Revolut vs PingPong Payments: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 10:26:09.0 10

Introduction

Cross-border money transfers have become an essential service for both individuals and businesses. However, many users encounter challenges such as high fees, slow delivery, hidden charges, and a less-than-ideal user experience. Revolut and PingPong Payments are two prominent options in this space, each offering unique features and pricing models. For users exploring alternatives, PandaRemit provides a reliable solution with competitive rates and convenient payment methods. For more insights on international money transfers, visit Investopedia.

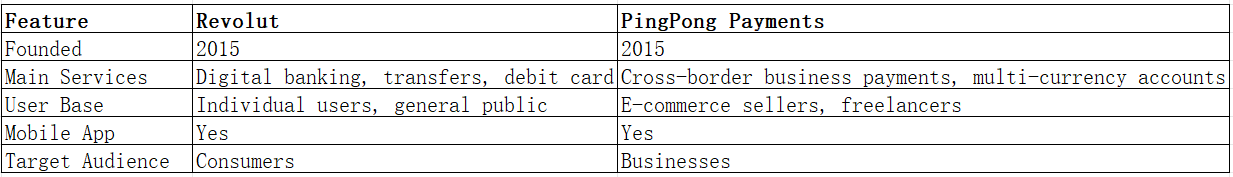

Revolut vs PingPong Payments – Overview

Revolut, founded in 2015, is a digital banking app offering currency exchange, international transfers, and debit card services to millions of users globally. PingPong Payments, established in 2015, focuses on cross-border payments for e-commerce sellers and freelancers, offering multi-currency accounts and fast payout options.

Both Revolut and PingPong Payments provide mobile apps, support for multiple currencies, and international transfer capabilities. Key differences include target audience—Revolut is consumer-focused while PingPong targets businesses—and fee structures, with PingPong often favoring e-commerce payouts. PandaRemit remains a strong alternative for users seeking low-cost and flexible transfer options.

Revolut vs PingPong Payments: Fees and Costs

Revolut offers a free tier with limited transfers, and paid subscriptions with additional features. International transfers may incur fees depending on currency and transfer type. PingPong Payments focuses on low-cost business payments with transparent fees and competitive exchange rates. Users should consider subscription plans or account types when calculating overall costs. For more details, see NerdWallet fee comparison.

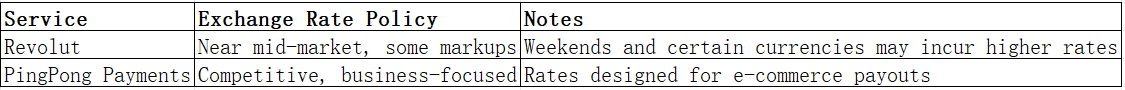

Revolut vs PingPong Payments: Exchange Rates

Exchange rate markups vary between the services. Revolut provides near mid-market rates for standard accounts, with slight markups on weekends or certain currencies. PingPong Payments offers competitive rates tailored for cross-border business payments.

Revolut vs PingPong Payments: Speed and Convenience

Revolut transfers are generally fast for standard international payments, with instant transfers between Revolut accounts. PingPong Payments emphasizes speed for e-commerce payouts, allowing businesses to access funds quickly. Both platforms feature intuitive mobile apps and integrations with third-party services. For a guide on transfer speed, visit WorldRemit speed guide.

Revolut vs PingPong Payments: Safety and Security

Both Revolut and PingPong Payments employ strong security measures, including encryption, fraud protection, and regulation under financial authorities in their respective jurisdictions. PandaRemit also maintains licensing and secure operations for added confidence.

Revolut vs PingPong Payments: Global Coverage

Revolut supports transfers to 150+ countries with multiple currencies, while PingPong Payments focuses on key business markets for cross-border e-commerce. Payment methods vary depending on the destination country. For more information, consult the World Bank remittance coverage report.

Revolut vs PingPong Payments: Which One is Better?

Revolut excels for individual users seeking versatile digital banking, while PingPong Payments is optimized for businesses handling cross-border e-commerce payouts. Both have strong mobile platforms and competitive services. For users seeking lower fees, flexible payment options, and fast transfers, PandaRemit presents a compelling alternative.

Conclusion

In summary, Revolut and PingPong Payments offer robust solutions for international money transfers and digital payments. Revolut is ideal for consumers who want banking and transfer services in one app, while PingPong Payments caters to e-commerce sellers requiring efficient cross-border payouts. PandaRemit stands out as an alternative with high exchange rates, low fees, flexible payment methods such as POLi, PayID, bank card, and e-transfer, coverage of 40+ currencies, and fast, all-online transfers. For more details, visit PandaRemit official site and learn more about global transfers at Investopedia.