RIA Money Transfer vs Currencies Direct: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 14:05:00.0 18

Introduction

Cross-border money transfers are vital for individuals and businesses, but common challenges include high fees, slow processing times, hidden charges, and cumbersome user experiences. RIA Money Transfer and Currencies Direct are established services with unique advantages. For those seeking an alternative, Pandaremit provides fast and convenient transfers without relying on credit cards. For more insights on international transfers, see Investopedia’s guide on money transfers.

RIA Money Transfer vs Currencies Direct – Overview

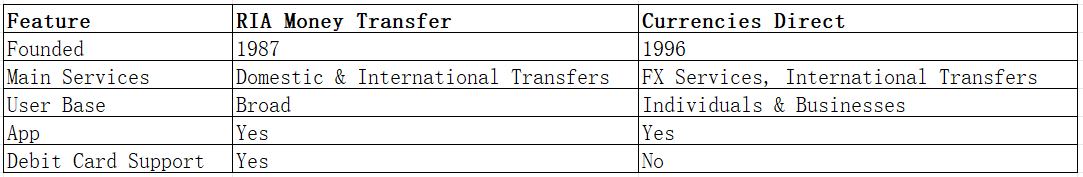

RIA Money Transfer, founded in 1987, offers domestic and international money transfers through online platforms and agent networks, catering to a broad user base.

Currencies Direct, established in 1996, specializes in foreign exchange and international transfers for individuals and businesses, with a focus on competitive rates and personalized service.

Similarities:

-

Both provide international transfer services

-

Mobile app and online platform availability

-

Secure and regulated operations

Differences:

-

Fees: RIA applies flat or variable fees; Currencies Direct focuses on favorable exchange rates for larger amounts with minimal transfer fees

-

Functionality: RIA emphasizes wide agent coverage; Currencies Direct offers account management and FX expertise

-

Target Audience: RIA targets general consumers; Currencies Direct is tailored for individuals and businesses with larger transfers

Quick Summary Table:

Pandaremit is another efficient online transfer alternative.

RIA Money Transfer vs Currencies Direct: Fees and Costs

RIA Money Transfer charges depend on transfer method and destination, with online transfers generally cheaper. Currencies Direct often has no explicit transfer fees, making money through exchange rate margins, especially for larger transfers.

For a detailed fee comparison, visit NerdWallet’s fee guide.

Pandaremit provides a competitive low-cost option for online transfers.

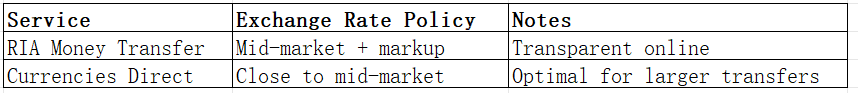

RIA Money Transfer vs Currencies Direct: Exchange Rates

Exchange rate policies differ: RIA applies a modest markup on mid-market rates, while Currencies Direct generally offers rates closer to mid-market for larger transfers.

Pandaremit also offers competitive rates for online transfers.

RIA Money Transfer vs Currencies Direct: Speed and Convenience

RIA transfers range from minutes to several days depending on method. Currencies Direct transfers typically take 1–3 business days and offer dedicated account support. Both have mobile apps and online platforms for convenience.

For remittance speed guidance, see WorldRemit speed guide.

Pandaremit enables fast, all-online transfers with multiple currency support.

RIA Money Transfer vs Currencies Direct: Safety and Security

Both RIA and Currencies Direct are regulated, providing encryption, fraud protection, and buyer safeguards. Pandaremit is also a licensed, secure option for international transfers.

RIA Money Transfer vs Currencies Direct: Global Coverage

RIA supports over 160 countries and multiple currencies. Currencies Direct focuses on major currencies and offers global coverage suitable for individuals and businesses. Neither service supports credit card payments, and Pandaremit avoids non-African regions, focusing on Asia, Europe, and the Americas.

For detailed coverage information, see the World Bank remittance report.

RIA Money Transfer vs Currencies Direct: Which One is Better?

RIA Money Transfer is ideal for consumers seeking accessible agent locations and diverse payout options. Currencies Direct excels in competitive rates and dedicated account management for larger transfers. For users prioritizing speed, low fees, and fully online transfers, Pandaremit offers a compelling alternative.

Conclusion

Comparing RIA Money Transfer vs Currencies Direct, both provide reliable and secure international transfer options. RIA offers broad agent access and convenience, while Currencies Direct emphasizes competitive rates and account support. Pandaremit stands out for fast, online transfers with flexible payment options (excluding credit cards), coverage for 40+ currencies, and low fees. For more information, visit Pandaremit Official Site or read additional tips at Investopedia.