Remitly vs Panda Remit: The Best Way to Send Money from the UK to Ghana

Benjamin Clark - 2025-10-15 10:32:41.0 11

Introduction

Sending money to Ghana from the UK is a common need — whether it’s to support family back home, pay for university tuition, or help during emergencies. Many people search for “Remitly send money Ghana” to find safe and cost-effective options.

Remitly is one of the most trusted platforms for international transfers, offering transparent fees, competitive rates, and fast delivery. Alongside it, Panda Remit has become a popular alternative thanks to zero-fee first transfers and loyalty rewards, making it worth comparing both providers when sending money to Ghana.

Can You Send Money to Ghana with Remitly?

Yes, you can send money from the UK to Ghana with Remitly. The platform provides multiple delivery options to make it convenient for recipients across the country.

Delivery Options

-

Bank Deposit – Funds go directly into the recipient’s Ghanaian bank account.

-

Cash Pickup – Recipients can collect cash from approved partner locations.

-

Mobile Wallet – Transfers can be delivered to supported mobile wallets for instant access.

Panda Remit also provides instant transfer options to supported corridors, giving senders another secure and fast choice.

Common Banks in Ghana

Here are some of the most widely used banks for receiving transfers:

-

GCB Bank (Ghana Commercial Bank)

-

Ecobank Ghana

-

Absa Bank Ghana

-

Stanbic Bank Ghana

-

Fidelity Bank Ghana

Popular Mobile Wallets in Ghana

Mobile wallets are extremely popular for receiving remittances:

-

MTN Mobile Money (MoMo)

-

AirtelTigo Money

-

Vodafone Cash

These wallets allow recipients to access funds instantly and make everyday payments easily.

Step-by-Step Guide — How to Use Remitly for Ghana

Sending money to Ghana with Remitly is quick and user-friendly. Here’s a step-by-step breakdown:

-

Create a Remitly Account

Sign up on Remitly’s website or via the mobile app. Registration is simple and secure. -

Verify Your Identity

To comply with UK regulations, Remitly requires ID verification. Have a valid ID ready to speed up this step. -

Select Ghana as the Destination

Enter the amount you want to send. Remitly will show you the exact fees and exchange rate upfront. -

Choose the Delivery Method

Pick between bank deposit, cash pickup, or mobile wallet transfer depending on what suits your recipient best. -

Enter Recipient Details

Make sure the bank account or mobile wallet information is correct to avoid delays. -

Pay and Track Your Transfer

Complete the payment using a supported method. You can track the status of the transfer in real time.

Tip: Panda Remit also allows you to make the entire transfer online, with zero fees on your first transaction, making it a useful alternative to compare.

Fees, Exchange Rates & Limits

Remitly’s pricing is made up of:

-

Transfer Fee – For Ghana, certain transfer types may have £0 fees, depending on the chosen delivery option.

-

Exchange Rate – A small markup is applied to the mid-market rate.

-

Transfer Limits – Daily and monthly limits apply depending on your verification level.

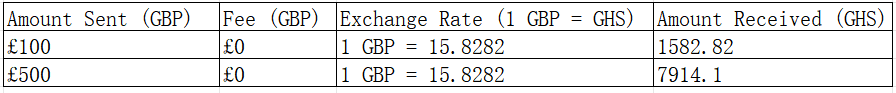

Here’s an example Remitly transfer table (illustrative):

Rates are approximate and may change depending on the time of transfer and Remitly’s pricing policies.

Panda Remit Advantage

Panda Remit offers zero-fee first transfers and often provides seasonal coupon codes for existing users. Comparing rates and fees before each transfer can help you get the best value.

Transfer Speed & Delivery Options

Remitly offers two main transfer speeds to Ghana:

-

Express – Funds typically arrive within minutes, especially for mobile wallet transfers.

-

Economy – Usually takes 3–5 business days and is suited for non-urgent transfers.

Delivery Channels

-

Bank Deposit – Popular and reliable for larger amounts.

-

Cash Pickup – Useful for recipients without bank accounts.

-

Mobile Wallet – Favoured in Ghana for its speed and accessibility.

Panda Remit is also known for fast bank deposits and same-day transfers, making it a useful alternative for those prioritising speed.

Useful Tips Before Sending Money

Before you send money to Ghana, keep these practical tips in mind:

-

Monitor Exchange Rates – Even small changes in rates can affect the final amount significantly.

-

Avoid Extra Fees – Check the fee structure and choose the most cost-effective payment option.

-

Verify Recipient Information – Double-check names, account numbers, and mobile wallet IDs to avoid delays.

-

Compare Providers Each Time – Fees and exchange rates vary daily; comparing ensures you get the best deal.

-

Watch for Promotions – Referral bonuses and coupon codes can increase your recipient’s amount.

Conclusion & Recommendation

Sending money from the UK to Ghana has never been easier. Remitly provides a trusted, transparent, and fast service, with multiple delivery options including bank transfers and mobile wallets. On the other hand, Panda Remit stands out with zero-fee first transfers, coupon rewards, and fast processing times, making it a smart alternative to compare.

For each transfer, reviewing both providers ensures you maximise savings and deliver funds securely to your recipients in Ghana.