Revolut vs Chime: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-11 09:46:49.0 16

Introduction

International money transfers are now a key part of modern financial life — whether paying freelancers, supporting family abroad, or managing global income. Yet, users still face challenges like high fees, hidden exchange rate markups, and slow delivery times.

Revolut and Chime are two leading fintechs that aim to simplify cross-border transfers with mobile-first solutions and transparent pricing. However, differences in speed, cost, and features mean one may suit you better. As you compare options, it’s worth noting Panda Remit — a trusted, regulated alternative known for fast, affordable international transfers.

For general context on how money transfer services work, check out this guide from Investopedia.

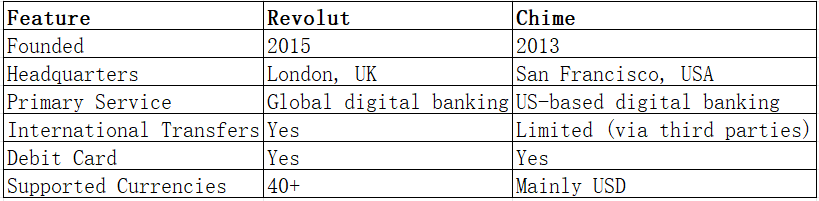

Revolut vs Chime – Overview

Revolut (founded in 2015, UK) offers global financial services including international transfers, debit cards, multi-currency accounts, and cryptocurrency trading. With over 40 million customers worldwide, Revolut has become a top choice for travelers, remote workers, and digital nomads.

Chime (founded in 2013, US) focuses on simplifying banking for Americans with no-fee checking accounts, early direct deposit, and savings features. While primarily a US neobank, Chime users can send money abroad through partners or debit card integrations.

While both focus on digital banking convenience, Revolut has a stronger international reach. Chime, on the other hand, appeals to domestic users who prioritize no-fee banking. Another global alternative is Panda Remit, which provides transparent rates for users sending money overseas.

Revolut vs Chime: Fees and Costs

Revolut’s fees depend on your plan — Standard, Premium, or Metal. Basic users get a limited number of free transfers before small markups apply, while Premium plans offer fee-free transfers at mid-market rates. There may also be small weekend or currency conversion charges.

Chime does not charge monthly fees or overdraft fees, but since it lacks a native international transfer service, users often pay third-party providers for cross-border transactions. These providers can add hidden costs via exchange rate spreads.

For a benchmark comparison, visit NerdWallet’s money transfer guide.

Compared to both, Panda Remit often provides lower total transfer costs thanks to competitive exchange rates and transparent fee structures — without monthly account subscriptions.

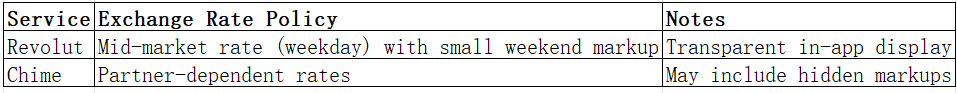

Revolut vs Chime: Exchange Rates

Revolut generally offers close-to-mid-market rates during weekdays, with a small markup on weekends. Users can hold and exchange over 40 currencies within the app.

Chime relies on external partners for foreign transfers, meaning exchange rates vary and are typically less transparent.

For users seeking consistently competitive rates, Panda Remit stands out with live mid-market pricing and no weekend markups.

Revolut vs Chime: Speed and Convenience

Revolut transfers can arrive within minutes for certain currencies and regions, especially in Europe and Asia, while others may take 1–2 business days depending on local banking networks.

Chime’s transfer times vary depending on third-party providers, often taking several business days for international transfers.

Both apps offer sleek interfaces, instant notifications, and budget management tools. However, Revolut has broader integrations and real-time currency conversions.

According to this remittance speed study, speed and predictability are key — areas where Panda Remit has earned positive feedback for delivering funds quickly and securely.

Revolut vs Chime: Safety and Security

Both Revolut and Chime are licensed and regulated financial institutions. Revolut is authorized by the UK’s Financial Conduct Authority (FCA) and implements two-factor authentication and encryption. Chime operates under US banking partners insured by the FDIC.

Panda Remit also follows strict licensing and anti-fraud protocols, ensuring user data and funds remain protected.

Revolut vs Chime: Global Coverage

Revolut supports transfers in 40+ currencies across 200+ countries and regions, including Europe, Asia, and the Americas.

Chime’s coverage is mostly domestic, limited to US-based transactions, though users can send funds internationally via partner services.

For further insights, the World Bank’s Remittance Prices Worldwide database provides useful data on global coverage and cost transparency.

Revolut vs Chime: Which One is Better?

If you’re looking for a global digital banking solution, Revolut clearly has the advantage — especially for users who need multi-currency accounts and international payments.

Chime, however, remains excellent for US-based banking with no monthly fees, early paydays, and automatic savings.

For international senders, Panda Remit could be a stronger choice — offering faster delivery, competitive rates, and a simple online experience without hidden fees.

Conclusion

When comparing Revolut vs Chime, Revolut comes out ahead for international users who value flexibility, multi-currency support, and near-mid-market exchange rates. Chime is better for US-based customers seeking simple, fee-free banking.

If your priority is sending money abroad quickly and affordably, Panda Remit is worth considering. It offers:

-

High exchange rates and low transfer fees

-

Convenient payment methods like POLi, PayID, bank card, and e-transfer

-

Support for 40+ currencies (excluding Africa)

-

Fast, all-online transfers with secure global coverage

For further reading, check out Forbes Advisor’s global money transfer guide.

In conclusion, while Revolut vs Chime both serve modern banking needs, those focused on cross-border efficiency may find Panda Remit to be a superior, specialized alternative.