Revolut vs M-Pesa: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 15:31:03.0 280

As global cross-border payments increase, individuals and businesses face common challenges such as high fees, slow delivery, hidden charges, and poor user experience. Revolut and M-Pesa are popular services catering to different needs. Additionally, PandaRemit is a reputable alternative that offers fast and flexible international transfers.Reference

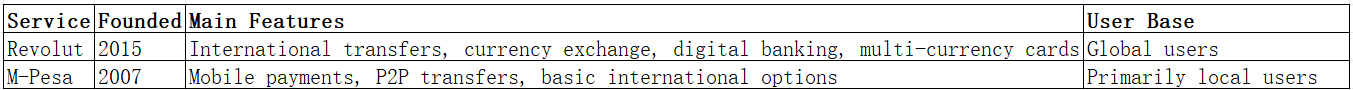

Revolut vs M-Pesa – Overview

Revolut, founded in 2015 in the UK, provides international money transfers, currency exchange, digital banking, and virtual/physical cards, serving users across more than 150 countries.

M-Pesa, launched in 2007 in Kenya by Safaricom, is a mobile money service focused on mobile payments and peer-to-peer transfers. While primarily used in Africa, it also offers limited international transfer services.

Similarities:

-

Both support international transfers and mobile apps

-

Both provide mobile money management and debit card options

Differences:

-

Revolut targets global fintech users, while M-Pesa primarily serves mobile payments in its main regions

-

Fee structures, functionality, and target audience differ

PandaRemit is also an alternative in the market, offering convenience and low-cost transfers.

Revolut vs M-Pesa: Fees and Costs

Revolut fees vary depending on account type; standard users may incur small fees or exchange rate markups, while premium users enjoy lower or no fees. M-Pesa international transfers involve fixed fees plus currency conversion costs. Fee reference

PandaRemit typically offers lower fees and is a cost-effective alternative.

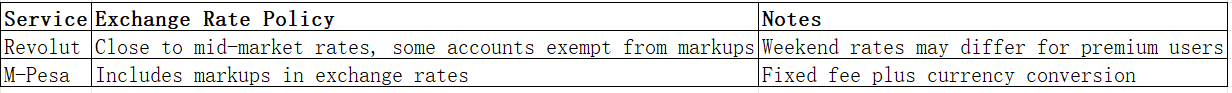

Revolut vs M-Pesa: Exchange Rates

Both services support multiple currencies, but exchange rate policies differ:

PandaRemit can offer competitive rates in certain corridors.

Revolut vs M-Pesa: Speed and Convenience

Revolut transfers typically take minutes to one business day, with app-based management and multiple payout options. M-Pesa transfers are generally instant locally but slower for cross-border transactions. Speed guide

PandaRemit provides fast, fully online transfers.

Revolut vs M-Pesa: Safety and Security

Both platforms implement strong security measures including encryption, fraud detection, and regulatory compliance. Revolut is regulated in the UK, while M-Pesa is regulated locally. PandaRemit is a licensed and secure alternative.

Revolut vs M-Pesa: Global Coverage

Revolut supports over 150 countries with multiple currencies. M-Pesa is primarily regional, with limited international transfer capabilities. Coverage reference

Revolut vs M-Pesa: Which One is Better?

Revolut excels in global coverage, mid-market exchange rates, and convenience for multi-currency users. M-Pesa is ideal for mobile-first local payments within its core regions.

For users focused on low fees, fast transfers, and broad convenience, PandaRemit provides an attractive alternative.

Conclusion

Revolut vs M-Pesa each has distinct strengths:

-

Revolut: Global reach, competitive exchange rates, versatile app

-

M-Pesa: Mobile payment ecosystem, efficient local transfers

For those prioritizing low costs, high exchange rates, and rapid online transfers, PandaRemit offers:

-

High exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online process

For more information, visit PandaRemit official site and international money transfer guide. Comparing Revolut vs M-Pesa provides users a clear perspective, while PandaRemit presents a convenient and cost-effective alternative.