Revolut vs Zelle: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-12 16:33:24.0 18

Sending money across borders has become part of daily life for global workers, students, and businesses. Yet, many still face challenges such as high fees, poor exchange rates, and slow transfer times. Revolut and Zelle are two major players that simplify digital payments—but they serve different markets and needs. While Revolut caters to international users, Zelle primarily focuses on U.S. domestic transfers. For users looking for a global, all-digital alternative, Panda Remit provides a trusted solution for quick and affordable international remittances. Learn more about global money transfers on Investopedia.

Revolut vs Zelle – Overview

Revolut, launched in 2015 in the United Kingdom, is a fintech super app that offers international money transfers, multi-currency accounts, debit cards, and financial management tools. It’s available in over 200 countries and supports more than 30 currencies, appealing to travelers, expats, and freelancers worldwide.

Zelle, established in 2017 in the United States, is a peer-to-peer payment network designed for instant domestic transfers. It operates within U.S. banks and financial institutions, allowing users to send money directly between U.S. bank accounts without additional apps or fees.

Similarities:

-

Both offer mobile apps for quick payments.

-

Support instant or near-instant transfers.

-

Enable users to send money directly from linked bank accounts.

Differences:

-

Revolut supports global transfers and currency exchange; Zelle is limited to domestic U.S. transfers.

-

Revolut offers debit cards and investment tools; Zelle integrates only with banks.

-

Zelle doesn’t support multi-currency or international payments.

For those seeking an international service combining speed and low fees, Panda Remit is a strong alternative in the global remittance space.

Revolut vs Zelle: Fees and Costs

Revolut charges minimal fees for international transfers, with pricing depending on the user’s account tier (Standard, Plus, Premium, or Metal). Some transfers outside Europe may incur small fees, especially on weekends or for certain currencies.

Zelle, on the other hand, charges no fees for domestic transfers within the U.S. However, it cannot be used for international transactions or currency exchanges. Users can only send and receive money in U.S. dollars.

According to NerdWallet’s guide to money transfer fees, Revolut is one of the most affordable options for global users, while Zelle remains cost-effective for domestic use.

If your goal is affordable international remittance, Panda Remit can offer better value with transparent pricing and no hidden fees.

Revolut vs Zelle: Exchange Rates

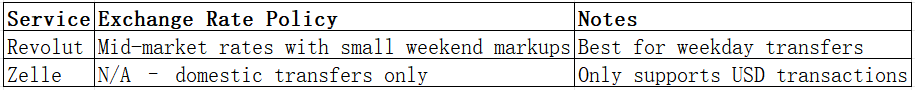

Exchange rates are a key factor for international transfers. Revolut offers near mid-market exchange rates during weekdays, but applies a small markup on weekends or high volatility periods.

Zelle does not handle foreign exchange at all, as it only supports transfers between U.S. bank accounts in U.S. dollars.

For users prioritizing transparency and fair exchange rates, Panda Remit offers competitive rates and full fee visibility before sending money.

Revolut vs Zelle: Speed and Convenience

Revolut transfers between Revolut users are typically instant, while international bank transfers may take 1–3 business days. The app’s design allows users to manage accounts, track spending, and automate recurring payments.

Zelle transfers are usually instant, provided both sender and receiver use participating U.S. banks. However, cross-border transactions are not supported.

According to the Finder Remittance Speed Report, domestic P2P transfers like Zelle lead in speed, but global remittance apps like Revolut and Panda Remit outperform in cross-border accessibility.

Revolut vs Zelle: Safety and Security

Both Revolut and Zelle prioritize security through encryption, multi-factor authentication, and regulatory compliance.

Revolut is authorized by the UK’s Financial Conduct Authority (FCA) and uses strong encryption to protect user data. Funds are safeguarded in segregated accounts with licensed banks.

Zelle operates under U.S. banking regulations and follows federal standards for data protection. However, users must remain vigilant against scams since Zelle transactions cannot be reversed once sent.

Likewise, Panda Remit follows strict financial compliance and encryption protocols, offering users safe and regulated international transfers.

Revolut vs Zelle: Global Coverage

Revolut serves users in over 200 countries and supports transfers in 30+ currencies, making it ideal for global money management.

Zelle, by contrast, is restricted to the U.S. market, supporting only transfers between American bank accounts. It’s best suited for domestic use among U.S. residents.

For more on international remittance networks, check the World Bank’s Remittance Data Report.

Although Panda Remit doesn’t cover Africa and doesn’t support credit card funding, it enables transfers across 40+ currencies—particularly strong in Asia-Pacific and Europe.

Revolut vs Zelle: Which One is Better?

Both Revolut and Zelle offer convenient ways to send money—but they serve different audiences.

-

Choose Revolut if you need international money transfers, multi-currency support, and travel-friendly features.

-

Choose Zelle if you only need fast, free transfers within the U.S. banking system.

For users who send money internationally, Panda Remit provides an alternative that combines affordability, transparency, and speed without relying on traditional banking systems.

Conclusion

In summary, Revolut vs Zelle showcases two very different approaches to money transfers. Revolut offers a global solution with strong currency and travel features, while Zelle excels in instant, no-fee domestic transfers within the U.S.

However, if your goal is to send money internationally with low fees and competitive exchange rates, Panda Remit stands out as a convenient choice. With support for 40+ currencies, flexible payment methods like PayID, POLi, and bank transfers, and an all-digital process, Panda Remit provides a fast, secure, and low-cost remittance experience.

For more insights, check Investopedia’s money transfer guide and the World Bank remittance overview to understand global transfer trends.