Revolut vs Sendwave: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-12 11:05:00.0 27

Introduction

In today’s global economy, sending money abroad is a common need for individuals and businesses. However, many users still face issues such as hidden fees, slow processing times, and unfavorable exchange rates. Fintech platforms like Revolut and Sendwave have simplified international transfers with digital-first solutions, mobile convenience, and competitive pricing.

If you’re looking for a secure and affordable alternative, Panda Remit offers a user-friendly experience designed for seamless global transfers. For context on digital remittance trends, refer to Investopedia’s guide on international money transfers.

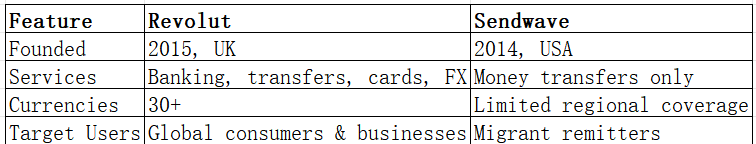

Revolut vs Sendwave – Overview

Revolut, founded in 2015 in the UK, is a global financial super app offering money transfers, debit cards, multi-currency management, and crypto trading. It has over 35 million customers worldwide and is known for its transparent pricing and wide range of financial services.

Sendwave, founded in 2014, focuses on mobile money transfers to specific regions, primarily between North America, Europe, and selected countries in Asia and Latin America. It’s valued for its ease of use and zero-fee transfers to supported destinations.

Similarities:

-

Mobile-first design for easy money transfers

-

Instant notifications and user-friendly apps

-

Support for debit card and bank account payments

Differences:

-

Revolut offers global financial management with multi-currency accounts and debit cards.

-

Sendwave specializes in quick personal remittances to select countries, often targeting migrant workers.

If you want more flexible cross-border payment options, Panda Remit is also a competitive choice in this space.

Revolut vs Sendwave: Fees and Costs

Revolut offers free transfers between Revolut users and low-cost international transfers. However, weekend or currency conversion fees may apply, especially on standard accounts. Premium and Metal subscribers enjoy better exchange rates and free global transfers.

Sendwave, on the other hand, markets itself on zero-fee transfers. The company earns through exchange rate margins, meaning the rate you get is slightly lower than the market rate. Despite this, it’s often cheaper than traditional banks for supported corridors.

For a detailed comparison of money transfer fees, check NerdWallet’s international money transfer guide.

If low costs are your priority, Panda Remit offers competitive rates and no hidden fees on many popular routes.

Revolut vs Sendwave: Exchange Rates

Exchange rate transparency can make a big difference in transfer value. Revolut uses the mid-market rate during weekdays, though a small markup applies on weekends. This makes it ideal for frequent travelers or those dealing with multiple currencies. Sendwave, by contrast, applies a small margin to the market rate for simplicity, though it supports fewer currencies overall.

If you need access to better rates and multi-currency flexibility, Panda Remit is another option to consider for international transfers.

Revolut vs Sendwave: Speed and Convenience

Revolut transfers between users are instant, while international bank transfers typically take 1–2 business days. The app’s all-in-one design (spending, saving, investing) provides a comprehensive financial experience.

Sendwave prioritizes simplicity and speed, often completing transfers in minutes for supported destinations. However, its coverage is limited compared to Revolut.

You can learn more about transfer timelines from Remitly’s guide on transfer speeds.

For users who value both speed and global reach, Panda Remit offers fast, secure transfers and full online convenience.

Revolut vs Sendwave: Safety and Security

Revolut is regulated in multiple jurisdictions, including the UK and EU, and holds banking licenses in Europe. It employs strong encryption, two-factor authentication, and advanced fraud monitoring systems.

Sendwave is registered as a money transmitter and regulated by financial authorities in the U.S. and Europe. It uses industry-standard encryption to protect user data and transactions.

Like both, Panda Remit operates under financial supervision and employs bank-level security to ensure safe transactions for users worldwide.

Revolut vs Sendwave: Global Coverage

Revolut supports money transfers in over 200 countries and more than 30 currencies, along with local banking details for multiple regions. It’s particularly strong in Europe and Asia-Pacific.

Sendwave has more limited coverage, focusing on key corridors between the U.S., UK, and select countries in Asia and Latin America. While it provides excellent speed and low fees within its network, its regional limitations may be a concern for users needing broader coverage.

For the latest international remittance coverage, see the World Bank Remittance Prices Worldwide report.

Revolut vs Sendwave: Which One is Better?

If you need a versatile multi-currency financial platform, Revolut is the better choice. It offers comprehensive services including debit cards, budgeting tools, and crypto access, making it ideal for digital nomads, global professionals, and small businesses.

However, if your primary goal is sending personal remittances quickly and cheaply, Sendwave is straightforward and efficient. Its zero-fee model is appealing, though limited coverage may restrict usability.

For those seeking a balance between cost efficiency, security, and global accessibility, Panda Remit offers a competitive middle ground with transparent pricing and user-friendly design.

Conclusion

In the Revolut vs Sendwave comparison, both platforms serve different audiences effectively. Revolut stands out as a complete digital financial ecosystem with strong global reach, while Sendwave offers simplicity and near-instant transfers for specific regions.

If you prioritize broader currency support, strong security, and multi-purpose use, Revolut is a solid choice. If you value straightforward, low-cost remittances, Sendwave delivers.

For users seeking a modern and transparent remittance service, Panda Remit provides an excellent alternative — featuring:

-

Competitive exchange rates & low fees

-

Multiple payment options (bank card, PayID, e-transfer, etc.)

-

40+ currency coverage

-

Fast transfers and full online convenience

To explore other trusted options for global transfers, visit NerdWallet’s international money transfer comparison or World Bank’s remittance data portal.