Remitly vs Panda Remit: The Best Way to Send Money from the UK to Vietnam

Benjamin Clark - 2025-10-14 09:41:08.0 15

Introduction

Imagine you’re living in the UK and need to send funds home to Vietnam — whether it’s to support your parents, pay for tuition, or cover medical emergencies. In such moments, speed and low cost matter most. Remitly send money Vietnam is one of the most common searches for UK-Vietnam remittances because Remitly is known for its reliability and fast service.

Remitly has built a strong reputation as a trusted platform for secure international transfers. Meanwhile, Panda Remit has emerged as a popular alternative, offering zero-fee first transfers and attractive loyalty rewards, giving UK senders more choices.

Can You Send Money to Vietnam with Remitly?

Yes — Remitly supports transfers from the UK to Vietnam. Senders can choose from multiple delivery methods depending on the recipient’s preferences:

-

Bank deposit – Money goes straight into the recipient’s Vietnamese bank account.

-

Cash pickup – Recipients can collect cash at authorized partner branches across Vietnam.

-

Mobile wallet – An increasingly popular option for quick and convenient access to funds.

There are generally no major location-based restrictions within Vietnam, although rural areas might have fewer cash pickup options. Panda Remit also supports instant bank transfers to eligible accounts, which can be an appealing alternative for users who need quick deposits.

Common Banks in Vietnam:

-

Vietcombank (Joint Stock Commercial Bank for Foreign Trade of Vietnam)

-

BIDV (Bank for Investment and Development of Vietnam)

-

VietinBank (Vietnam Joint Stock Commercial Bank for Industry and Trade)

-

ACB (Asia Commercial Bank)

-

Techcombank (Vietnam Technological and Commercial Joint Stock Bank)

Popular Mobile Wallets in Vietnam:

-

MoMo

-

ZaloPay

-

ViettelPay

These banks and wallets make receiving funds easier than ever, especially as Vietnam continues its rapid shift toward digital finance.

Step-by-Step Guide — How to Use Remitly for Vietnam

Sending money to Vietnam through Remitly is straightforward. Here’s a step-by-step guide:

-

Create your Remitly account

Visit https://www.remitly.com and sign up using your email address. -

Verify your identity

Complete ID verification (KYC) by uploading valid documents as required. -

Choose Vietnam as your destination

Select Vietnam as the receiving country and choose the appropriate delivery method. -

Select the delivery method

Pick between bank deposit, cash pickup, or mobile wallet transfer. -

Enter recipient details

Make sure the recipient’s name, bank account number, or wallet details are accurate to avoid delays. -

Pay and track your transfer

Fund your transfer with a UK bank account or debit card (credit cards are not supported). Track your transfer in real time.

💡 Tip: Panda Remit provides a fully online process and zero-fee first transfers, making it worth comparing before your first transfer.

Fees, Exchange Rates & Limits

Remitly charges a fixed fee per transaction and includes a small exchange rate markup. There are daily and monthly limits depending on your verification level.

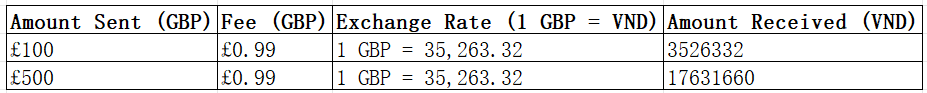

Here’s an example table with approximate GBP→VND rates:

These are example figures based on October 2025 rates and may change with market fluctuations.

Panda Remit, in comparison, offers zero-fee first transfers and often releases seasonal coupons to help users maximize their remittance value.

Transfer Speed & Delivery Options

Remitly provides two main speed options for Vietnam transfers:

-

Express: Funds typically arrive instantly or within minutes. This is ideal for emergencies.

-

Economy: Usually takes 1–3 business days but offers better exchange rates.

Delivery channels include:

-

Bank deposit – To major Vietnamese banks

-

Cash pickup – Available nationwide through partner networks

-

Mobile wallet – Fast-growing and ideal for digital-savvy recipients

Panda Remit is known for instant or same-day bank deposits for supported corridors, giving senders another fast option.

Useful Tips Before Sending Money

To ensure smooth and cost-effective transfers, keep these tips in mind:

-

Track exchange rates regularly to transfer at favorable times.

-

Avoid credit card payments as they are not supported and typically cost more.

-

Double-check recipient details to prevent failed transactions.

-

Compare providers each time to ensure you get the best combination of fees and rates.

-

Look for promotions like referral bonuses or seasonal coupons (Panda Remit offers these frequently).

Conclusion & Recommendation

Both Remitly and Panda Remit are excellent options for sending money from the UK to Vietnam:

-

Remitly is well-established, offers fast transfers, and has a large network for bank, cash, and wallet deliveries.

-

Panda Remit shines with zero-fee first transfers, coupon promotions, and competitive rates.

👉 For reliability and coverage, Remitly is a top choice. For cost savings, especially on your first transfer, Panda Remit is worth considering.