Remitly vs PayerMax: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-22 14:12:55.0 19

In 2025, the digital remittance landscape continues to evolve as users seek faster, cheaper, and more transparent international transfer solutions. Remitly and PayerMax have become two prominent names, each with distinct strengths. Yet, many users are also exploring other trusted platforms such as Panda Remit for lower fees and more flexible payment options.

For an overview of how international money transfers work, visit Investopedia’s remittance guide.

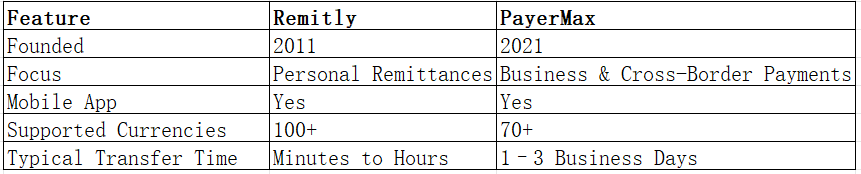

Remitly vs PayerMax – Overview

Remitly, founded in 2011 in the U.S., specializes in international money transfers targeting migrant workers and families. It offers multiple delivery methods such as bank deposits, cash pickups, and mobile wallets.

PayerMax, launched in 2021, is a newer digital payment platform focusing on global digital commerce and cross-border payment solutions for businesses and individuals. It integrates payment gateways and supports localized methods.

Similarities: Both offer mobile apps, multi-currency transfers, and aim to simplify international payments.

Differences: Remitly focuses more on remittances to families and individuals, while PayerMax leans toward business and digital service payments. Remitly offers clearer personal-use pricing, while PayerMax’s corporate pricing structure may vary.

For individuals seeking affordable, fast personal transfers, Panda Remit offers another competitive option in the same space.

Remitly vs PayerMax: Fees and Costs

Remitly’s fee structure depends on the delivery method and transfer speed (Economy vs Express). Fees usually range between USD 1.99 to 3.99 for standard transfers, though they may increase for exotic currencies. Exchange rate margins also vary by corridor.

PayerMax, on the other hand, offers customized fee models for business transactions and regional transfers. It may charge processing fees or network costs depending on volume and country.

For a reliable benchmark of global remittance fees, visit World Bank’s Remittance Prices Worldwide.

If affordability is your priority, Panda Remit is known for offering competitive rates with low or zero transfer fees for new users.

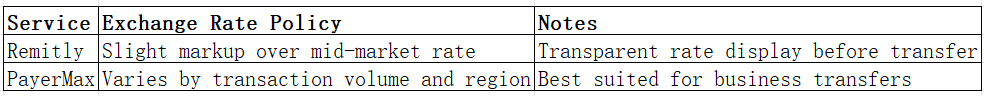

Remitly vs PayerMax: Exchange Rates

Exchange rates are often where remittance providers differ significantly. Remitly applies a small markup over the mid-market rate, which can change depending on transfer volume and route. PayerMax typically uses commercial bank rates with business-to-business pricing.

Panda Remit frequently provides rates closer to the mid-market rate, helping users receive more in their destination currency.

Remitly vs PayerMax: Speed and Convenience

Remitly’s Express option enables instant transfers using debit card payments, while Economy transfers (via bank accounts) may take up to 3 business days. PayerMax generally processes payments within 1–3 business days, depending on regulatory and partner networks.

Both platforms offer well-designed mobile apps, 24/7 access, and tracking capabilities.

For a deeper understanding of transfer speeds, refer to NerdWallet’s guide to remittance speeds.

If you value speed, Panda Remit is often praised for near-instant transfers through online channels and simple interfaces.

Remitly vs PayerMax: Safety and Security

Security is vital in money transfer services. Remitly is regulated by financial authorities such as the U.S. Department of Treasury and uses advanced encryption and fraud detection tools. PayerMax complies with multiple jurisdictional standards and provides PCI DSS-certified payment solutions.

Similarly, Panda Remit operates as a licensed and secure platform, offering encryption and regulatory compliance for safe cross-border transfers.

Remitly vs PayerMax: Global Coverage

Remitly supports transfers to over 170 countries, with strong coverage in Asia, Latin America, and Europe. PayerMax offers services in more than 70 countries, catering primarily to regions in Asia-Pacific and the Middle East.

For a global comparison of remittance coverage, see the World Bank remittance report.

While both platforms provide broad reach, Panda Remit covers 40+ currencies, offering flexible methods like bank transfers, PayID, and e-wallet payments (excluding credit cards).

Remitly vs PayerMax: Which One is Better?

When choosing between Remitly vs PayerMax, it depends on your needs. Remitly is ideal for individuals sending money to family abroad, offering intuitive apps and transparent pricing. PayerMax suits business users or merchants seeking seamless international payment solutions.

However, if you want a service that combines personal affordability, simplicity, and speed, Panda Remit is a strong contender offering reliable online transfers at lower fees.

Conclusion

In the Remitly vs PayerMax debate, both services cater to different audiences. Remitly provides easy-to-use personal remittances with multiple payout options, while PayerMax supports business transactions and payment integrations.

For those looking for an all-digital platform with fast, affordable transfers, Panda Remit stands out for its:

-

High exchange rates and low fees

-

Multiple payment methods (bank card, PayID, e-transfer, POLi, etc.)

-

Coverage of 40+ currencies

-

Quick transfers with an easy online process

You can learn more at https://www.pandaremit.com or explore NerdWallet’s remittance comparison for additional insights.

Ultimately, whether you choose Remitly or PayerMax, it’s crucial to compare their fees, exchange rates, and delivery times—and keep Panda Remit in mind as a flexible, secure, and fast remittance option for 2025.