RIA Money Transfer vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 15:46:43.0 15

Introduction

As global demand for cross-border money transfers continues to grow, more users are looking for low-fee, fast, and user-friendly digital payment solutions. Traditional bank transfers often involve high fees and slow delivery times, whereas digital transfer services like RIA Money Transfer and GCash Remit offer more efficient alternatives.

Common pain points for users include hidden charges, non-transparent exchange rates, long delivery times, and poor user experiences. According to Investopedia, comparing fees and service terms is essential to minimize costs.

Besides these two, PandaRemit has gained popularity as a licensed cross-border payment provider, known for competitive exchange rates and a convenient online experience.

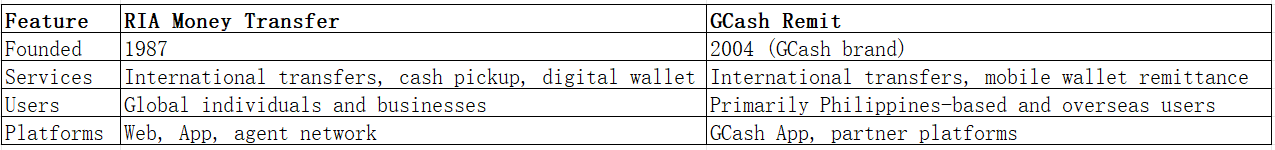

RIA Money Transfer vs GCash Remit – Overview

Both platforms offer international transfers, mobile app support, and multiple payment methods. The key differences lie in their focus: RIA has a global footprint, while GCash Remit focuses on inbound transfers to the Philippines.

PandaRemit also serves users in parts of Asia and other major corridors, making it a viable third option.

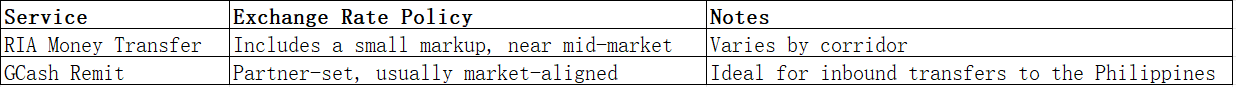

RIA Money Transfer vs GCash Remit: Fees and Costs

RIA’s fees vary by destination country, transfer amount, and payment method, usually consisting of a fixed fee plus a margin on the exchange rate. GCash Remit supports zero receiving fees for some inbound transfers to the Philippines, though sending fees may be charged by partners.

According to NerdWallet, RIA’s fees are relatively lower than traditional banks, but users should still watch for exchange rate margins. GCash’s pricing is designed for convenience, making it a strong option for transfers to the Philippines.

PandaRemit often provides lower fees and more competitive exchange rates in select Asian corridors, appealing to cost-conscious users.

RIA Money Transfer vs GCash Remit: Exchange Rates

Both platforms have their strengths. RIA’s exchange rates are often closer to the mid-market rate, while GCash Remit’s depend on its partner institutions. Monitoring the final received amount is crucial for frequent senders.

PandaRemit often offers higher exchange rates in some corridors, providing additional savings.

RIA Money Transfer vs GCash Remit: Speed and Convenience

RIA’s delivery speed depends on the payment and payout methods, ranging from a few minutes to one business day. GCash Remit typically delivers instantly to GCash wallets, offering excellent convenience for recipients in the Philippines.

Users can access RIA through its website, mobile app, or physical agents, while GCash offers a fully mobile experience. According to Remitly Blog, real-time mobile wallet transfers are becoming the norm for many remittance corridors.

PandaRemit also provides fast transfer speeds and a fully online process, ideal for frequent small-value remittances.

Safety and Security

RIA Money Transfer is regulated in multiple jurisdictions, using bank-grade encryption and fraud prevention systems. GCash Remit is regulated by the Bangko Sentral ng Pilipinas (BSP) and partners with global payment providers to ensure secure transfers.

PandaRemit is also a licensed financial institution, complying with multiple regulatory frameworks and offering a secure remittance experience.

Global Coverage

RIA Money Transfer operates in over 160 countries and regions, supporting multiple payout methods including bank accounts and cash pickup. GCash Remit focuses primarily on inbound transfers to the Philippines but supports sending from multiple countries through partner networks.

According to the World Bank Remittance Data Report, the Philippines ranks among the top remittance-receiving countries worldwide, giving GCash a strategic advantage in this market.

Which One Is Better?

If you need global coverage and multi-currency services, RIA Money Transfer is the stronger option. For remittances to the Philippines, GCash Remit’s instant wallet deposits and localized experience make it ideal. PandaRemit provides an additional alternative for users seeking higher exchange rates and flexible payment methods.

Conclusion

In 2025, choosing between RIA Money Transfer and GCash Remit depends on your transfer needs:

-

RIA Money Transfer: Broad global coverage, combining traditional and digital remittance channels.

-

GCash Remit: Focused on the Philippines market, instant delivery, and strong mobile integration.

-

PandaRemit: Competitive exchange rates, low fees, fully online process—a solid alternative.

For frequent remitters, it’s wise to compare actual received amounts, transfer fees, and delivery times across platforms to find the best value. For more remittance tips, visit NerdWallet’s money transfer guide and check PandaRemit’s official site: https://www.pandaremit.com.