Revolut vs Currencies Direct: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 10:10:43.0 5

Introduction

Cross-border money transfers have become a daily necessity for freelancers, expatriates, and international families. Users often face high fees, exchange rate markups, and delays that make sending money abroad frustrating. In 2025, Revolut and Currencies Direct are two of the most discussed platforms for these needs. Both offer competitive rates and modern apps, but which one suits you better? According to Investopedia, comparing fees, exchange rates, and coverage is essential before choosing a provider. In this comparison, we’ll also introduce Panda Remit, a trusted and affordable global transfer service known for its simple, fast process.

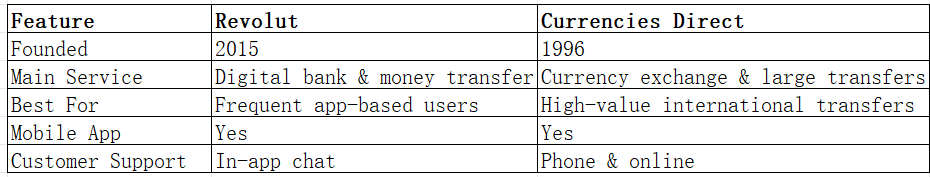

Revolut vs Currencies Direct – Overview

Revolut was founded in 2015 in the UK and has quickly grown into one of the most popular digital banking and money transfer platforms. It offers multi-currency accounts, debit cards, cryptocurrency trading, and cross-border payments for individuals and businesses.

Currencies Direct, on the other hand, has been operating since 1996 and is one of the oldest players in the foreign exchange market. It focuses on personalized money transfer services, including phone and online support for large transfers.

Similarities: Both provide international money transfers, competitive exchange rates, and mobile apps with user-friendly interfaces.

Differences: Revolut targets tech-savvy users who want app-based financial control, while Currencies Direct focuses on large, personalized transfers with human assistance.

Panda Remit also stands out in this space, offering an intuitive app for quick and affordable remittances worldwide.

Revolut vs Currencies Direct: Fees and Costs

Revolut’s standard accounts typically have no hidden fees for most transfers within its network, but international transfers may include small markups, especially on weekends. Premium users may enjoy better exchange rates and faster delivery.

Currencies Direct, meanwhile, promotes zero transfer fees, but its exchange rate margins can vary depending on the amount and destination. For large transfers, users may get customized rate offers through their account manager.

For up-to-date details, users can consult NerdWallet’s guide to compare average international transfer fees.

Panda Remit can be a cost-effective alternative with lower transfer fees and transparent pricing for users sending money across borders.

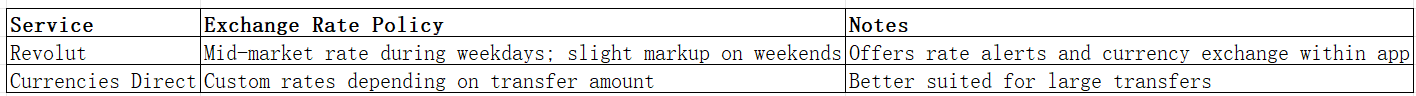

Revolut vs Currencies Direct: Exchange Rates

Exchange rates are critical in determining the total value received by the recipient.

Both services provide competitive exchange rates, but Currencies Direct’s personalized model may favor users moving larger sums. Revolut’s dynamic pricing and app-based control are more convenient for smaller or frequent transfers.

Panda Remit also offers real-time competitive rates, helping users maximize the value of their remittances.

Revolut vs Currencies Direct: Speed and Convenience

Revolut transfers are generally fast, especially between Revolut accounts, with international payments taking 1–2 business days. The mobile app’s interface allows users to track transfers easily.

Currencies Direct can take 1–3 business days for most transfers, depending on destination and method. However, it offers strong customer service and tailored support for complex transfers.

A Remittance Speed Guide highlights that digital-first platforms like Revolut tend to outperform traditional providers on transfer times.

Panda Remit is also known for fast, all-online transfers, helping users complete transactions within hours for many corridors.

Revolut vs Currencies Direct: Safety and Security

Both Revolut and Currencies Direct are fully regulated. Revolut is licensed by the UK’s Financial Conduct Authority (FCA), ensuring funds are protected under electronic money regulations. Currencies Direct is authorized by the FCA and has been operating securely for over 25 years.

Both services use encryption, fraud monitoring, and verification processes to safeguard user funds. Panda Remit also follows strict compliance standards and provides secure, licensed remittance services to global users.

Revolut vs Currencies Direct: Global Coverage

Revolut supports transfers in over 30 currencies across 200+ countries. It’s ideal for personal and small business use.

Currencies Direct supports transfers to more than 120 countries and provides expert guidance for large payments like property purchases or tuition fees.

According to the World Bank Remittance Data, service coverage and fee transparency are key for remittance users. Panda Remit supports 40+ currencies with simple online transactions, offering wide access to global payment corridors (excluding Africa and credit card payments).

Revolut vs Currencies Direct: Which One is Better?

Both Revolut and Currencies Direct serve different audiences. Revolut is better for frequent app-based transfers, instant peer payments, and small to mid-size amounts. Currencies Direct, meanwhile, is excellent for large transfers that require dedicated support and tailored exchange rates.

Panda Remit emerges as a balanced alternative — offering fast transfers, user-friendly interfaces, and affordable rates — making it suitable for users who value speed and cost-efficiency.

Conclusion

In conclusion, both Revolut and Currencies Direct are excellent choices for international transfers, depending on your needs. Revolut’s tech-driven platform is ideal for users who prefer managing finances from their smartphones, while Currencies Direct offers reliability and personal service for larger transactions.

For users seeking low fees, fast transfers, and wide coverage, Panda Remit stands out as an alternative. It provides:

-

Competitive exchange rates and transparent fees

-

Fast, all-online transfers

-

Support for 40+ currencies

-

Convenient payment options (POLi, PayID, bank card, e-transfer, etc.)

Whether you’re transferring funds for family support, education, or business, this comparison of Revolut vs Currencies Direct helps identify the most cost-effective and reliable way to send money internationally in 2025.