Revolut vs Venmo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-12 17:08:55.0 11

Introduction

Sending money across borders has become easier but not always cheaper. Users often face high fees, slow delivery times, and unclear exchange rates when transferring funds internationally. In this article, we compare Revolut vs Venmo, two major digital payment platforms redefining the remittance experience. Alongside them, we also highlight Panda Remit, a trusted alternative for international transfers that combines low fees and fast delivery. For an overview of how digital remittance services work, check out Investopedia’s guide to money transfers.

Revolut vs Venmo – Overview

Revolut was founded in 2015 in the UK and has grown into a global fintech brand with over 40 million customers. It offers multi-currency accounts, debit cards, crypto trading, and low-cost international transfers.

Venmo, on the other hand, launched in 2009 and is owned by PayPal. While originally focused on peer-to-peer (P2P) transfers in the U.S., Venmo is gradually expanding its features, including debit cards and limited international functionality through PayPal integrations.

Similarities: Both services offer user-friendly mobile apps, digital cards, and social payment features. They’re designed for modern consumers who prefer fast, app-based financial management.

Differences: Revolut supports multi-currency wallets and global transfers, whereas Venmo mainly serves U.S.-based users for domestic payments. Revolut also integrates budgeting tools, whereas Venmo focuses more on social payments.

If you’re looking for a platform optimized specifically for cross-border payments, Panda Remit provides a reliable and secure alternative for international users.

Revolut vs Venmo: Fees and Costs

Revolut offers free transfers between Revolut users and competitive fees for international transfers, depending on the user’s subscription plan. Standard users might incur small fees for sending money abroad, while Premium and Metal users enjoy lower or waived charges.

Venmo’s domestic transfers are mostly free, but sending money internationally via PayPal’s network involves higher costs and conversion fees.

For an overview of average remittance costs, visit the World Bank’s Remittance Prices Worldwide.

Panda Remit, on the other hand, often provides lower transfer fees and transparent pricing for supported regions, making it a cost-effective option for users sending money overseas.

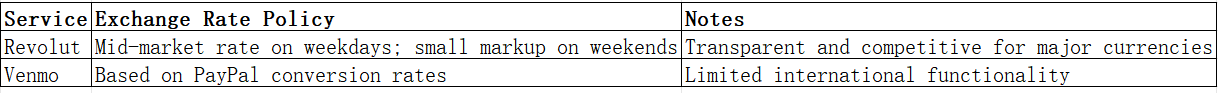

Revolut vs Venmo: Exchange Rates

Revolut uses the mid-market exchange rate during weekdays, with a small markup on weekends or for exotic currencies. Venmo does not directly handle currency conversion for most users, as it operates in USD and relies on PayPal’s exchange rates when cross-border features are used.

If you need consistently competitive exchange rates with no hidden markups, Panda Remit may be a better fit for your international transfer needs.

Revolut vs Venmo: Speed and Convenience

Revolut transfers between users are instant, while international transfers usually take 1–2 business days, depending on the destination and receiving bank. The app supports multiple integrations and offers advanced features such as split bills and budgeting analytics.

Venmo’s transfers are near-instant domestically but lack international support. Users can cash out to their bank accounts quickly, but cross-border payments are routed via PayPal and may take several days.

According to NerdWallet’s guide to fast money transfers, specialized platforms like Panda Remit deliver funds rapidly, often within minutes, for supported corridors.

Revolut vs Venmo: Safety and Security

Both Revolut and Venmo are regulated and use encryption to protect customer data. Revolut operates under the Financial Conduct Authority (FCA) in the UK, while Venmo complies with U.S. financial regulations and uses multi-factor authentication.

Panda Remit is also a licensed and regulated remittance service provider, offering secure transactions with advanced anti-fraud measures and encryption technology.

Revolut vs Venmo: Global Coverage

Revolut supports transactions in 200+ countries and 30+ currencies, making it ideal for travelers and global professionals. Venmo remains U.S.-focused, offering limited or no international reach for most users.

For global remittance coverage insights, see the World Bank’s report on remittance flows.

Although Panda Remit doesn’t cover every region, it supports transfers to key countries in Asia, Europe, and the Americas, offering reliable cross-border services.

Revolut vs Venmo: Which One is Better?

Revolut excels in international usability, exchange rate transparency, and app functionality. It’s ideal for global users who travel or send money abroad regularly.

Venmo, however, remains a strong choice for U.S.-based peer-to-peer payments thanks to its ease of use and social interface. But it falls short for international transfers.

For users seeking a more specialized, fast, and affordable international money transfer solution, Panda Remit presents a compelling alternative.

Conclusion

In the debate of Revolut vs Venmo, the choice depends on your needs. Revolut offers global reach, competitive exchange rates, and powerful app features, while Venmo shines in local, social-driven payments within the U.S. For users prioritizing international transfers with low fees, high exchange rates, and fast processing, Panda Remit is worth exploring.

With flexible payment options such as PayID, bank card, and online transfers, and support for over 40 currencies, Panda Remit delivers a seamless digital remittance experience. Learn more about global money transfer trends through the World Bank’s remittance overview.