fees.

Delivery channels for Canada include:

-

Direct bank deposits into major Canadian banks

-

Cash pickup at partnered locations

-

Some mobile wallet options depending on recipient bank integration

Panda Remit provides instant or same-day transfers to many bank accounts, making it a good choice for those needing faster delivery.

Useful Tips Before Sending Money

Here are some practical ways to make your UK–Canada transfers smoother and more cost-efficient:

-

✅ Monitor exchange rates – Rates can fluctuate daily; transferring at the right moment can save you money.

-

✅ Avoid credit card payments – Use bank transfers or debit cards to minimize additional charges. (Credit card payments are not supported for this route.)

-

✅ Double-check recipient details – Errors can lead to delays or failed transfers.

-

✅ Compare providers – Fees and rates differ between platforms; check before each transfer.

-

✅ Take advantage of promotions – Both Remitly and Panda Remit offer referral bonuses and coupon rewards from time to time.

Conclusion & Recommendation

For UK residents, Remitly is a reliable and convenient option for sending money to Canada, with transparent pricing and multiple delivery methods. If you’re looking to save on fees and potentially get faster delivery, Panda Remit is worth exploring — especially with their zero-fee first transfers and coupon rewards.

🌟 Recommendation: Use Remitly for its simplicity and trusted brand. Consider Panda Remit for competitive rates, first-transfer perks, and ongoing promotions.