RIA Money Transfer vs GrabPay Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 15:55:20.0 16

Introduction

Sending money internationally has become faster and more accessible than ever, but choosing the right transfer platform remains a challenge for many users. High fees, slow delivery, and hidden costs often make cross-border payments a frustrating experience. In this article, we compare RIA Money Transfer vs GrabPay Remit to help you decide which service suits your needs in 2025. Additionally, we'll introduce PandaRemit as a reputable alternative that offers competitive rates and user-friendly services. For more background on international remittances, check out this Investopedia remittance guide.

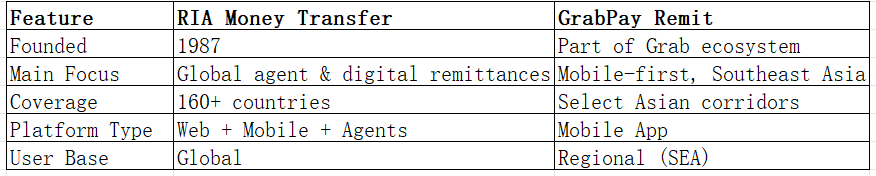

RIA Money Transfer vs GrabPay Remit – Overview

RIA Money Transfer was founded in 1987 and has grown into one of the world’s largest remittance providers, offering international money transfer services through a network of agents and digital platforms. It serves millions of customers globally, supporting transfers to over 160 countries.

GrabPay Remit, part of the Grab ecosystem, is a digital remittance service focused on providing mobile-first cross-border payments in Southeast Asia. It integrates with the Grab app, allowing users to send funds conveniently to several key markets in Asia.

Similarities:

-

Both offer international money transfers via mobile apps.

-

Both support bank account and wallet transfers.

-

Both are regulated financial service providers with a focus on compliance.

Differences:

-

RIA has a much broader global reach and agent network.

-

GrabPay Remit focuses more on Southeast Asia and mobile-native users.

-

Fee structures and exchange rates differ significantly between the two.

While both are strong players, PandaRemit has emerged as a modern alternative offering competitive fees and digital convenience for a growing number of users.

RIA Money Transfer vs GrabPay Remit: Fees and Costs

Fees are a crucial factor when comparing money transfer services. RIA Money Transfer typically charges transaction fees depending on the sending country, destination, and payout method. In some cases, fees may be higher for agent-assisted transfers compared to digital transfers. GrabPay Remit, on the other hand, often advertises low or zero transfer fees for certain corridors within Southeast Asia.

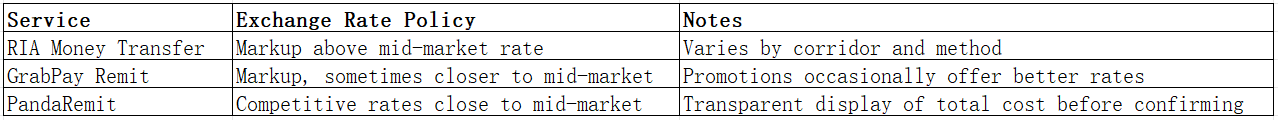

However, both services may apply exchange rate markups, which can significantly affect the total cost received by the recipient. According to NerdWallet’s fee comparison, even services with low upfront fees may offset costs through less favorable exchange rates.

PandaRemit is often positioned as a low-fee alternative, providing transparent pricing with no hidden costs.

RIA Money Transfer vs GrabPay Remit: Exchange Rates

Exchange rates determine how much your recipient ultimately receives. RIA Money Transfer typically applies a markup above the mid-market rate, which varies depending on the corridor. GrabPay Remit also uses a markup, though some regional transfers may be closer to mid-market rates during promotional periods.

For users who prioritize getting the best possible exchange rate, PandaRemit often stands out as a cost-efficient alternative.

RIA Money Transfer vs GrabPay Remit: Speed and Convenience

When it comes to speed, RIA Money Transfer offers a variety of delivery options. Some transfers can be delivered within minutes, while others may take 1–3 business days depending on the destination and payout method. GrabPay Remit focuses on fast mobile transfers, particularly for users in Southeast Asia, with many transactions completed on the same day.

Both platforms offer mobile apps with user-friendly interfaces. GrabPay Remit is fully integrated into the Grab ecosystem, making it highly convenient for existing Grab users. RIA has improved its digital presence but still relies heavily on its agent network.

For an overview of typical transfer times, see this remittance speed guide.

PandaRemit is known for offering fast all-online transfers, appealing to users who prefer fully digital solutions.

RIA Money Transfer vs GrabPay Remit: Safety and Security

Both RIA and GrabPay Remit are licensed and regulated by financial authorities in their operating regions. They use encryption, identity verification, and fraud prevention measures to secure transactions.

Similarly, PandaRemit is a licensed and secure platform, complying with regulatory standards in the jurisdictions where it operates.

RIA Money Transfer vs GrabPay Remit: Global Coverage

RIA Money Transfer supports over 160 countries and multiple payout methods, including bank deposits and cash pick-ups. GrabPay Remit focuses on Southeast Asian corridors such as the Philippines, Indonesia, and Vietnam, making it ideal for regional transfers but less versatile for global remittances.

For global coverage trends, see the World Bank Remittance Data.

RIA Money Transfer vs GrabPay Remit: Which One is Better?

RIA Money Transfer excels in global coverage and offers both digital and physical agent networks, making it suitable for users sending money to multiple regions. GrabPay Remit, on the other hand, is a great option for mobile-first users in Southeast Asia, offering simplicity and speed for popular corridors.

However, for users who want transparent pricing, competitive rates, and a fully online experience, PandaRemit provides a compelling alternative worth considering.

Conclusion

When comparing RIA Money Transfer vs GrabPay Remit, the best choice ultimately depends on your transfer corridor, fees, and preferred user experience. RIA’s extensive global network makes it reliable for users sending funds to multiple regions, while GrabPay Remit is perfect for regional transfers within Southeast Asia.

For users seeking high exchange rates, low fees, and a fast, fully online transfer experience, PandaRemit is a strong alternative. It supports 40+ currencies, provides multiple payment methods such as POLi, PayID, bank card, and e-transfer, and prioritizes transparency at every step.

To explore more about international remittances and compare providers, visit the NerdWallet international transfers guide and the World Bank remittance overview.