Remitly vs Panda Remit: The Best Way to Send Money from the UK to India

Benjamin Clark - 2025-10-14 09:31:33.0 12

Introduction

Sending money home for family support, paying university fees, or covering emergencies abroad has become part of everyday life for many people living in the UK. Whether you're helping loved ones in Mumbai, supporting students in Delhi, or paying for medical expenses in Bangalore, Remitly send money India services offer a fast and secure way to transfer funds.

Remitly is a trusted global digital money transfer service, known for transparent pricing and multiple delivery options. A growing alternative is Panda Remit, which attracts users with zero-fee first transfers and loyalty rewards, making it an appealing option for cost-conscious senders.

Can You Send Money to India with Remitly?

✅ Yes, Remitly supports transfers to India. You can send GBP from the UK, and your recipient will receive Indian rupees (INR). The platform provides several flexible delivery methods to accommodate different needs:

-

Bank deposit – Send money directly into the recipient’s Indian bank account.

-

Cash pickup – Collect cash at designated partner locations across India.

-

Mobile wallet – Some wallet options are available depending on the recipient’s bank and region.

Remitly has wide coverage across India, so recipients in both urban and rural areas can receive funds easily through banks or cash pickup partners. Panda Remit also offers instant bank deposits to India, enabling quick and convenient transfers.

Common Banks in India

Here are some of the most common banks used for international transfers:

-

State Bank of India (SBI)

-

HDFC Bank

-

ICICI Bank

-

Punjab National Bank (PNB)

-

Axis Bank

-

Bank of Baroda

Popular Mobile Wallets in India

While bank deposits are the most common, mobile wallet usage is widespread for domestic transactions:

-

Paytm

-

PhonePe

-

Google Pay (GPay)

Step-by-Step Guide — How to Use Remitly for India

Transferring money to India through Remitly is straightforward:

-

Create a Remitly Account

Go to www.remitly.com or download the mobile app and sign up. -

Verify Your Identity

Provide valid personal identification to meet regulatory requirements. -

Choose India as Your Destination

Select India from the country list. -

Select Delivery Method

Pick bank deposit, cash pickup, or mobile wallet, depending on the recipient's preference. -

Enter Recipient Details

Input correct bank account or pickup information to ensure smooth delivery. -

Pay and Track the Transfer

Pay via your UK bank account or debit card. You can monitor the transaction status in real time.

💡 Tip: Panda Remit also offers a fully online process with zero-fee first transfers, making it a good alternative for first-time users.

Fees, Exchange Rates & Limits

Understanding fees and exchange rates is key when sending money internationally. Remitly typically charges:

-

Fixed transfer fees depending on amount and delivery speed

-

Exchange rate markups slightly below mid-market rates

-

Transfer limits based on your account verification level

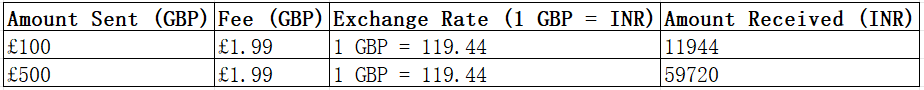

Below is an example transfer table for sending money from the UK to India through Remitly:

These are illustrative example rates. Actual rates vary depending on market conditions and selected delivery speed.

Panda Remit offers zero-fee first transfers and seasonal coupons, which can make it more cost-effective for frequent senders.

Transfer Speed & Delivery Options

Remitly offers two delivery speeds:

-

Express – Funds usually arrive within minutes (higher fees may apply).

-

Economy – Typically takes 3–5 business days but offers better rates and lower fees.

Delivery Channels to India

-

✅ Bank deposit – Most popular and convenient option for recipients.

-

✅ Cash pickup – Ideal for recipients without bank accounts.

-

✅ Mobile wallets – Selected options available depending on region.

Panda Remit provides instant bank transfers and same-day arrivals for many Indian banks, offering competitive delivery speeds.

Useful Tips Before Sending Money

Here are a few practical tips to optimize your UK–India money transfers:

-

📊 Monitor exchange rates – INR rates fluctuate; a small timing difference can save you money.

-

🏦 Avoid credit card payments – Only use bank accounts or debit cards to avoid extra fees. (Credit card payments are not supported for this route.)

-

📝 Verify recipient details – Incorrect information can cause delays.

-

🔄 Compare providers – Fees and rates can differ significantly between platforms.

-

🎁 Watch promotions – Referral bonuses and coupon offers can reduce costs.

Conclusion & Recommendation

Remitly is a reliable and widely used platform for sending money to India from the UK. It offers flexible delivery methods, fast transfers, and clear pricing. For users seeking additional savings, Panda Remit provides zero-fee first transfers and promotional offers, making it a strong alternative.

👉 Recommendation: Use Remitly for its simplicity and trusted service. Try Panda Remit if you're looking for a more cost-effective way to send your first transfer.