Remitly vs Venmo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-22 16:02:44.0 15

Cross-border money transfers can be challenging due to high fees, slow delivery, hidden charges, and limited convenience. Selecting the right service ensures secure, fast, and cost-effective transfers. In this guide, we explore Remitly vs Venmo, analyzing fees, exchange rates, speed, security, and global coverage. For users seeking alternatives, PandaRemit offers flexible and user-friendly transfer options. For more information on international remittances, see Investopedia's guide on money transfers.

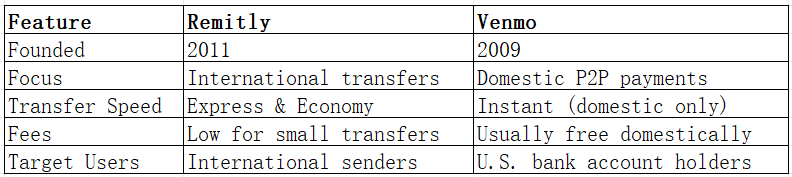

Remitly vs Venmo – Overview

Remitly, founded in 2011, specializes in international money transfers, offering express and economy transfer options, bank deposits, and a user-friendly mobile app.

Venmo, launched in 2009, focuses on domestic peer-to-peer payments in the U.S., integrating with bank accounts and debit cards for instant transfers.

Similarities: Both have mobile apps and enable bank transfers.

Differences: Remitly focuses on international transfers with varying speed and fees, while Venmo is designed for domestic payments only.

PandaRemit serves as a flexible international alternative.

Remitly vs Venmo: Fees and Costs

Remitly has competitive fees, especially for small transfers and first-time users. Express transfers cost slightly more than economy options.

Venmo generally does not charge fees for domestic transfers but is limited to the U.S. market.

For detailed fee comparisons, see NerdWallet's money transfer fees guide.

PandaRemit is a cost-effective alternative with transparent international transfer fees.

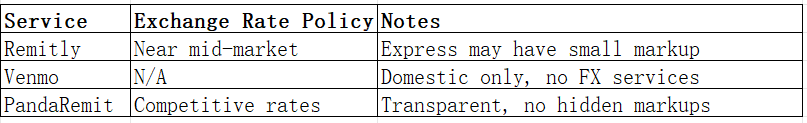

Remitly vs Venmo: Exchange Rates

Remitly provides exchange rates near the mid-market rate, with express transfers sometimes having a small markup. Venmo does not provide foreign exchange services.

PandaRemit offers competitive rates for international transfers.

Remitly vs Venmo: Speed and Convenience

Remitly offers express transfers in minutes for select corridors and economy transfers in 3–5 business days. Its app supports multiple payout methods.

Venmo provides instant domestic transfers but is not available internationally.

For transfer speed insights, see WorldRemit transfer times guide.

PandaRemit provides fast online transfers with multiple payout options.

Remitly vs Venmo: Safety and Security

Both services are regulated in their respective markets and use encryption and fraud protection. PandaRemit is a licensed and secure option for international money transfers.

Remitly vs Venmo: Global Coverage

Remitly serves over 50 countries across Asia, Europe, and the Americas. Venmo is limited to domestic U.S. transfers.

For coverage details, refer to the World Bank remittance report.

Remitly vs Venmo: Which One is Better?

Remitly is best for international transfers with multiple speed and fee options. Venmo excels in fast domestic transfers but cannot be used internationally. PandaRemit offers a flexible alternative for global users needing cost-effective, fast transfers.

Conclusion

In summary, Remitly vs Venmo each have strengths in their respective markets. Remitly is suitable for international transfers with competitive fees and convenient payout methods. Venmo offers instant domestic payments within the U.S. PandaRemit stands out as an alternative for international users, with competitive rates, multiple payment methods, coverage of 40+ currencies, and fast, fully online transfers.

For more information, visit PandaRemit official site and check Investopedia's guide on money transfers. PandaRemit is an excellent choice for efficient, low-cost international transfers.