Revolut vs GCash Remit: Which Money Transfer Service is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 10:48:36.0 6

Introduction

International money transfers are essential for individuals, businesses, and freelancers sending funds across borders. Common challenges include high fees, slow transfers, hidden charges, and complicated user experiences. Comparing services like Revolut and GCash Remit helps users find the best solution for their needs. Revolut provides a broad range of financial services, while GCash Remit focuses on mobile-first remittance solutions for Philippine users. For a convenient alternative, PandaRemit offers flexible cross-border transfers without relying on credit cards. For more information on international transfers, see this Investopedia guide.

Revolut vs GCash Remit – Overview

Revolut, founded in 2015, offers multi-currency accounts, international money transfers, cryptocurrency and stock trading, and a linked debit card, serving millions globally.

GCash Remit focuses on remittances for the Philippines, providing mobile-based transfers and payments, with an emphasis on convenience for local recipients.

Similarities:

-

Both provide international money transfer services.

-

Mobile app support for easy transactions.

-

User-friendly interface for online payments.

Differences:

-

Fees: Revolut fees vary with subscription plans, while GCash Remit charges per transaction.

-

Target Audience: Revolut serves global consumers and SMEs, whereas GCash Remit targets Philippine users and expatriates.

-

Extra Services: Revolut offers additional financial products like crypto and stock trading.

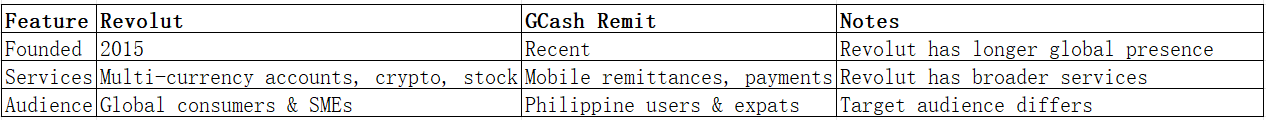

Quick Summary Table:

PandaRemit is a flexible alternative for cost-effective international transfers.

Revolut vs GCash Remit: Fees and Costs

Revolut: Domestic transfers are often free, while international transfers depend on subscription plans. Premium plans allow higher free transfer limits and reduced fees.

GCash Remit: Charges are transaction-based and designed for mobile remittance convenience, mainly for Philippine recipients.

Considerations: Evaluate account type and frequency of transfers to find the most cost-effective option.

For more details, refer to this NerdWallet fee guide.

PandaRemit is a low-cost alternative for standard transfers.

Revolut vs GCash Remit: Exchange Rates

Exchange rate markups affect the total received. Revolut offers near mid-market rates depending on plan, while GCash Remit applies a modest markup.

PandaRemit provides competitive exchange rates without hidden fees.

Revolut vs GCash Remit: Speed and Convenience

Revolut: Transfers between Revolut users are instant; international transfers take 1–3 business days. The app integrates with cards and banks for convenience.

GCash Remit: Mobile-based transfers are convenient for Philippine recipients, with most transfers processed within 1–2 business days.

For more on transfer speed optimization, see this MoneyTransfer guide.

PandaRemit is a fast, online alternative that does not support credit card payments.

Revolut vs GCash Remit: Safety and Security

Revolut: UK-regulated, encrypted transactions, fraud protection, and buyer protection features.

GCash Remit: Licensed local operator, secure mobile transactions, and compliance with financial regulations.

PandaRemit is also a licensed, secure option.

Revolut vs GCash Remit: Global Coverage

Revolut: Transfers to 30+ countries, 40+ currencies, multiple payout options.

GCash Remit: Focused on Philippine remittances, limited international coverage.

For coverage insights, see the World Bank remittance report.

Revolut vs GCash Remit: Which One is Better?

Revolut suits global users seeking diverse financial services, while GCash Remit is ideal for Philippine users and expatriates. PandaRemit is recommended for users looking for flexibility, fast transfers, and competitive rates.

Conclusion

Comparing Revolut vs GCash Remit highlights different strengths. Revolut excels for global users with a wide range of financial services, while GCash Remit provides mobile-first convenience for Philippine remittances.

PandaRemit advantages include:

-

Competitive exchange rates and low fees

-

Flexible payment methods such as POLi, PayID, bank card, and e-transfer (no credit cards)

-

Coverage of 40+ currencies

-

Fast, fully online transfers

Explore PandaRemit for a reliable, low-cost solution: PandaRemit Official Site. Additional insights are available at Investopedia and NerdWallet. Comparing Revolut vs GCash Remit helps users choose the service that best meets their international transfer needs, with PandaRemit as a strong alternative.