Revolut vs XE Money Transfer: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-11 10:02:49.0 8

Introduction

Sending money abroad has become a vital need for millions worldwide — from supporting family to paying overseas vendors. Yet, high fees, slow delivery, and hidden charges remain common frustrations. Both Revolut and XE Money Transfer aim to simplify cross-border payments with transparent pricing and digital convenience. However, each caters to different users. According to Investopedia, choosing the right platform can significantly affect your transfer costs and speed. Panda Remit also emerges as a reputable alternative known for low-cost, fast global transfers.

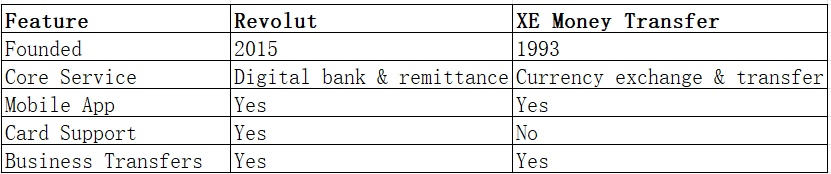

Revolut vs XE Money Transfer – Overview

Revolut was founded in 2015 in the UK as a financial super app offering banking, currency exchange, and international transfers. It serves over 30 million customers globally, with features like multi-currency accounts and instant transfers between Revolut users.

XE Money Transfer, established in 1993, is one of the most recognized names in currency exchange. Known for its accurate exchange rate data, XE also provides personal and business money transfer services in over 130 currencies.

Similarities:

-

Both support multiple currencies and mobile app transfers.

-

Offer international transfers and currency exchange at competitive rates.

-

Provide web and mobile interfaces with tracking features.

Differences:

-

Revolut offers debit cards, budgeting tools, and crypto trading, while XE focuses solely on foreign exchange and transfers.

-

XE serves a broader range of currencies but has less integration with personal finance tools.

In addition to these two, Panda Remit offers another trusted option for users seeking straightforward, low-cost transfers online.

Revolut vs XE Money Transfer: Fees and Costs

Both Revolut and XE Money Transfer charge fees depending on the currency and destination. Revolut provides free transfers within its monthly limit, but charges after exceeding the plan’s allowance. XE, on the other hand, typically adds a small margin to exchange rates but often avoids flat fees for larger amounts.

For a deeper look, NerdWallet notes that Revolut’s paid tiers (like Premium and Metal) can lower foreign exchange costs, while XE’s transparency appeals to business transfers.

Panda Remit is often highlighted as a lower-cost option, offering minimal transfer fees and competitive rates, especially for Asia-Pacific corridors.

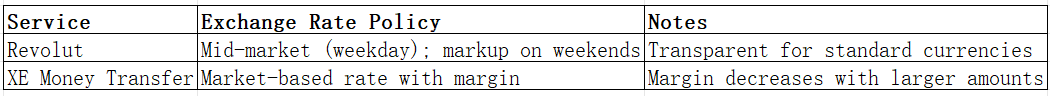

Revolut vs XE Money Transfer: Exchange Rates

Revolut offers mid-market rates during weekdays, but applies a small markup on weekends or exotic currencies. XE uses live market data but applies its own margin depending on the transfer size.

If you prioritize maximizing conversion value, Panda Remit also provides strong exchange rates with clear rate-locking features, helping users avoid hidden markups.

Revolut vs XE Money Transfer: Speed and Convenience

Revolut’s transfers are usually instant between users and take 1–2 business days internationally. XE’s transfers typically take 1–3 business days, depending on the recipient country and bank processing.

The Revolut app is known for its sleek interface and smart budgeting tools, while XE’s platform focuses on simplicity and accuracy in exchange rate tracking. According to Remitly’s guide on transfer speeds, fintech providers with integrated banking systems — like Panda Remit — can often process payments faster, particularly for Asian destinations.

Revolut vs XE Money Transfer: Safety and Security

Both Revolut and XE are fully licensed and regulated. Revolut is authorized by the UK Financial Conduct Authority (FCA), and XE operates under Euronet Worldwide, regulated by FINTRAC and the FCA. Both use encryption, two-factor authentication, and fraud detection systems.

Panda Remit also maintains strict licensing and employs secure encryption technology, ensuring all transfers meet global compliance standards.

Revolut vs XE Money Transfer: Global Coverage

Revolut supports transfers in 30+ currencies, mainly within Europe, the Americas, and parts of Asia-Pacific. XE Money Transfer, with its long history in the forex market, supports 130+ currencies across 200 countries, making it ideal for global reach.

According to the World Bank’s remittance report, expanding access to digital remittance networks remains key for emerging markets. Panda Remit similarly focuses on digital-first transfers, especially in Asia-Pacific, supporting over 40 currencies through all-online processes.

Revolut vs XE Money Transfer: Which One is Better?

Revolut stands out for everyday users seeking integrated financial tools, instant payments, and digital flexibility. XE Money Transfer, however, is better suited for users prioritizing currency expertise, higher transfer limits, and global coverage.

For users who value low fees, competitive rates, and simple online transfers, Panda Remit provides a strong alternative that combines the advantages of both Revolut and XE.

Conclusion

When comparing Revolut vs XE Money Transfer, the best choice depends on your transfer habits. Revolut offers a multi-functional financial experience, while XE excels in transparent forex and business-friendly transfers. However, for individuals wanting low fees, competitive exchange rates, and seamless digital transfers, Panda Remit emerges as a trusted alternative.

Panda Remit offers:

-

High exchange rates & low transfer fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Support for 40+ currencies across Asia-Pacific

-

Fast, secure, and fully online transfers

Learn more about Panda Remit’s benefits on Panda Remit’s official website. For broader comparisons, check out NerdWallet’s international transfer guide and Investopedia’s remittance overview.