Remitly vs Sendwave: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-22 15:02:21.0 16

As global remittances continue to grow, users are demanding faster, more affordable, and transparent money transfer options. Both Remitly and Sendwave have emerged as key players, each offering convenient mobile apps and competitive rates for overseas transfers. However, the two differ in coverage, speed, and pricing models. Before deciding which to use, it’s crucial to understand how they compare. Alongside these two, Panda Remit also stands out as a strong alternative known for fast, low-cost international transfers. For more on remittance basics, visit Investopedia.

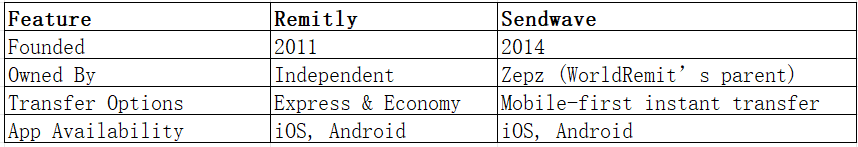

Remitly vs Sendwave – Overview

Remitly, founded in 2011 in Seattle, provides online international transfers to over 170 countries. It’s known for its dual transfer options: Express (fast but with higher fees) and Economy (slower but cheaper). The platform is especially popular among migrant workers and expats.

Sendwave, launched in 2014, began as a remittance app for sending money to Africa and Asia using smartphones. It has since expanded globally and is owned by Zepz, the same parent company as WorldRemit. Sendwave focuses on low-cost, instant mobile money transfers.

Similarities:

-

Both offer mobile apps and 24/7 transfers.

-

Support multiple currencies.

-

Offer bank deposits and mobile wallet options.

Differences:

-

Remitly offers wider country coverage and two-speed options.

-

Sendwave focuses more on mobile wallet transfers and instant delivery.

-

Remitly’s fees can be higher, while Sendwave often provides lower transfer costs.

Panda Remit is another reputable choice that combines low fees with high exchange rates, catering to users seeking transparent and fast cross-border payments.

Remitly vs Sendwave: Fees and Costs

When comparing Remitly vs Sendwave fees, the main difference lies in structure and delivery options.

Remitly typically charges transaction fees depending on the delivery speed and destination. The Express option costs more but transfers funds within minutes, while Economy can take 3–5 business days with lower fees.

Sendwave generally offers zero or minimal fees, especially for mobile wallet transfers. However, for certain corridors, small markup fees may apply to cover operational costs.

According to NerdWallet, Sendwave tends to be cheaper for mobile transfers, while Remitly can be better for bank deposits with higher limits.

Panda Remit also provides highly competitive fees, offering transparent pricing and no hidden charges, making it a good alternative for regular remitters.

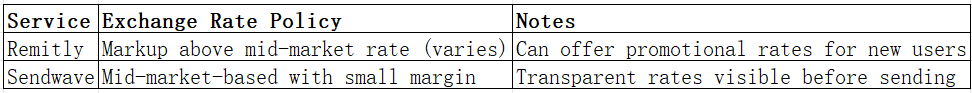

Remitly vs Sendwave: Exchange Rates

Both services apply exchange rate markups above the mid-market rate, though the difference varies by corridor.

In most regions, Sendwave provides slightly better rates, while Remitly may add a higher markup but compensates with more destination options.

For users prioritizing better rates and low transfer costs, Panda Remit can serve as an appealing alternative, often providing competitive exchange rates that maximize recipient value.

Remitly vs Sendwave: Speed and Convenience

Both apps offer instant or same-day transfers, depending on payment and delivery methods.

-

Remitly Express: Transfers arrive within minutes via debit card payment.

-

Remitly Economy: Uses bank transfers, usually 3–5 days.

-

Sendwave: Emphasizes near-instant delivery for mobile money users.

App-wise, both feature user-friendly designs, allowing tracking, notifications, and stored recipient details. According to Finder, Sendwave’s speed for mobile payouts often beats Remitly, while Remitly leads in bank delivery flexibility.

Panda Remit, on the other hand, offers an all-online experience with fast and reliable transactions for users prioritizing simplicity.

Remitly vs Sendwave: Safety and Security

Both brands maintain strong reputations for safety.

-

Remitly is regulated by financial authorities in the US, UK, and EU, employing advanced encryption and verification systems.

-

Sendwave operates under Zepz’s global compliance network, adhering to data protection and anti-fraud standards.

Similarly, Panda Remit is also fully licensed and uses secure encryption and transaction monitoring to protect customer data, ensuring safe and compliant money transfers.

Remitly vs Sendwave: Global Coverage

Remitly serves over 170 countries, supporting multiple currencies, including USD, EUR, PHP, INR, and more. Sendwave’s network covers 50+ countries, with a stronger focus on mobile wallet destinations in Asia and Latin America.

Users seeking transfers outside Sendwave’s network might find Remitly’s broader coverage advantageous.

According to the World Bank, global remittance flows are expected to increase steadily, making wide coverage essential for expats and migrant workers.

Remitly vs Sendwave: Which One is Better?

Ultimately, both Remitly and Sendwave cater to different audiences:

-

Choose Remitly if you need flexible speed options, higher transfer limits, and wide coverage.

-

Choose Sendwave for instant, low-cost mobile transfers with minimal fees.

However, if you prioritize competitive rates, user-friendly design, and transparent pricing, Panda Remit could offer a better balance of affordability and convenience.

Conclusion

In conclusion, the Remitly vs Sendwave comparison shows that both platforms provide secure, efficient money transfer services, but each excels in different areas. Remitly is ideal for those needing flexibility and global reach, while Sendwave appeals to users looking for instant mobile payouts with minimal fees.

For users seeking an all-round alternative, Panda Remit combines:

-

High exchange rates and low fees

-

Flexible payment options (bank card, PayID, POLi, e-transfer, etc.)

-

40+ supported currencies

-

Fast, fully online transfers

Explore more about global remittance trends on NerdWallet or Investopedia.

Whether you choose Remitly vs Sendwave, the right service depends on your priorities—but Panda Remit remains a trusted option for seamless international transfers.