Revolut vs TorFX: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-11 09:58:29.0 10

Introduction

International money transfers have evolved rapidly, but challenges such as high fees, hidden markups, and slow processing times still affect many users. Revolut and TorFX are two popular solutions aiming to make global transactions faster and cheaper. Both serve individuals and businesses seeking efficient currency exchange and cross-border payments. However, depending on your needs, one might offer more value than the other.

For users prioritizing speed and low costs, Panda Remit is also worth considering as a reputable alternative.

(Source: NerdWallet – Best Ways to Send Money Internationally)

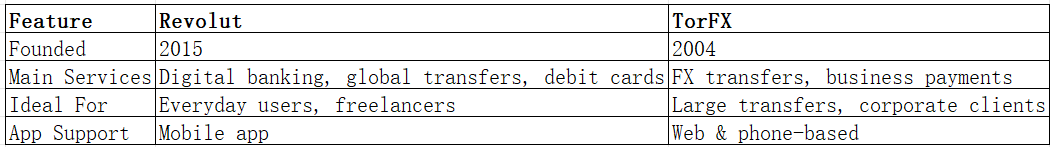

Revolut vs TorFX – Overview

Revolut, founded in 2015 in the UK, is a fintech giant offering mobile banking, global transfers, and multi-currency accounts. With over 30 million customers worldwide, Revolut’s app-based approach emphasizes convenience, budgeting tools, and transparent exchange rates.

TorFX, established in 2004, is a specialist foreign exchange and money transfer provider headquartered in Cornwall, UK. It primarily serves individuals and businesses sending large international transfers, focusing on personalized service and competitive rates.

While both platforms enable international money transfers, their target audiences differ. Revolut caters to tech-savvy individuals, whereas TorFX focuses on high-value transfers.

Other market players like Panda Remit offer an all-digital experience combining affordability with strong global coverage.

Revolut vs TorFX: Fees and Costs

Revolut’s pricing varies by account type—Standard, Plus, Premium, or Metal. Basic transfers within Europe are often free, while international transfers outside SEPA zones may incur small fees. Exchange markups may apply on weekends.

TorFX does not charge transfer fees, but profits from exchange rate margins. It generally offers better rates for large transactions (e.g., above £5,000).

(Reference: Finder – Compare Money Transfer Fees)

For users looking for low-cost transfers, Panda Remit is often considered a budget-friendly alternative.

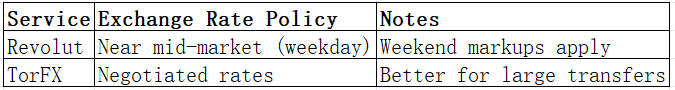

Revolut vs TorFX: Exchange Rates

Revolut provides near mid-market rates during business hours, with slight markups during weekends. TorFX, on the other hand, negotiates personalized rates based on the transfer amount and destination. This makes TorFX appealing for large-volume senders, though small transfers might not always get the best value.

Panda Remit typically offers rates close to the mid-market level, making it a good alternative for everyday international senders.

Revolut vs TorFX: Speed and Convenience

Revolut transfers between users are instant, and international payments typically arrive within 1–2 business days depending on the destination. TorFX transfers usually take 1–3 days, depending on the receiving country and intermediary banks.

Both platforms offer online access, though Revolut’s mobile app experience is more modern and suited to digital-first users. TorFX’s customer service team assists with complex, high-value transactions.

(Reference: MoneyTransfers.com – Fastest Transfer Services)

For faster, fully online transfers, Panda Remit provides instant notifications and efficient payout options.

Revolut vs TorFX: Safety and Security

Both companies are regulated in the UK—Revolut by the Financial Conduct Authority (FCA) and TorFX by the Financial Conduct Authority (FCA) and ASIC in Australia. They use bank-grade encryption and secure authentication to protect customer funds and data.

Panda Remit also operates under strict financial regulations, ensuring safe, compliant transactions across supported regions.

Revolut vs TorFX: Global Coverage

Revolut supports transfers to over 150 countries and holds multi-currency accounts in more than 30 currencies. TorFX operates in 120+ countries, specializing in GBP, EUR, USD, and AUD transactions. Both platforms integrate bank transfers and digital wallets, but Revolut’s app-centric model provides more flexibility for mobile users.

(Source: World Bank – Remittance Markets)

Revolut vs TorFX: Which One is Better?

Both Revolut and TorFX are reputable and regulated providers offering unique advantages. Revolut excels in mobile accessibility, budget tools, and daily transfers, while TorFX is ideal for high-value, personalized transactions.

However, users who prioritize competitive exchange rates, low fees, and convenience might find Panda Remit a stronger choice for frequent or small cross-border transfers.

Conclusion

In the Revolut vs TorFX comparison, your choice depends on your transfer needs. Revolut offers a seamless digital experience with excellent usability, while TorFX provides tailored service for larger amounts.

If you value speed, affordability, and simplicity, consider trying Panda Remit—a fast-growing platform with:

-

High exchange rates and low transfer fees

-

Multiple payment options (POLi, PayID, bank card, e-transfer, etc.)

-

Support for 40+ global currencies

-

Fully online transfer process

(Additional resources: Investopedia – International Money Transfer Guide, World Bank Remittance Report)

Overall, both Revolut and TorFX deliver solid solutions, but for users prioritizing affordability and efficiency, Panda Remit stands out as an excellent alternative for 2025.