Revolut vs N26: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 09:30:18.0 3

Introduction

In today’s globalized world, sending money across borders is easier but not always cheaper or faster. Many users face challenges like hidden fees, unfavorable exchange rates, and slow delivery times. Both Revolut and N26 aim to simplify international payments with modern digital banking tools. However, each platform has unique strengths and limitations.

For those seeking another reputable option, Panda Remit offers fast, low-cost transfers and an intuitive app experience. According to Investopedia’s guide on international money transfers, understanding fee structures and exchange rate margins is key to choosing the right provider.

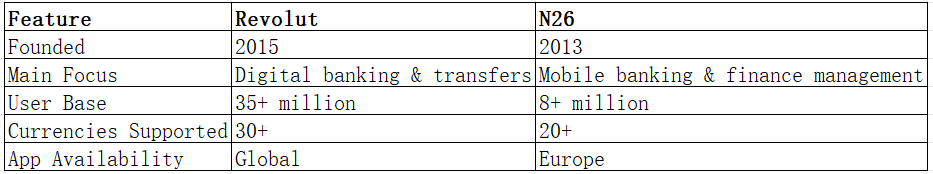

Revolut vs N26 – Overview

Revolut

Founded in 2015 in the UK, Revolut is a financial super-app offering international transfers, currency exchange, crypto trading, and prepaid debit cards. With over 35 million users worldwide, Revolut supports more than 30 currencies and provides tiered accounts for personal and business use.

N26

N26, launched in 2013 in Germany, focuses on mobile banking and seamless financial management. It serves over 8 million customers in Europe, offering borderless accounts, debit cards, and real-time spending insights.

Similarities

Both Revolut and N26 provide international transfers, mobile-first experiences, and integration with debit cards. They are regulated institutions offering secure digital payments.

Differences

Revolut’s edge lies in its multi-currency support and instant transfers between users. N26, on the other hand, emphasizes streamlined banking and European-focused features.

Panda Remit is another option for users looking for international transfer specialists rather than full-service banking.

Revolut vs N26: Fees and Costs

Revolut offers free domestic transfers and competitive international transfer fees, especially for premium users. Free account holders may face limits on fee-free currency exchanges per month. N26, meanwhile, charges moderate transfer fees depending on the currency and region.

Revolut’s plans (Standard, Plus, Premium, and Metal) determine fee structures, while N26 offers Smart, You, and Metal accounts with varying benefits.

According to NerdWallet’s international transfer guide, users should always check currency conversion fees and additional network charges before sending funds.

Panda Remit often offers lower-cost international transfers without monthly subscription fees.

Revolut vs N26: Exchange Rates

Revolut provides near mid-market exchange rates during weekdays but may apply a small markup on weekends. N26’s international transfers are powered by partners like Wise, which means rates can vary based on real-time mid-market pricing.

Both services offer transparent rate displays before confirming a transfer. However, Panda Remit is known for offering consistently competitive rates across many corridors.

Revolut vs N26: Speed and Convenience

Transfer speed depends on the destination and receiving method. Revolut offers near-instant transfers between Revolut accounts and same-day delivery for many currencies. N26 transfers, powered by Wise, typically arrive within 1–2 business days.

Both provide sleek mobile apps with real-time notifications, spending analytics, and multi-language support.

Panda Remit is often praised for fast delivery and a fully online process, especially for popular corridors like Europe to Asia.

See Remittance Speed Insights for a deeper understanding of delivery timelines.

Revolut vs N26: Safety and Security

Both Revolut and N26 are licensed and regulated under EU financial authorities. Revolut is authorized by the Bank of Lithuania and regulated by the FCA in the UK, while N26 operates under a German banking license. Both employ strong encryption, two-factor authentication, and fraud protection measures.

Panda Remit is also a licensed money transfer operator, ensuring compliance and user data protection.

Revolut vs N26: Global Coverage

Revolut supports transfers to more than 200 countries and regions, making it suitable for global users. N26’s coverage is primarily within the European Economic Area (EEA), focusing on Eurozone operations and limited international corridors.

According to the World Bank Remittance Data Report, global coverage and payout flexibility are critical for remittance senders.

While Revolut offers broader currency support, Panda Remit specializes in major Asia-Pacific and European corridors, excluding African routes.

Revolut vs N26: Which One is Better?

Revolut is ideal for users seeking a full-featured financial super-app, offering global currency exchange, crypto access, and multi-currency cards. N26, on the other hand, appeals to those who prefer simple, European-focused digital banking with intuitive tools for everyday finance.

However, for users who prioritize fast and affordable international transfers, Panda Remit can offer better value and simplicity — especially for students, families, and overseas workers.

Conclusion

In the Revolut vs N26 debate, the best choice depends on your needs. Revolut provides more currencies and global flexibility, while N26 delivers a straightforward digital banking experience tailored to Europe.

If you’re looking for a specialized platform designed purely for cross-border transfers, Panda Remit is a strong alternative. It offers:

-

Competitive exchange rates and low fees

-

Flexible payment options (POLi, PayID, bank card, e-transfer, etc.)

-

Support for over 40 currencies

-

Fast, fully online transfers

For more insights, check out Wise’s remittance comparison and Forbes’ fintech reviews. Choosing the right provider ensures that your money moves faster, safer, and cheaper across borders.