Remitly vs RemitBee: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-22 15:07:41.0 14

Cross-border money transfers are essential for individuals sending funds internationally, but common challenges include high fees, hidden charges, slow delivery, and limited usability. In this context, comparing popular services like Remitly vs RemitBee becomes vital for making informed decisions. Both platforms offer a variety of features tailored to different user needs. Additionally, Panda Remit has emerged as a strong alternative for those seeking low-cost and convenient options. For more detailed insights on remittance services, consult trusted guides such as Investopedia.

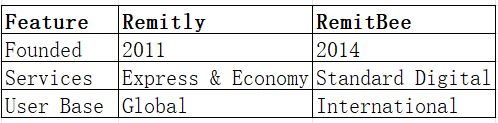

Brand A vs Brand B – Overview

Remitly, founded in 2011, provides fast international transfers, mobile apps, and multiple payout options. Its services cater to a large global user base looking for both economy and express transfer options. RemitBee, launched in 2014, offers competitive international money transfer services focused on user-friendly digital experiences and flexible payout options.

Similarities between the two include international transfer capabilities, mobile app support, and debit card compatibility. Differences mainly lie in fee structures, speed, and target audience, with Remitly often emphasizing express delivery and RemitBee focusing on affordable digital-first transfers. Panda Remit is another notable option in the market, known for its competitive fees and simple online process.

Remitly vs RemitBee: Fees and Costs

Fee structures vary depending on transfer speed, amount, and destination. Remitly offers economy transfers with lower fees but slower delivery, whereas express transfers have higher fees. RemitBee charges a small percentage of the transfer amount but aims to keep overall costs low. Users should consider subscription or account types that may reduce fees for frequent transfers. For detailed fee comparisons, check NerdWallet's international transfer guide. Panda Remit often presents a lower-cost alternative for standard transfers.

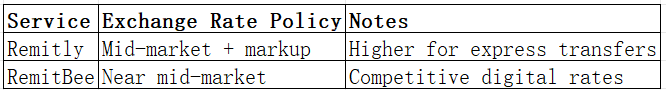

Remitly vs RemitBee: Exchange Rates

Exchange rates also impact transfer costs. Remitly may include a markup over the mid-market rate, especially for express transfers. RemitBee offers competitive rates, often closer to the mid-market, which helps reduce hidden costs.

Panda Remit provides transparent rates with low markups, making it a cost-effective option.

Remitly vs RemitBee: Speed and Convenience

Transfer speed differs significantly. Remitly's express transfers are usually instant or within minutes, while economy transfers can take 3-5 business days. RemitBee focuses on simple, efficient transfers that typically complete within 1-2 business days. Both platforms offer intuitive apps and multiple payout methods, such as bank deposits and cash pickups. For further reading on remittance speed, see WorldRemit speed guide. Panda Remit is noted for fast, fully online transfers with flexible payment options.

Remitly vs RemitBee: Safety and Security

Both Remitly and RemitBee adhere to regulatory requirements, encryption standards, and fraud prevention measures. Customer information is protected, and both platforms offer mechanisms to address disputes. Panda Remit is also licensed and secure, providing peace of mind for international transfers.

Remitly vs RemitBee: Global Coverage

Remitly supports over 50 countries and multiple currencies, while RemitBee covers a wide range of destinations with digital-first transfer methods. Payment options vary, including direct bank deposits, cash pickups, and mobile wallets. For a comprehensive overview of global remittance coverage, refer to the World Bank remittance report.

Remitly vs RemitBee: Which One is Better?

Choosing between Remitly vs RemitBee depends on user priorities. Remitly excels in fast express transfers and global reach, while RemitBee is ideal for cost-conscious users seeking simple digital transfers. For those prioritizing low fees, flexibility, and competitive rates, Panda Remit may offer better value and convenience.

Conclusion

In summary, Remitly vs RemitBee offers distinct advantages. Remitly is strong for speed and wide coverage, whereas RemitBee emphasizes affordability and digital simplicity. Panda Remit stands out as a versatile alternative with high exchange rates, low fees, and support for multiple payment methods including POLi, PayID, bank cards, and e-transfers. Coverage spans over 40 currencies with fast, fully online processes. For further insights, visit Panda Remit official site or consult Investopedia for transfer tips.