Remitly vs Revolut: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-21 10:29:12.0 41

Introduction

International money transfers have become easier thanks to digital fintech platforms, but users still face challenges like high fees, slow delivery, and hidden costs. In this article, we compare Remitly vs Revolut, two major players in the global remittance space. Both services help users send money across borders, but each caters to different needs and regions. For those seeking low fees and fast delivery, Panda Remit is another trusted alternative. Learn more about the basics of online remittances at Investopedia.

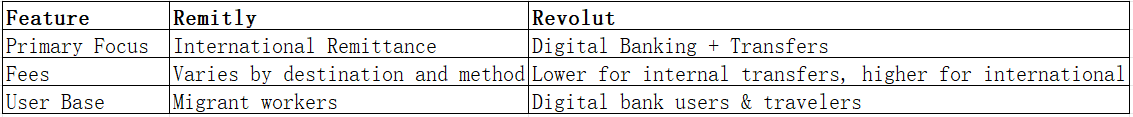

Remitly vs Revolut – Overview

Remitly was founded in 2011 in the U.S. and focuses on fast and affordable remittances for individuals sending money abroad. It is popular among expatriates and migrant workers due to its straightforward service and flexible delivery methods.

Revolut, launched in 2015 in the U.K., began as a digital banking app and expanded to include international transfers, cards, crypto trading, and more. Its appeal lies in its multi-functional financial ecosystem rather than remittances alone.

Similarities

-

Both offer mobile apps for Android and iOS.

-

Enable users to send money internationally with transparent exchange rates.

-

Provide tracking features for transfers.

Differences

Panda Remit is another reputable global transfer option offering a fast, secure, and user-friendly platform for international payments.

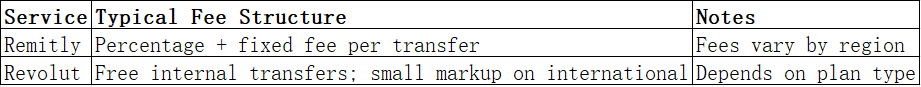

Remitly vs Revolut: Fees and Costs

Remitly typically charges variable fees depending on the destination, transfer amount, and delivery speed (Economy vs Express). Revolut offers fee-free transfers within its own network but applies markups for international payments outside Europe or for weekend transactions.

For more details on global transfer costs, visit NerdWallet’s guide.

Panda Remit can often be a more affordable choice, with transparent pricing and no hidden charges.

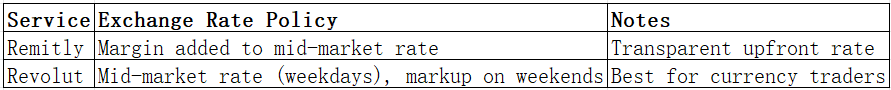

Remitly vs Revolut: Exchange Rates

Both Remitly and Revolut use exchange rates that can differ slightly from the mid-market rate. Revolut tends to offer better weekday rates, while Remitly’s rates may vary depending on the corridor and transfer method.

Panda Remit also provides competitive exchange rates close to the real mid-market value.

Remitly vs Revolut: Speed and Convenience

Remitly offers Express transfers (within minutes) and Economy transfers (1–3 business days), while Revolut transfers can be near-instant within its ecosystem but take longer when sent to external bank accounts. Both platforms have user-friendly apps, though Revolut’s interface is more feature-rich.

Check out a detailed remittance speed comparison on Monito.

If you value speed and simplicity, Panda Remit offers consistently fast online transfers.

Remitly vs Revolut: Safety and Security

Both Remitly and Revolut are licensed and regulated by financial authorities in multiple jurisdictions. They use encryption, identity verification, and anti-fraud measures to secure transactions. Panda Remit also adheres to strict compliance standards, ensuring secure cross-border transactions.

Remitly vs Revolut: Global Coverage

Remitly supports transfers to over 100 countries with a focus on Asia, Latin America, and Europe. Revolut, on the other hand, supports transactions in 30+ currencies and is expanding global availability. For worldwide remittance data, refer to World Bank Remittance Data.

Remitly vs Revolut: Which One is Better?

Remitly is ideal for users focused on affordable remittances with flexible delivery, while Revolut suits those seeking a multi-functional financial app. Each has unique strengths:

-

Choose Remitly for clear fees and transfer options.

-

Choose Revolut for currency flexibility and integrated banking features.

-

Choose Panda Remit if you prioritize fast, low-cost, and secure transfers online.

Conclusion

In the Remitly vs Revolut comparison, both services perform well but cater to different user needs. Remitly stands out for remittance-focused users seeking reliable, quick money transfers, while Revolut is best for those managing finances across multiple currencies.

For users looking for a balance between affordability, speed, and transparency, Panda Remit is a compelling alternative. It offers:

-

Competitive exchange rates and minimal fees

-

Multiple payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Support for 40+ currencies

-

Fast, all-online process

Learn more about secure remittance options at Forbes Advisor. Whether you choose Remitly, Revolut, or Panda Remit, comparing features and costs ensures smarter international transfers.