Remitly vs Panda Remit: The Best Way to Send Money from the UK to Thailand

Benjamin Clark - 2025-10-14 09:36:05.0 12

Introduction

Imagine you’re living in the UK and need to support family in Thailand, pay for a loved one’s education, or quickly send money for an emergency. Knowing the best way to transfer funds can make a real difference in cost and speed. Remitly send money Thailand is one of the most searched options in 2025 because of its reliability and fast service.

Remitly is trusted by millions worldwide for secure and quick international money transfers. At the same time, Panda Remit has gained popularity for its zero-fee first transfers and attractive loyalty rewards, making it a compelling alternative for many UK users.

Can You Send Money to Thailand with Remitly?

Yes — Remitly supports transfers from the UK to Thailand. You can send money conveniently through various channels, including:

-

Bank deposit – Funds are sent directly to the recipient’s Thai bank account.

-

Cash pickup – Recipients can collect cash at designated partner locations.

-

Mobile wallet – Remitly also supports popular Thai e-wallets for added flexibility.

There are generally no special location-based restrictions for recipients, though some remote rural areas may have fewer cash pickup points. Panda Remit, on the other hand, also provides instant transfer options for eligible bank accounts in supported corridors, making it a good alternative if you want fast bank deposits.

Common Banks in Thailand:

-

Bangkok Bank

-

Kasikorn Bank (KBank)

-

Siam Commercial Bank (SCB)

-

Krungthai Bank

-

TMBThanachart Bank (TTB)

Popular Mobile Wallets in Thailand:

-

TrueMoney Wallet

-

Rabbit LINE Pay

-

AirPay

These institutions and wallets make receiving funds more convenient and widespread, even for people without regular access to traditional banking.

Step-by-Step Guide — How to Use Remitly for Thailand

Sending money from the UK to Thailand through Remitly is straightforward. Follow these steps:

-

Create your Remitly account

Visit https://www.remitly.com and sign up with your email address. -

Verify your identity

Complete the KYC (Know Your Customer) process by uploading a valid ID. -

Choose Thailand as the destination

Select Thailand and specify how you’d like the recipient to receive the money. -

Select the delivery method

Choose between bank deposit, cash pickup, or mobile wallet. -

Enter the recipient’s information

Ensure that bank account numbers, names, and wallet details are accurate to avoid delays. -

Pay and track your transfer

Use your UK bank account or debit card to fund the transfer (credit cards are not supported). Remitly provides real-time tracking so you know when your money arrives.

💡 Tip: Panda Remit offers fully online, zero-fee first transfers — a good option to try if you want to compare costs for your initial transaction.

Fees, Exchange Rates & Limits

Remitly charges a fixed transfer fee and applies a small exchange rate markup. There are also daily and monthly transfer limits depending on your verification level.

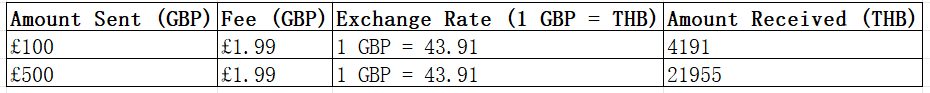

Below is an example table using approximate rates for GBP→THB:

Rates and fees are examples as of October 2025 and may vary based on market conditions.

Panda Remit distinguishes itself with zero-fee first transfers and frequent coupon promotions, which can help new users maximize the amount received in Thailand.

Transfer Speed & Delivery Options

Remitly offers two main delivery speeds:

-

Express: Instant or near-instant transfers, usually arriving within minutes. Ideal for emergencies.

-

Economy: Typically takes 1–3 business days but offers better exchange rates and lower fees.

Delivery channels to Thailand include:

-

Bank deposit – Direct to Thai bank accounts.

-

Cash pickup – Through Remitly’s partner network.

-

Mobile wallet – For faster digital delivery.

Panda Remit is known for instant or same-day bank deposits for eligible transactions, making it a competitive alternative for users prioritizing speed.

Useful Tips Before Sending Money

Before you hit the “Send” button, keep these practical tips in mind:

-

Monitor exchange rates to make sure you’re transferring when the rates are favorable.

-

Avoid credit card fees by using bank accounts or debit cards (credit cards aren’t supported for these transfers).

-

Double-check recipient details to avoid delays or rejections.

-

Compare providers each time — exchange rates and fees change regularly.

-

Look out for promotions like referral bonuses, seasonal coupons, or loyalty rewards from services like Panda Remit.

Conclusion & Recommendation

Both Remitly and Panda Remit are solid options for sending money from the UK to Thailand.

-

Remitly is widely trusted, has broad coverage, and provides transparent pricing.

-

Panda Remit is great for newcomers looking for savings through zero-fee first transfers, coupon codes, and competitive exchange rates.

👉 If you want a reliable transfer with a long-standing brand, Remitly is a safe bet. But if saving on fees and maximizing value is your priority, it’s worth trying Panda Remit for your first transaction.