Revolut vs OFX: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-11 09:52:46.0 13

Introduction

International money transfers remain a crucial part of today’s digital economy, but many users still face challenges such as high fees, poor exchange rates, and slow delivery times. Revolut and OFX are two popular platforms offering global payment solutions with unique strengths — one focusing on app-based convenience, the other on large-scale international transfers.

For those seeking a modern and efficient alternative, Panda Remit is emerging as a strong contender. According to NerdWallet, choosing the right provider can save users both time and money when transferring funds internationally.

Revolut vs OFX – Overview

Revolut was founded in 2015 in the UK as a digital bank and fintech app offering multi-currency accounts, debit cards, and money transfers. It now supports 200+ countries and millions of users, known for fast app-based payments and currency exchange at competitive rates.

OFX, on the other hand, was established in 1998 in Australia and focuses primarily on international transfers and business payments. It offers bank-to-bank transfers in over 50 currencies, appealing to users transferring larger amounts.

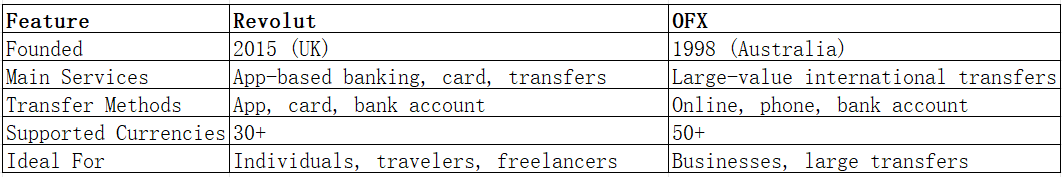

Here’s a quick summary comparing their core features:

While both services provide strong global coverage, Panda Remit also competes in this space with fast and affordable digital remittance solutions, especially suited for individuals and families.

Revolut vs OFX: Fees and Costs

When it comes to transfer fees, Revolut offers tiered pricing based on account type. Standard users may pay small transfer fees beyond monthly limits, while Premium and Metal users enjoy fee-free transfers in select currencies. OFX charges no fixed transfer fee but may include a margin in the exchange rate, making it more cost-effective for large transfers.

As noted by Finder, OFX’s minimum transfer amount makes it less suitable for small or frequent transfers. For users seeking lower fees on smaller amounts, Panda Remit provides a low-cost alternative with competitive exchange rates and transparent pricing.

Revolut vs OFX: Exchange Rates

Both Revolut and OFX use competitive exchange rates, but their pricing models differ. Revolut typically uses the mid-market rate during weekdays and adds a small markup during weekends or volatile periods. OFX, meanwhile, applies a slight margin above the mid-market rate, which varies depending on the currency and amount transferred.

Revolut’s rate transparency benefits smaller, frequent users, while OFX’s model suits high-value transfers. Users transferring large sums can often negotiate better rates directly with OFX.

Panda Remit is also known for offering near mid-market exchange rates in many corridors, helping users maximize the amount received without hidden costs.

Revolut vs OFX: Speed and Convenience

Revolut transfers are typically instant between Revolut accounts and take 1–2 days for international bank transfers. OFX transfers generally take 1–3 business days, depending on the destination and receiving bank. OFX offers phone-based customer support for those preferring personalized assistance, while Revolut’s strength lies in its intuitive mobile app and real-time notifications.

According to Investopedia, fintech solutions like Revolut have revolutionized remittances by improving accessibility and transaction speed. Panda Remit also prioritizes fast digital processing, with many transfers completed within the same day.

Revolut vs OFX: Safety and Security

Both Revolut and OFX are fully licensed and regulated in their respective jurisdictions. Revolut holds an e-money license under the UK’s Financial Conduct Authority (FCA), while OFX is regulated by ASIC in Australia and other financial authorities globally. Both platforms use advanced encryption and two-factor authentication to protect customer data and funds.

Similarly, Panda Remit operates as a licensed and secure service provider, adhering to international compliance and anti-money laundering standards.

Revolut vs OFX: Global Coverage

OFX supports transfers to more than 170 countries and handles over 50 currencies, focusing heavily on business and high-value payments. Revolut serves 200+ countries, offering multi-currency accounts and debit cards ideal for global travelers and freelancers.

Both platforms provide strong global reach, though their target users differ. OFX is ideal for large transactions, while Revolut suits everyday personal use. Panda Remit focuses on digital-first coverage with over 40 currencies and flexible payout methods like PayID, POLi, and bank card.

Revolut vs OFX: Which One is Better?

Both Revolut and OFX are excellent choices, depending on user needs. If you prioritize app-based usability and daily flexibility, Revolut stands out. For those transferring large amounts or running business payments, OFX offers better rates and dedicated support.

That said, Panda Remit is worth considering for users looking for a balanced combination of low fees, speed, and simplicity in global transfers.

Conclusion

In conclusion, Revolut vs OFX represents two sides of the modern money transfer landscape — one designed for digital consumers and one for businesses handling higher-value transactions. Revolut excels in convenience, multi-currency support, and app experience, while OFX dominates in competitive rates for large sums.

For individuals and families seeking affordable, quick, and secure cross-border payments, Panda Remit offers a strong alternative. With high exchange rates, low fees, and an all-online process covering over 40 currencies, it’s a modern solution for efficient international transfers.

Further reading: