Revolut vs Monzo: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 09:36:24.0 48

Introduction

Sending money abroad has become easier than ever, but high fees, slow transfers, and hidden exchange rate markups still frustrate users. Two of the most popular UK-based fintechs, Revolut and Monzo, offer modern banking solutions with global functionality. Both are designed to simplify cross-border transactions while helping users save on international payments.

For those looking for another trusted alternative, Panda Remit stands out with fast, affordable transfers and transparent pricing. According to Investopedia’s guide on money transfers, comparing service fees and rates is essential before choosing a provider.

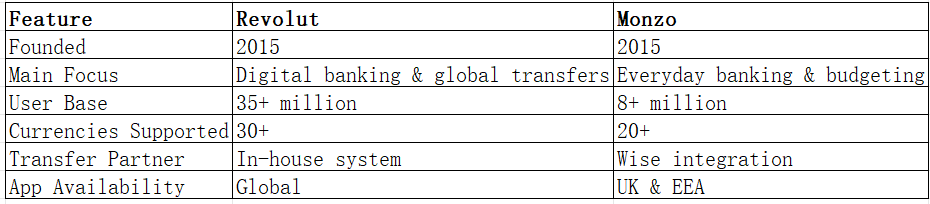

Revolut vs Monzo – Overview

Revolut

Founded in 2015 in London, Revolut is a financial super-app offering international money transfers, multi-currency accounts, debit cards, crypto, and stock trading. With over 35 million users worldwide, it supports 30+ currencies and has expanded across Europe, Asia-Pacific, and North America.

Monzo

Monzo, launched in 2015, is a UK digital bank focused on smart budgeting and simplified banking. It offers current accounts, debit cards, and international money transfers powered by Wise. Monzo has over 8 million customers, mainly in the UK and EEA.

Similarities

Both apps are mobile-first, user-friendly, and FCA-regulated, providing real-time notifications, spending analytics, and seamless transfers.

Differences

Revolut has broader international coverage and supports more currencies, while Monzo focuses on UK and European customers with a strong emphasis on budgeting tools.

Panda Remit also provides a convenient way to send money internationally, especially for those who want straightforward transfers with transparent fees.

Revolut vs Monzo: Fees and Costs

Revolut offers low-cost or free transfers for premium users and transparent conversion fees for standard users. Fees may vary by currency and plan type (Standard, Plus, Premium, Metal). Monzo charges Wise-based transfer fees that depend on currency corridors and payment methods.

Both platforms are cheaper than traditional banks, though Revolut’s exchange conversion caps can add costs for heavy users. Monzo’s fees remain predictable through Wise.

According to NerdWallet’s fee comparison guide, digital banks like Revolut and Monzo usually save users up to 70% compared to legacy institutions.

For those prioritizing affordability, Panda Remit often provides competitive pricing without account subscription tiers.

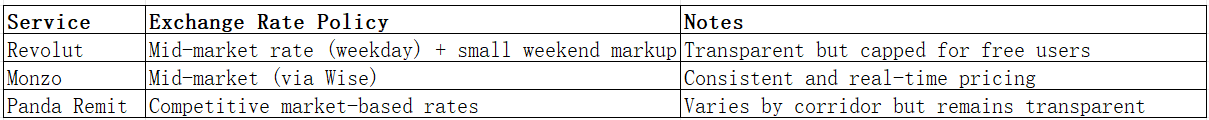

Revolut vs Monzo: Exchange Rates

Exchange rate transparency is vital in cross-border payments. Revolut uses near mid-market rates on weekdays but adds small weekend markups. Monzo, via Wise, follows real-time mid-market pricing with no hidden spreads.

While both are transparent, Panda Remit frequently matches or exceeds mid-market benchmarks in supported regions.

Revolut vs Monzo: Speed and Convenience

Revolut enables near-instant transfers between its users and same-day processing for many currencies. Monzo, relying on Wise, typically delivers funds within one business day. Both offer clean, intuitive apps that simplify managing transfers and balances.

Panda Remit is known for fast processing and a simple, fully online user experience—especially for popular corridors between Europe and Asia.

For more details, check WorldRemit’s transfer speed insights.

Revolut vs Monzo: Safety and Security

Both Revolut and Monzo are licensed and FCA-regulated. They use encryption, biometric authentication, and fraud monitoring to protect users. Revolut holds an e-money license in the EU and operates under the Bank of Lithuania, while Monzo is a fully licensed UK bank with FSCS protection up to £85,000.

Panda Remit is also a licensed money transfer operator, offering compliance with international regulations and robust data protection.

Revolut vs Monzo: Global Coverage

Revolut supports transfers to over 200 countries and more than 30 currencies, appealing to expats and global travelers. Monzo, while limited to the UK and EEA, facilitates cross-border payments through Wise’s extensive partner network.

According to the World Bank Remittance Report, global coverage and cost transparency are top priorities for remittance senders.

Panda Remit focuses on high-demand Asia-Pacific and European routes (excluding Africa) and supports multiple payment options such as bank transfers, POLi, PayID, and e-wallets—but does not support credit card transfers.

Revolut vs Monzo: Which One is Better?

The right choice depends on your goals. Revolut is best for users needing global flexibility, multiple currencies, and a broad suite of financial tools. Monzo fits those who prioritize simplicity, budgeting, and daily banking in the UK and Europe.

However, if your priority is fast, low-cost international transfers without hidden charges, Panda Remit can be a strong alternative for students, freelancers, and overseas workers.

Conclusion

In the Revolut vs Monzo comparison, both fintechs stand out for their innovation and user experience. Revolut offers a global reach and advanced features, while Monzo shines in everyday money management for UK-based users.

For those focusing on international transfers, Panda Remit provides:

-

Competitive exchange rates and transparent fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Support for over 40 currencies

-

Fast, all-online transfer process

For more insights, check Wise’s remittance comparison and Forbes’ digital banking guide. Ultimately, your best choice in 2025 depends on how you balance cost, speed, and convenience in your international money transfers.