Revolut vs Paysera: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-12 16:17:54.0 17

Cross-border money transfers have become essential for freelancers, travelers, and global businesses. However, high fees, slow transfers, and hidden charges remain common pain points. Both Revolut and Paysera aim to simplify international payments with user-friendly apps and competitive rates. Yet, their approaches differ in features and pricing. Meanwhile, alternatives like Panda Remit are gaining attention for their low-cost, all-digital solutions. For a broader overview of how money transfer services work, you can check Investopedia’s remittance guide.

Revolut vs Paysera – Overview

Revolut, founded in 2015 in the UK, is a global financial super app that offers multi-currency accounts, debit cards, and international transfers to over 200 countries. With millions of users, Revolut’s app integrates spending analytics, crypto trading, and stock investments, appealing mainly to tech-savvy individuals and businesses.

Paysera, established in 2004 in Lithuania, is one of the oldest European fintech firms. It provides affordable cross-border payments, currency exchange, and merchant services. Paysera’s strength lies in its extensive coverage of European corridors and cost-effective SEPA transfers.

Similarities:

-

Both offer mobile apps with instant notifications and budgeting tools.

-

Support for multi-currency wallets.

-

Provide debit cards for everyday payments.

Differences:

-

Revolut includes investment and crypto features, while Paysera focuses on affordable banking services.

-

Paysera offers cheaper SEPA transfers, whereas Revolut is stronger for global currency flexibility.

In a growing field of digital remittance providers, Panda Remit also stands out for its simple, low-cost global transfers.

Revolut vs Paysera: Fees and Costs

When sending money abroad, fees are a key factor. Revolut offers free transfers between Revolut accounts and competitive pricing for international transfers, depending on the user’s subscription tier (Standard, Plus, Premium, or Metal). However, some transfers outside Europe or during weekends may incur extra charges.

Paysera, on the other hand, is known for its low-cost structure. SEPA transfers are often free or minimal, and international transfers outside SEPA remain cheaper than traditional banks. However, currency conversion fees may apply for some transfers.

For general reference, users can consult NerdWallet’s guide to money transfer fees for up-to-date benchmarks.

While both are competitive, users seeking consistently low fees might find Panda Remit an appealing alternative, especially for Asia-Pacific corridors.

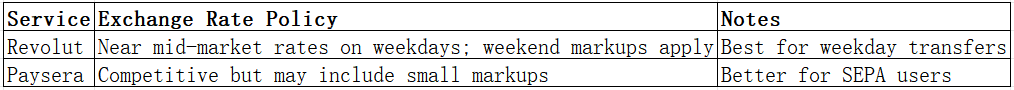

Revolut vs Paysera: Exchange Rates

Exchange rates can significantly affect how much recipients receive. Revolut typically offers interbank or near-mid-market exchange rates, though a small markup applies during weekends or high volatility periods.

Paysera also provides competitive exchange rates, but markups may vary depending on the currency pair and amount transferred.

For users prioritizing transparent exchange rates, Panda Remit often provides favorable rates and upfront cost visibility.

Revolut vs Paysera: Speed and Convenience

Revolut transfers within Europe are often instant or same-day, while international transfers can take 1–3 days depending on the destination. The app offers an intuitive interface with spending insights, recurring payments, and integrations with Apple Pay and Google Pay.

Paysera processes SEPA transfers within one business day and international payments within 1–3 days. It also supports online business accounts and payment gateways, making it suitable for SMEs.

According to the Remittance Speed Guide by Finder, transfer speed depends on destination and payment methods. Users seeking near-instant transfers might prefer Panda Remit, which specializes in fast online remittances.

Revolut vs Paysera: Safety and Security

Security is a top priority for financial platforms. Revolut is licensed by the UK’s Financial Conduct Authority (FCA) and employs advanced encryption and biometric authentication. Customer funds are safeguarded through regulated financial institutions.

Paysera is licensed and supervised by the Bank of Lithuania, adhering to strict European Union regulations. It also uses two-factor authentication (2FA) and SSL encryption.

Similarly, Panda Remit operates under financial licenses and uses advanced security protocols to protect user transactions.

Revolut vs Paysera: Global Coverage

Revolut supports transfers to over 200 countries and 30+ currencies, making it one of the most globally available fintech platforms.

Paysera focuses primarily on Europe and parts of Asia, supporting transfers in over 20 currencies. It’s ideal for users who frequently send money within the EU or to neighboring regions.

For a global perspective on remittance networks, refer to the World Bank’s Remittance Data Report.

Though Panda Remit doesn’t yet cover Africa and does not support credit card payments, it maintains wide coverage across 40+ currencies, especially for Asia-Pacific and European users.

Revolut vs Paysera: Which One is Better?

Both Revolut and Paysera offer reliable, secure, and affordable international transfer services—but they cater to different audiences.

-

Choose Revolut if you need a modern all-in-one financial app with global reach and investment features.

-

Choose Paysera if you prioritize low-cost European transfers and business-friendly tools.

For users who value low fees, transparent exchange rates, and fast transfers, Panda Remit can be an excellent alternative. It’s ideal for individuals and families seeking straightforward online remittances without hidden costs.

Conclusion

In the debate of Revolut vs Paysera, the right choice depends on your transfer needs. Revolut excels in app experience and global flexibility, while Paysera offers unbeatable pricing within Europe. Both platforms maintain high standards of safety and transparency.

However, for users seeking a low-cost and efficient international remittance service, Panda Remit deserves serious consideration. With competitive exchange rates, minimal fees, flexible payment methods (such as POLi, PayID, and e-transfer), and support for over 40 currencies, Panda Remit delivers speed and simplicity in every transaction.

For more information on digital remittances, explore Investopedia’s guide to money transfer services and World Bank’s global remittance insights.