Remitly vs Panda Remit: The Best Way to Send Money from the UK to Lithuania

Benjamin Clark - 2025-10-14 09:50:54.0 11

Introduction

If you have family, friends, or financial commitments in Lithuania, you probably know how important it is to find a fast, secure, and affordable way to transfer funds. Whether you’re supporting loved ones, paying tuition, or covering an emergency, finding the best transfer service can make a big difference.

Remitly send money Lithuania is one of the most popular search terms for UK users looking for reliable transfers. Remitly is a trusted name in international remittances, offering transparent fees and quick delivery times. As an alternative, Panda Remit is also becoming popular, especially because it offers zero-fee first transfers and attractive loyalty rewards for frequent users.

Can You Send Money to Lithuania with Remitly?

Yes — Remitly fully supports sending money from the UK to Lithuania. The platform allows users to transfer funds quickly and securely through several delivery options:

-

Bank deposit: Send directly to a recipient’s bank account in Lithuania.

-

Cash pickup: Certain partner locations allow recipients to collect cash in person.

-

Mobile wallet: Some Lithuanian digital wallet services can receive transfers instantly.

There are no major location restrictions within Lithuania, but recipients should have valid bank or wallet accounts to receive funds.

Panda Remit, on the other hand, provides instant bank transfers for supported routes and focuses on offering competitive exchange rates. While both services are popular, Panda Remit often appeals to cost-conscious users looking to avoid fees.

Common Banks in Lithuania

When sending money to Lithuania, you’ll likely be transferring to accounts in one of these well-known banks:

-

Swedbank Lietuva

-

SEB Bankas

-

Luminor Bank

-

Šiaulių Bankas

-

Citadele Bankas

Popular Mobile Wallets

Lithuania has a growing digital payment ecosystem. Some mobile wallet and fintech solutions include:

-

Paysera

-

Revolut (Lithuania)

-

N26

Step-by-Step Guide — How to Use Remitly for Lithuania

Using Remitly to send money from the UK to Lithuania is simple. Here’s a quick walkthrough:

-

Create your Remitly account

Visit https://www.remitly.com and sign up using your email or mobile number. -

Verify your ID

Provide proof of identity (such as a passport or driver’s license) to meet compliance requirements. -

Choose Lithuania as your destination

This will ensure you see the correct exchange rates and delivery options. -

Select your delivery method

Choose between bank deposit, cash pickup, or mobile wallet. -

Enter recipient information

Double-check bank account or wallet details to avoid delays. -

Pay and track your transfer

You can use a UK debit card or bank account to fund your transfer. Remitly will provide real-time tracking.

💡 Tip: Panda Remit also offers fully online transfers with zero-fee for first-time users, which can be a cost-effective alternative.

Fees, Exchange Rates & Limits

Remitly charges a small fixed fee for most transfers from the UK to Lithuania. There’s also an exchange rate markup, which varies depending on the amount sent and delivery speed. Daily and monthly transfer limits apply, especially before account verification is completed.

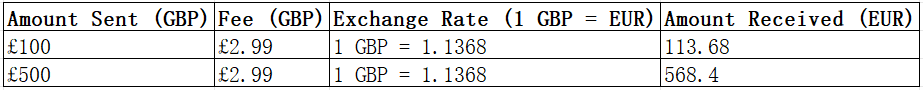

Here’s an example of how much your recipient might get based on approximate exchange rates (as of October 2025):

Panda Remit often attracts users with zero-fee first transfers and seasonal coupon codes, allowing them to save even more on their initial transactions.

Transfer Speed & Delivery Options

Remitly offers two main delivery speeds for transfers from the UK to Lithuania:

-

Express: Usually instant or within minutes when paying by debit card. Ideal for emergencies.

-

Economy: Lower fees but takes 1–3 business days, depending on bank processing times.

Delivery methods include:

-

Bank transfers to Lithuanian accounts

-

Cash pickup at partner locations

-

Mobile wallet deposits

Panda Remit is known for instant bank deposits and same-day transfers on many routes, which can be a significant advantage if speed is your top priority.

Useful Tips Before Sending Money

To ensure your transfers are cost-effective and hassle-free, keep these tips in mind:

-

✅ Monitor exchange rates: Even small differences can impact the total amount your recipient receives.

-

🚫 Avoid credit card payments: Credit card transfers usually come with higher fees and are not supported for some routes.

-

📝 Double-check recipient details: Mistakes in bank account numbers or names can cause delays or cancellations.

-

🔄 Compare providers each time: Rates and fees change, so check both Remitly and Panda Remit before each transfer.

-

🎁 Use promotions: Panda Remit often provides referral bonuses and coupon rewards, which can further reduce costs.

Conclusion & Recommendation

Sending money from the UK to Lithuania in 2025 has never been easier. Remitly remains a trusted and widely used service, offering clear fees, solid exchange rates, and multiple delivery options. For those seeking even lower costs, Panda Remit provides strong value with zero-fee first transfers and promotional rewards.

Both services are fully online, secure, and built for convenience. If you’re transferring regularly, comparing rates between the two can help you maximize the amount your recipient receives.

👉 Try https://www.remitly.com for reliable service or explore Panda Remit for potential savings.