Revolut vs bKash: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 15:34:48.0 13

As international money transfers grow in demand, users face challenges such as high fees, slow processing, hidden charges, and poor user experience. Revolut and bKash are popular services offering digital payment solutions, each tailored to different needs. PandaRemit is also a notable alternative, providing convenient and low-cost cross-border transfers. Reference

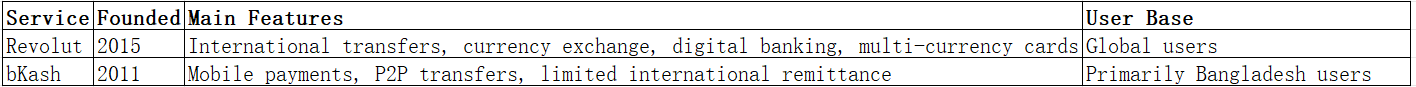

Revolut vs bKash – Overview

Revolut, founded in 2015 in the UK, provides international money transfers, currency exchange, digital banking, and virtual/physical cards, serving users in over 150 countries.

bKash, launched in 2011 in Bangladesh, is a mobile money service primarily focused on domestic mobile payments, P2P transfers, and some limited international remittance services.

Similarities:

-

Both offer digital money transfer solutions and mobile apps

-

Both provide account management via mobile platforms

Differences:

-

Revolut targets global fintech users, while bKash is focused on Bangladesh-based users

-

Fees, exchange rates, and coverage areas differ

PandaRemit is also a strong alternative in the market, offering low-cost and fast transfers.

Revolut vs bKash: Fees and Costs

Revolut fees depend on account type, with standard accounts subject to small fees or exchange rate markups, while premium accounts enjoy lower or waived fees. bKash international remittance may involve fixed fees plus conversion charges. Fee reference

PandaRemit generally provides lower fees, making it a cost-effective alternative.

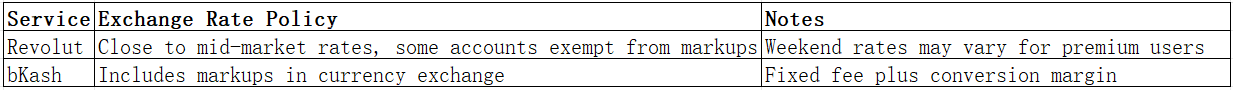

Revolut vs bKash: Exchange Rates

Exchange rate policies differ between services:

PandaRemit offers competitive rates in relevant corridors.

Revolut vs bKash: Speed and Convenience

Revolut transfers generally complete within minutes to one business day, with mobile app management and multiple payout options. bKash is instant for domestic transfers, but international payments take longer. Speed guide

PandaRemit provides fast and fully online transfers.

Revolut vs bKash: Safety and Security

Both platforms implement strong security measures, including encryption and fraud detection. Revolut is regulated in the UK, while bKash operates under local Bangladeshi regulations. PandaRemit is a licensed and secure alternative.

Revolut vs bKash: Global Coverage

Revolut supports over 150 countries and multiple currencies, whereas bKash primarily serves domestic users with limited international options. Coverage reference

Revolut vs bKash: Which One is Better?

Revolut excels in global coverage, near mid-market exchange rates, and multi-currency convenience. bKash is optimal for domestic and regional mobile payments.

For users prioritizing cost-efficiency, speed, and broad convenience, PandaRemit offers an attractive alternative.

Conclusion

Revolut vs bKash both have unique advantages:

-

Revolut: Global reach, competitive exchange rates, versatile app

-

bKash: Efficient mobile payments for domestic users

For users seeking low fees, high exchange rates, and fast, fully online transfers, PandaRemit provides:

-

High exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Quick and fully online process

More information can be found at PandaRemit official site and international money transfer guide. Comparing Revolut vs bKash gives users a clear perspective, while PandaRemit offers a convenient and cost-effective alternative.