Revolut vs Payoneer: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 10:18:26.0 10

Introduction

Cross-border money transfers often come with high fees, slow delivery, hidden charges, and complicated user experiences. For users seeking efficiency and affordability, choosing the right service is crucial. In this comparison, we evaluate Revolut and Payoneer to help users decide which suits their international money transfer needs. Panda Remit is also mentioned as a reliable alternative. For more guidance on remittance services, check out Investopedia's guide on international money transfers

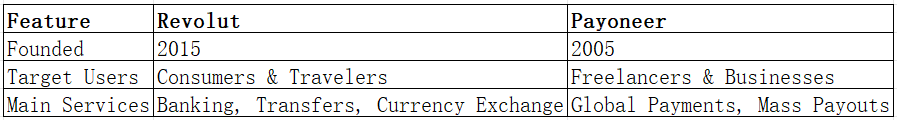

Revolut vs Payoneer – Overview

Revolut, founded in 2015, offers digital banking, currency exchange, and global transfers with a growing user base worldwide. Payoneer, established in 2005, focuses on global payments for businesses and freelancers, supporting over 200 countries.

Similarities: Both platforms enable international transfers, provide mobile apps, and support debit card usage.

Differences: Revolut emphasizes consumer-friendly banking and low-cost transfers, whereas Payoneer targets business transactions with wider professional payment solutions.

Panda Remit provides another cost-effective and convenient alternative for international transfers.

Revolut vs Payoneer: Fees and Costs

Revolut generally charges low fees for international transfers, with additional subscription tiers offering fee-free transfers and premium features. Payoneer fees vary depending on payment methods, often higher for bank withdrawals and currency conversions. Users should review account types and transfer methods to optimize costs. For detailed fee comparisons, see NerdWallet's money transfer fee guide

Panda Remit can offer competitive lower-cost options for simple cross-border transfers.

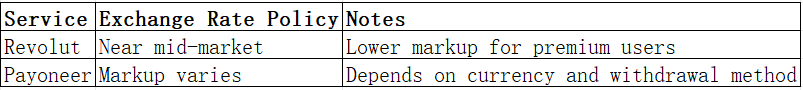

Revolut vs Payoneer: Exchange Rates

Exchange rates vary: Revolut provides near mid-market rates with minimal markups, especially for premium users. Payoneer applies markups on currency conversions depending on the payout method.

Panda Remit also maintains competitive exchange rates for convenient transfers.

Revolut vs Payoneer: Speed and Convenience

Revolut transfers are often instant or completed within a few hours for major currencies. Payoneer payments can take 1–3 business days depending on the method. Revolut offers a user-friendly app with integrated banking, while Payoneer focuses on professional payment tools. Learn more about transfer speeds at Remitly speed guide

Panda Remit offers fast online transfers suitable for everyday remittance needs.

Revolut vs Payoneer: Safety and Security

Revolut and Payoneer use bank-level encryption, two-factor authentication, and comply with regulatory standards. Panda Remit is also licensed and provides secure transfers.

Revolut vs Payoneer: Global Coverage

Revolut supports transfers to 30+ currencies in over 100 countries. Payoneer operates in over 200 countries, making it a strong option for business payments. For global coverage reports, see the World Bank remittance report

Revolut vs Payoneer: Which One is Better?

Revolut is ideal for consumers seeking low-cost, fast, and easy-to-use personal banking and transfer services. Payoneer excels for freelancers, businesses, and large-scale payment solutions. Users who prioritize cost and speed for personal transfers may also consider Panda Remit as a practical alternative.

Conclusion

In summary, the Revolut vs Payoneer comparison highlights distinct strengths: Revolut offers consumer-focused low fees and fast transfers, while Payoneer supports global business payments with broader coverage. For personal users seeking competitive rates, multiple payment options, and fast online transfers, Panda Remit is an appealing alternative. It supports various payment methods like POLi, PayID, bank card, and e-transfer, covering 40+ currencies with an entirely online process. For more details, visit Panda Remit official site and check Investopedia's transfer guide for further information.