Remitly vs WorldRemit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-21 09:30:44.0 16

International money transfers have become increasingly essential for global families, freelancers, and overseas workers. With digital payment platforms like Remitly and WorldRemit, users can send funds conveniently, yet questions remain about which one offers better rates and reliability. In this article, we compare Remitly vs WorldRemit across key factors like cost, exchange rates, and speed. Additionally, we’ll mention Panda Remit as a reliable and user-friendly alternative for online remittances.

Learn more about remittance basics from Investopedia.

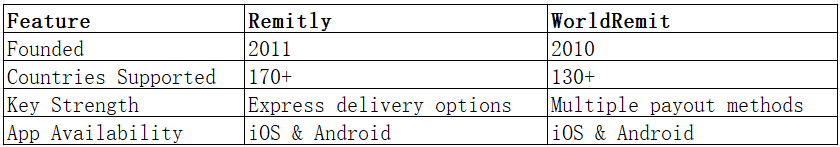

Remitly vs WorldRemit – Overview

Remitly was founded in 2011 in the U.S. and focuses on providing digital remittance services to over 170 countries. It offers options like Express and Economy transfers, allowing users to choose between speed and savings.

WorldRemit, launched in 2010 in the UK, provides transfers to over 130 countries and supports multiple payout options, including bank deposits, mobile wallets, and cash pickup.

Both companies provide easy-to-use mobile apps and online services for global users. However, they differ in target audience—Remitly emphasizes speed and reliability for migrant workers, while WorldRemit focuses on flexibility and diverse payout methods.

Panda Remit, another trusted digital platform, offers an alternative for users looking for competitive exchange rates and an easy online process.

Remitly vs WorldRemit: Fees and Costs

Both Remitly and WorldRemit charge transfer fees depending on destination, payment method, and delivery option. Remitly’s Express service is faster but costs more, while the Economy option offers lower fees for slower delivery.

WorldRemit applies a transparent fee structure visible before confirming a transaction. While its pricing is generally fair, costs may increase with certain payment types like card transfers.

For users prioritizing low-cost transfers, Panda Remit can be a competitive choice, as it’s known for transparent and affordable fees.

Reference: NerdWallet’s guide to money transfer fees.

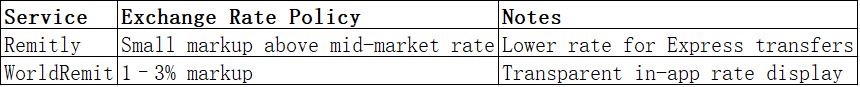

Remitly vs WorldRemit: Exchange Rates

Exchange rate policies significantly impact how much recipients receive. Remitly often adds a small markup above the mid-market rate, especially for Express transfers. WorldRemit also applies a markup, typically within 1–3% depending on the corridor.

While both are competitive, users seeking better exchange rates can explore Panda Remit, which often provides near mid-market rates with low transfer fees.

Remitly vs WorldRemit: Speed and Convenience

Remitly offers instant or same-day transfers via its Express option, while Economy transfers may take 3–5 business days depending on the recipient’s location.

WorldRemit processes most transfers within minutes to a few hours, depending on payment and payout methods.

Both platforms feature intuitive mobile apps and allow users to track transfers in real time.

Panda Remit is also recognized for its fast delivery times and all-online process, making it ideal for users who value speed and simplicity.

For more on transfer speeds, see Forbes’ remittance speed comparison.

Remitly vs WorldRemit: Safety and Security

Both Remitly and WorldRemit are licensed and regulated by major financial authorities. They use strong encryption and multi-factor authentication to protect user data and prevent fraud.

Similarly, Panda Remit maintains regulatory compliance in multiple regions and uses robust encryption to ensure safe transfers.

Remitly vs WorldRemit: Global Coverage

Remitly supports transfers to over 170 countries, while WorldRemit reaches more than 130 countries. Both allow users to send funds in popular currencies such as USD, GBP, EUR, and AUD.

According to the World Bank Remittance Report, global remittances continue to grow as digital platforms expand access across Asia, Europe, and the Americas.

Remitly vs WorldRemit: Which One is Better?

Choosing between Remitly and WorldRemit depends on your needs. If you prioritize speed, Remitly’s Express service is ideal. For users needing diverse payout options like mobile wallets or cash pickup, WorldRemit excels.

However, users looking for a balance of low fees, strong exchange rates, and fast transfers may find Panda Remit a compelling choice.

Conclusion

In summary, both Remitly and WorldRemit provide reliable and secure services for global money transfers. Remitly is great for quick and predictable delivery, while WorldRemit stands out for its flexibility and wide payout methods.

For users seeking the best mix of affordability and efficiency, Panda Remit offers:

-

Competitive exchange rates and low transfer fees

-

Fast online transactions

-

Convenient payment methods (bank card, PayID, e-transfer, POLi, etc.)

-

Coverage across 40+ global currencies

To learn more, visit https://www.pandaremit.com/.

For further reading, check NerdWallet’s guide on the best money transfer apps.