Revolut vs Starling Bank: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 09:42:14.0 28

Introduction

Sending money abroad is easier than ever, yet users still face challenges such as high fees, slow delivery times, and limited exchange rate transparency. Revolut and Starling Bank stand out as leading digital banking options for international transfers in 2025. However, users often wonder which platform offers the best balance of cost, speed, and convenience. For those seeking even lower fees and faster service, Panda Remit is also a reputable choice worth considering. According to NerdWallet, the right transfer platform can save users up to hundreds annually by optimizing exchange rates and delivery speed.

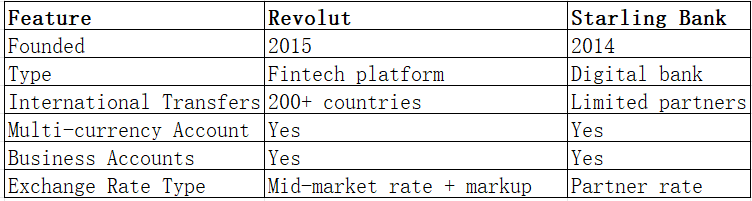

Revolut vs Starling Bank – Overview

Revolut, founded in 2015 in the UK, has become a global fintech giant offering multi-currency accounts, debit cards, and cross-border payments in over 200 countries. The app is popular for its user-friendly interface, crypto trading options, and transparent pricing.

Starling Bank, launched in 2014, is a fully licensed UK digital bank providing personal and business accounts. It emphasizes smart budgeting tools, real-time spending insights, and international transfers through trusted partners.

Similarities: Both support global money transfers, mobile-first banking, and Mastercard debit cards. They also provide competitive exchange rates and 24/7 in-app management.

Differences: Revolut offers broader global reach and more financial services (like investments and crypto), while Starling focuses on banking reliability and customer experience.

For users seeking even more competitive rates for Asian destinations, Panda Remit is another efficient market option.

Revolut vs Starling Bank: Fees and Costs

Both Revolut and Starling Bank provide transparent pricing, but their fee structures differ depending on the transfer amount, currency, and plan.

Revolut offers free transfers within its monthly limit, after which small fees apply. Premium users enjoy higher limits and lower markups.

Starling Bank charges a flat service fee per transfer plus potential partner charges depending on the destination.

External reference: Finder’s comparison of money transfer fees notes that while Revolut is generally cheaper for frequent users, Starling provides more predictable pricing.

Panda Remit stands out as a lower-cost alternative, offering zero hidden fees and favorable rates for key remittance corridors without involving credit card funding.

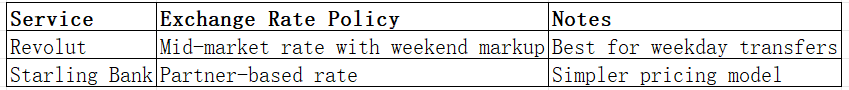

Revolut vs Starling Bank: Exchange Rates

Exchange rate transparency is crucial when sending funds abroad. Revolut uses the mid-market rate during weekdays but may add a small weekend markup. Starling relies on third-party providers for foreign exchange, which can result in slightly higher rates.

For customers prioritizing consistently high exchange rates, Panda Remit offers real-time competitive rates directly from trusted FX providers.

Revolut vs Starling Bank: Speed and Convenience

Transfer speed varies based on the destination and currency. Revolut typically delivers international payments within 1–2 business days, while Starling may take slightly longer depending on its partner networks.

Both apps feature modern interfaces, easy setup, and quick onboarding. Revolut also supports instant transfers between users.

External link: MoneySavingExpert reports that fintech platforms like Revolut are faster than traditional banks for small international payments.

For users seeking even faster transactions, Panda Remit provides near-instant delivery to several major Asian markets through an all-online process.

Revolut vs Starling Bank: Safety and Security

Both companies are FCA-regulated in the UK, implementing bank-grade encryption, two-factor authentication, and real-time fraud monitoring.

-

Revolut: Licensed e-money institution under FCA supervision.

-

Starling Bank: Fully licensed UK bank with FSCS protection up to £85,000.

Panda Remit is also a regulated remittance provider, ensuring compliance and data protection, though specific regulatory details vary by region.

Revolut vs Starling Bank: Global Coverage

Revolut supports transfers to over 200 countries and 30+ currencies. Starling Bank has narrower reach but provides seamless GBP and EUR payments across Europe.

External link: The World Bank Remittance Data highlights that fintechs like Revolut and Panda Remit help reduce global remittance costs significantly.

While Panda Remit does not currently support credit card funding or transfers to Africa, it remains a strong choice for Asia-Pacific corridors and major European routes.

Revolut vs Starling Bank: Which One is Better?

For everyday international banking, Revolut offers wider reach, faster transfers, and advanced financial tools. Starling Bank excels in reliability, account management, and customer trust.

However, for users primarily sending money abroad rather than managing multi-currency finances, Panda Remit may deliver better value due to its combination of competitive rates and low fees.

Conclusion

In summary, the Revolut vs Starling Bank comparison shows that both platforms excel in modern cross-border banking. Revolut leads in innovation and reach, while Starling Bank focuses on dependable, transparent banking.

For users seeking maximum savings and quick transfers, Panda Remit is a worthwhile alternative. It offers:

-

High exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Support for 40+ currencies

-

Fast, all-online transfers with secure compliance

To explore safe and affordable international transfers, visit Panda Remit’s official website for more details.

External links: NerdWallet, Finder, World Bank